The Chase Sapphire Reserve’s annual fee jumped to $795 after its 2025 refresh, and the question on every Chase cardholder’s mind is blunt: Is the Reserve really worth $700 more per year than the Preferred? The chase sapphire preferred vs reserve debate has never been more polarized. Some cardholders are canceling the Reserve in droves. Others insist the math still works—if you know how to extract full value from every credit and perk.

This guide cuts through the noise. Instead of vague “it depends” advice, it provides a concrete break-even framework with real dollar amounts, a decision tree for three traveler types, and step-by-step upgrade (and downgrade) timing so the annual fee never catches anyone off guard.

The bottom line: both cards share the same powerful Chase Ultimate Rewards transfer partners, but they diverge sharply on portal redemption value, lounge access, credits, and—most importantly—who actually comes out ahead after the travel rewards math.

Key Takeaways

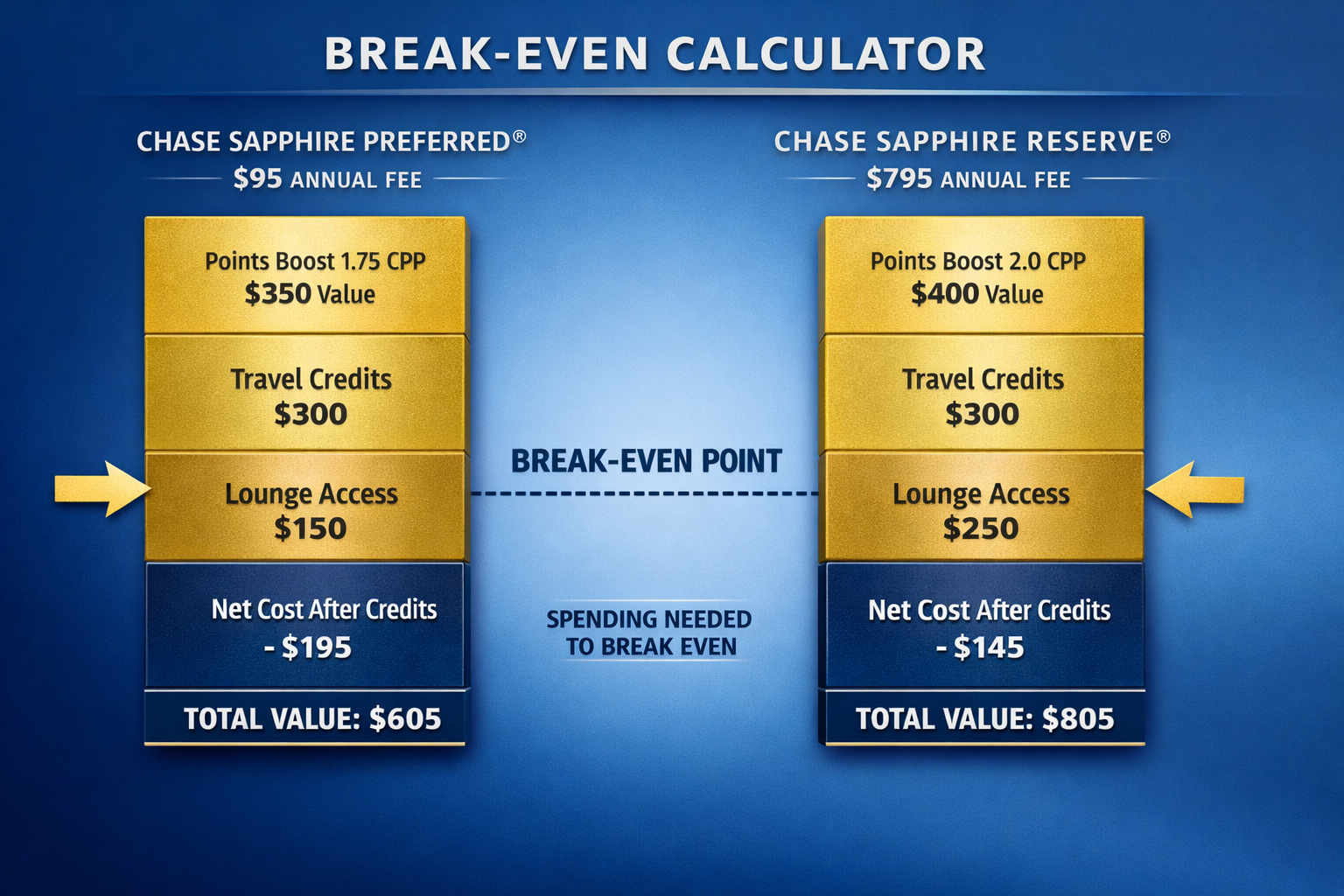

- The net fee gap is smaller than it looks. After subtracting usable credits, the Reserve’s effective cost drops to roughly $245–$295 vs. the Preferred’s $95—a real gap of ~$150–$200, not $700.

- Points Boost is the swing factor. The Reserve offers up to 2.0 cents per point (CPP) on select flights and hotels via Chase Travel; the Preferred offers up to 1.75 CPP on select flights and 1.5 CPP on select hotels. For heavy portal bookers, this difference compounds fast.

- Lounge access has a concrete dollar value—but only if you actually use it. Four Priority Pass or Chase Lounge visits per year can be worth $200+; zero visits means zero value.

- Transfer partners are identical. If most redemptions go through partner airlines for premium cabin awards, the portal-based Points Boost advantage shrinks, and the Preferred often wins on pure fee math.

- The January 2026 bonus eligibility change now lets holders of one Sapphire card earn the welcome bonus on the other (if they’ve never previously earned it on that specific product), making product switches more strategic.

Chase Sapphire Preferred vs Reserve 2026: Key Differences That Matter

Before diving into the math, here’s a side-by-side snapshot of the features that actually move the needle. Many benefits—trip cancellation insurance, no foreign transaction fees, primary rental car coverage (Reserve) vs. primary (also Reserve; secondary on Preferred)—matter, but the items below drive the decision on the annual fee.

| Feature | Sapphire Preferred (CSP) | Sapphire Reserve (CSR) |

|---|---|---|

| Annual Fee | $95 | $795 |

| Points Boost (Flights) | Up to 1.75 CPP on select flights | Up to 2.0 CPP on select flights |

| Points Boost (Hotels) | Up to 1.5 CPP on select hotels | Up to 2.0 CPP on select hotels |

| Travel Credit | None | $300 annual travel credit |

| The Edit Hotel Credit | None | $500/year (two $250 credits) |

| New 2026 Hotel Credit | None | $250 one-time credit (prepaid stays, min. 2 nights, select hotels via Chase Travel) |

| Dining Earning | 3x | 3x (10x via Chase Travel dining) |

| Travel Earning | 2x | 1x (general) / 5x flights, 10x hotels+car via Chase Travel |

| Lounge Access | ❌ | ✅ Priority Pass + Chase Sapphire Lounges |

| Global Entry/TSA PreCheck | ❌ | $100 credit every 4 years |

| Anniversary Bonus | 10% of prior-year points earned back | None |

| Transfer Partners | Same 14+ airline/hotel partners | Same 14+ airline/hotel partners |

💡 Key insight: Both cards access the exact same Chase Ultimate Rewards transfer partners. The difference is what happens when points are redeemed through the Chase Travel portal rather than transferred out. For a deep dive on those partners, see the Chase Transfer Partners Guide 2026.

Chase Sapphire Preferred vs Reserve Annual Fee Math: $95 vs $795

This is where most comparisons stop too early. Comparing $95 to $795 is misleading because the Reserve bundles credits that offset the sticker price—if they’re usable.

Step 1: Calculate the Reserve’s Effective Annual Fee

| Credit / Perk | Value | Notes |

|---|---|---|

| $300 travel credit | $300 | Auto-applies to travel purchases; easy to use |

| The Edit hotel credit | $500 | Two $250 credits; select luxury/boutique hotels via Chase Travel |

| $250 one-time hotel credit (2026) | $250 | Prepaid stays at IHG, Omni, Virgin, Montage, Pendry, Minor, Pan Pacific via Chase Travel (min. 2 nights). One-time, not recurring. |

| Global Entry/TSA PreCheck | ~$25/year | $100 every 4 years, amortized |

| Total usable credits (Year 1) | $1,075 | |

| Total usable credits (Year 2+) | $825 | Without the one-time $250 |

Year 1 effective fee: $795 − $1,075 = −$280 (net positive) Year 2+ effective fee: $795 − $825 = −$30 (still net positive—but only if every credit is fully used)

Step 2: Apply a “Realistic Use” Discount

Not everyone will book at Edit-eligible hotels or use the full $500. A conservative approach:

- $300 travel credit: 100% usable for most travelers → $300

- The Edit hotel credit: Realistically 50–80% usable → $250–$400

- Global Entry: Already have it? → $0–$25

Conservative effective fee (Year 2+): $795 − $550 = $245 Optimistic effective fee (Year 2+): $795 − $725 = $70

The Preferred’s $95 fee has no credits to offset, so its effective fee is simply $95.

The real gap: somewhere between $0 and $200 per year for most travelers—not $700.

For a personalized calculation, use the Award Travel Hub break-even calculator to plug in actual spending patterns.

Points Boost and Redemptions: Up to 1.75 vs 2.0 Cents Per Point

Points Boost is Chase’s enhanced portal redemption feature, and it’s the single biggest mathematical differentiator between these two cards in 2026.

How Points Boost Works

When booking eligible flights or hotels through the Chase Travel portal, cardholders receive an enhanced redemption rate:

- CSR: Up to 2.0 CPP on select flights and hotels

- CSP: Up to 1.75 CPP on select flights, 1.5 CPP on select hotels

The word “select” matters. Not every booking qualifies for the maximum rate. Points Boost applies to eligible options flagged in the portal—think of it as a dynamic enhancement, not a blanket guarantee.

The Math on 100,000 Points

| Redemption Method | CSP Value | CSR Value | Difference |

|---|---|---|---|

| Portal flights (Points Boost max) | $1,750 | $2,000 | +$250 CSR |

| Portal hotels (Points Boost max) | $1,500 | $2,000 | +$500 CSR |

| Transfer to partner airlines | Same | Same | $0 |

| Cash back | $1,000 | $1,000 | $0 |

For 100,000 points redeemed through the portal at max Points Boost rates, the Reserve delivers $250–$500 more in value. That alone can justify the fee gap for heavy portal users.

When Points Boost Doesn’t Matter

If the booking strategy centers on transferring Chase points to partner airlines for premium cabin awards—say, transferring to Hyatt for hotels or to United/Air Canada Aeroplan for business class flights—both cards are identical. The transfer ratios are 1:1 regardless of which Sapphire card is held.

This is critical: the best use of points often comes from transfers, not portal bookings. A business class award on ANA via Virgin Atlantic miles can yield 5–10+ CPP, dwarfing any Points Boost rate. For strategies on maximizing transfers, see how to book business class with points.

⚠️ Common mistake: Assuming Points Boost always beats transfers. Run the cents per point calculation both ways before committing. Our guide to cents per point walks through the math step by step.

Earning Rates and Credits: What Actually Changes the Bottom Line

Earning Rate Comparison

The Reserve’s earning structure was overhauled in the 2025 refresh, shifting heavily toward Chase Travel portal bookings:

| Spend Category | CSP | CSR |

|---|---|---|

| Chase Travel (flights) | 5x | 5x |

| Chase Travel (hotels, car rental) | 5x | 10x |

| Dining | 3x | 3x |

| Online grocery | 3x | 3x |

| Streaming | 3x | 3x |

| General travel (non-portal) | 2x | 1x |

| All other purchases | 1x | 1x |

Two things jump out:

The Reserve earns 10x on portal hotels/cars—double the Preferred’s 5x. For someone booking $5,000/year in hotels through Chase Travel, that’s 50,000 vs. 25,000 points, a difference of 25,000 points (worth $375–$500 at Points Boost rates).

The Preferred earns 2x on general travel; the Reserve earns only 1x. If travel is booked outside the Chase portal (directly with airlines, through other OTAs, etc.), the Preferred actually earns more. This is a meaningful tradeoff for travelers who prefer booking direct for status credits or better cancellation policies.

The Preferred’s 10% Anniversary Bonus

Often overlooked: the CSP returns 10% of prior-year points as an anniversary bonus. Earn 80,000 points in a year? That’s 8,000 bonus points—worth $140 at 1.75 CPP or up to $160 transferred to partners. The Reserve has no equivalent.

Credits Unique to the Reserve

Beyond Points Boost and earning rates, the Reserve’s credit stack includes:

- $300 annual travel credit (auto-applied to travel purchases)

- $500 The Edit hotel credit (two flexible $250 credits at select hotels via Chase Travel)

- $250 one-time hotel credit (new for 2026; select hotel brands, min. 2-night prepaid stay)

- $100 Global Entry/TSA PreCheck credit (every 4 years)

The Preferred has none of these. But credits only count if they align with actual spending. Booking an Edit-eligible hotel that costs $400/night when a $150/night option better suits the trip isn’t “saving money”—it’s spending more to use a credit.

Lounge Access: When CSR’s Lounge Benefits Outweigh the Fee

The Reserve provides Priority Pass Select membership (including a guest) and access to Chase Sapphire Lounges where available. The Preferred offers neither.

Putting a Dollar Value on Lounges

| Usage Level | Estimated Annual Value | Notes |

|---|---|---|

| 0 visits/year | $0 | No value if unused |

| 2–3 visits/year | $75–$120 | Meal + drink replacement |

| 4–6 visits/year | $160–$300 | Meaningful savings on airport food |

| 8+ visits/year | $300+ | Heavy travelers; families benefit more |

Chase Sapphire Lounges (currently in select airports like Boston and Hong Kong, with expansion underway) offer a premium experience with complimentary food and beverages. Priority Pass restaurants can offer $28–$36 in credits per person at participating locations.

When Lounges Don’t Justify the Fee

- Domestic-only travelers with short layovers rarely use lounges enough.

- Travelers with Amex Platinum or Capital One Venture X already have lounge access through those cards—doubling up adds little incremental value.

- Priority Pass restaurant access has been reduced at some airports; verify current availability before counting on it.

For a comparison of lounge networks across premium cards, see how the Capital One Venture X stacks up against the Reserve.

Upgrade CSP → CSR: Best Timing, Rules, and What Changes Immediately

The January 2026 Bonus Eligibility Update

As of January 22, 2026, Chase updated Sapphire bonus eligibility: holders of one Sapphire card can now earn the welcome bonus on the other if they’ve never previously earned a bonus on that specific product. This is a significant change from the stricter rules imposed in June 2025.

What this means practically:

- A current CSP holder who has never held a CSR can apply for the Reserve and earn its sign-up bonus (currently 60,000 points for the standard public offer, though targeted offers may be higher).

- A product change (upgrade) from CSP to CSR does not earn a new welcome bonus. To get the bonus, a new application is required.

Decision: Upgrade (Product Change) vs. New Application

| Path | Pros | Cons |

|---|---|---|

| Product change (upgrade) | No hard pull, no 5/24 slot used, keeps credit history | No welcome bonus; immediate fee change |

| New application | Earns welcome bonus (potentially 60k–75k+ points) | Hard inquiry, uses a 5/24 slot, new account |

| Downgrade CSR → CSP | Saves $700/year; keeps transfer access | Loses lounge, Points Boost at 2 CPP, credits |

For guidance on the 5/24 implications, review the Chase 5/24 Rule explainer.

Step-by-Step Upgrade Timing

If upgrading via product change:

- Check when the annual fee posts. Call the number on the back of the CSP or check the Chase app for the statement closing date.

- Request the product change before the next annual fee posts. This avoids paying the $95 CSP fee and then immediately paying $795 for the CSR.

- Confirm the change is effective. The new benefits (Points Boost at 2 CPP, lounge access, credits) activate immediately upon product change.

- The $300 travel credit resets each new cardmember year. Use it within 12 months.

- Authorized users automatically get Priority Pass access after the product change.

If applying for a new CSR while holding CSP:

- Verify 5/24 status. Count all new credit card accounts opened in the past 24 months across all banks.

- Apply for the CSR. If approved, the welcome bonus offer will apply.

- After earning the CSR bonus, downgrade the CSP to a Chase Freedom Flex or Freedom Unlimited to avoid paying two annual fees while keeping the credit line and account history.

- Combine points in the Chase app by linking both Ultimate Rewards accounts.

📋 Important: If planning to downgrade or cancel either card, review the credit card downgrade versus cancel decision guide to protect credit history and avoid losing points.

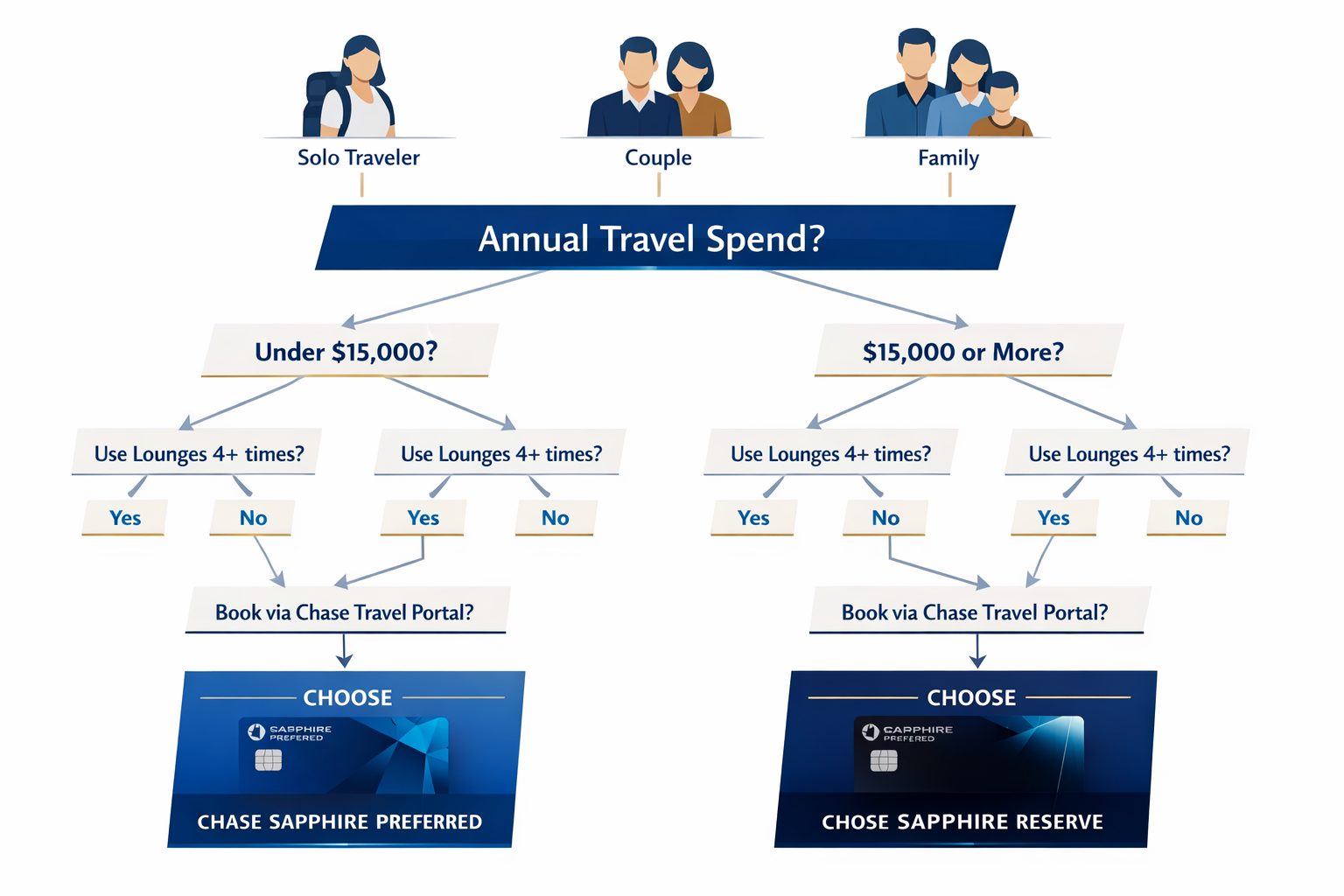

Decision Tree + Scenario Math: Which Card Wins for 3 Traveler Types

This is where the break-even framework comes together. Three realistic profiles illustrate when each card wins.

🧳 Scenario 1: Solo Traveler — 2 Trips/Year, Moderate Spend

Profile:

- $30,000/year total card spend

- $4,000 on dining, $3,000 on travel (booked directly, not via portal)

- 2 domestic round-trip tickets, 1 international trip every other year

- Rarely uses airport lounges

- Transfers points to partners for the occasional business class deal

CSP Math:

- Points earned: ~48,000/year (3x dining + 2x travel + 1x other)

- 10% anniversary bonus: 4,800 points

- Total: ~52,800 points

- Annual fee: $95

- Effective cost: $95

CSR Math:

- Points earned: ~42,000/year (3x dining + 1x non-portal travel + 1x other; lower because general travel earns only 1x)

- $300 travel credit: saves $300

- The Edit credit: uses ~$250 (one qualifying hotel stay)

- Lounge visits: 2 ($60 value)

- Effective cost: $795 − $300 − $250 − $60 = $185

Winner: CSP. The $90 annual savings is real, and this traveler doesn’t book enough through the Chase portal to benefit from Points Boost or the 10x hotel earning. Transfer partners deliver the same value on either card.

👫 Scenario 2: Couple — 3–4 Trips/Year, Books Through Chase Travel

Profile:

- $60,000/year total card spend

- $8,000 on dining, $10,000 on travel booked via Chase Travel (flights + hotels)

- 3 domestic trips, 1 international trip per year

- Uses lounges 4–5 times/year (with guest)

- Mix of portal bookings and partner transfers

CSP Math:

- Points earned: ~82,000/year

- 10% anniversary bonus: 8,200 points

- Total: ~90,200 points

- Portal value at 1.75 CPP (flights): ~$1,579 on 90,200 points

- Annual fee: $95

- Net value: ~$1,484

CSR Math:

- Points earned: ~107,000/year (10x on $6,000 portal hotels + 5x on $4,000 portal flights + 3x dining + 1x other)

- Portal value at 2.0 CPP: ~$2,140 on 107,000 points

- $300 travel credit: $300

- The Edit credit: $500 (couple uses both $250 credits on two hotel stays)

- Lounge visits: 5 × $40 avg = $200

- Global Entry: $25/year amortized

- Total benefits: $2,140 + $300 + $500 + $200 + $25 = $3,165

- Annual fee: $795

- Net value: ~$2,370

Winner: CSR by ~$886/year. The combination of 10x portal hotel earning, 2.0 CPP Points Boost, and full credit utilization makes the Reserve clearly superior for this couple.

👨👩👧👦 Scenario 3: Family of Four — 2 Big Trips/Year, High Hotel Spend

Profile:

- $80,000/year total card spend

- $12,000 dining, $15,000 travel via Chase Travel (mostly hotels for family)

- 2 major trips (1 domestic, 1 international)

- Uses lounges 3 times/year, but with 4 people (only 2 covered by Priority Pass)

- Transfers to Hyatt for family hotel stays; uses the portal for flights

CSP Math:

- Points earned: ~106,000/year

- 10% anniversary bonus: 10,600 points

- Total: ~116,600 points

- Portal flights at 1.75 CPP + Hyatt transfers: blended ~1.8 CPP → ~$2,099

- Annual fee: $95

- Net value: ~$2,004

CSR Math:

- Points earned: ~143,000/year (10x on $10,000 portal hotels, 5x on $5,000 portal flights, 3x dining, 1x other)

- Blended redemption (2.0 CPP portal + Hyatt transfers): ~1.9 CPP → ~$2,717

- $300 travel credit: $300

- The Edit credit: $400 (family uses most but not all)

- Lounge: 3 visits × $40 = $120 (only cardholder + 1 guest covered; 2 kids pay or don’t enter)

- Global Entry: $25

- Total benefits: $2,717 + $300 + $400 + $120 + $25 = $3,562

- Annual fee: $795

- Net value: ~$2,767

Winner: CSR by ~$763/year. High hotel spend through the portal is the key driver. However, if this family books hotels directly for loyalty status instead of through Chase Travel, the gap narrows significantly—and the CSP could pull ahead.

📊 Break-Even Summary Table

| Traveler Type | CSP Net Value | CSR Net Value | Winner | Margin |

|---|---|---|---|---|

| Solo, moderate spend | $1,389 | $1,295 | CSP | +$94 |

| Couple, portal-heavy | $1,484 | $2,370 | CSR | +$886 |

| Family, high hotel spend | $2,004 | $2,767 | CSR | +$763 |

🔑 The tipping point: The Reserve generally wins when annual Chase Travel portal bookings exceed $8,000–$10,000 and at least $400 of The Edit credit is realistically usable. Below those thresholds, the Preferred’s lower fee and 2x general travel earning often win.

For a more detailed, personalized calculation, plug specific numbers into the Award Travel Hub break-even calculator.

The Downgrade Path: When the Math Stops Working

Life changes. Travel patterns shift. If the Reserve stops paying for itself, here’s the playbook:

When to Downgrade CSR → CSP

- Annual portal bookings drop below $5,000

- The Edit credits go unused (no qualifying hotel stays planned)

- Lounge access is redundant (holding Amex Platinum or Venture X)

- Spending shifts away from Chase Travel to direct bookings for airline/hotel status

How to Downgrade

- Call Chase (or secure message) and request a product change from CSR to CSP.

- Time it within 30 days of the annual fee posting to receive a full refund of the $795 fee.

- Points are preserved. Ultimate Rewards points stay in the account, but portal redemption rates drop to CSP levels immediately.

- Lounge access ends immediately upon downgrade.

- Authorized user Priority Pass cards are deactivated.

⚠️ Don’t cancel—downgrade. Closing the account entirely forfeits the credit history and could impact credit scores. A product change to CSP, Freedom Flex, or Freedom Unlimited preserves the account age and credit line. More details in the downgrade versus cancel guide.

The “Hybrid” Strategy

Some experienced points users hold the CSP as their daily Sapphire card (lower fee, 2x general travel, 10% anniversary bonus) while keeping a no-annual-fee Freedom card for bonus categories. When a large portal booking arises, they temporarily upgrade to the CSR, use the enhanced Points Boost and credits, then downgrade before the next annual fee cycle.

Risks of this approach:

- Chase may restrict frequent product changes (no official limit has been published, but multiple changes per year can trigger a review).

- Credits may not fully reset with each upgrade cycle.

- The Edit hotel credits require booking through Chase Travel at qualifying properties—timing may not align.

This is an advanced tactic. For most cardholders, picking one card and committing for the full year is simpler and more predictable.

Common Mistakes to Avoid

❌ Counting credits at face value without checking usability. The $500 Edit credit is only valuable if there are qualifying hotel stays planned. Don’t let a credit drive spending that wouldn’t otherwise happen.

❌ Ignoring the CSP’s 2x general travel earning. The Reserve earns only 1x on non-portal travel. For travelers who book directly with airlines and hotels, this is a real cost.

❌ Forgetting that transfer partners are identical. The chase sapphire preferred vs reserve decision should not hinge on transfer partner access—both cards offer the same 14+ partners at the same 1:1 ratios. For a full comparison of transfer ecosystems, see Comparing Transfer Partners 2026: Chase vs Amex vs Citi vs Capital One.

❌ Overlooking the welcome bonus opportunity. With the January 2026 eligibility update, a CSP holder who has never held a CSR can apply for the Reserve and earn the bonus. That one-time bonus (60,000–75,000+ points) can shift the first-year math dramatically in the Reserve’s favor.

❌ Paying $795 for “just in case” lounge access. If lounge visits happen fewer than 3–4 times per year, the access alone doesn’t justify the fee premium.

Best For / Not For

Chase Sapphire Preferred Is Best For:

✅ Travelers who spend under $8,000/year on travel ✅ Those who book directly with airlines/hotels (not through Chase Travel) ✅ Points enthusiasts who primarily transfer to partner airlines for premium cabin awards ✅ Anyone who values simplicity and a low annual fee ✅ Cardholders who already have lounge access through another premium card

Chase Sapphire Preferred Is NOT For:

🚫 Heavy Chase Travel portal users who’d benefit from 10x earning and 2.0 CPP 🚫 Frequent travelers who’d use lounges 4+ times per year

Chase Sapphire Reserve Is Best For:

✅ Travelers who book $8,000+ annually through Chase Travel ✅ Those who can realistically use The Edit hotel credits ($400+/year) ✅ Frequent flyers who value Priority Pass and Chase Sapphire Lounge access ✅ Couples or families with high hotel spend through the portal ✅ Cardholders who want the highest possible portal redemption rate (2.0 CPP)

Chase Sapphire Reserve Is NOT For:

🚫 Light travelers or those with under $5,000 in annual travel spend 🚫 Points users who exclusively transfer to partners (no portal advantage) 🚫 Anyone uncomfortable with a $795 annual fee, even after credits 🚫 Travelers who already hold Amex Platinum + Venture X (redundant lounge access and credits)

Conclusion: Making the Right Call in 2026

The chase sapphire preferred vs reserve decision in 2026 comes down to one question: How much value can be extracted from the Reserve’s credits and Points Boost?

If the answer is $500+ per year in usable credits and $8,000+ in Chase Travel portal bookings, the Reserve wins—often by a wide margin. The 2.0 CPP Points Boost, 10x hotel earning, and lounge access create a compelling package for medium-to-heavy travelers.

If the answer is “I mostly transfer points to partners and book directly with airlines,” the Preferred is the smarter pick. It costs $700 less, earns 2x on general travel (vs. the Reserve’s 1x), offers a 10% anniversary points bonus, and accesses the exact same transfer partners.

Next Steps

- Run the numbers. Use the Award Travel Hub break-even calculator with actual spending data from the past 12 months.

- Check the transfer partner value. Before defaulting to portal bookings, compare options through Chase transfer partners to see if partner transfers beat Points Boost rates.

- Time to move. If upgrading from CSP to CSR, do it before the next annual fee posts. If applying fresh, verify 5/24 status first via the Chase 5/24 rule guide.

- Reassess annually. Travel patterns change. Set a calendar reminder 30 days before the annual fee posts to re-run the math and downgrade if needed.

- Explore premium cabin bookings. Regardless of which card is held, the real outsized value of Chase points comes from booking Business Class with points through partner airlines, where redemptions can exceed 5 CPP.

The right Sapphire card isn’t about prestige—it’s about math. Run the framework, pick the winner for this year’s travel plans, and revisit when circumstances change.