When Sarah and Mike decided to plan their dream honeymoon to Japan, they had no idea their combined credit card strategy would earn them enough points for two Business Class tickets plus five nights at a luxury Tokyo hotel. Their secret? A well-executed two-player mode credit card strategy for couples that doubled their earning potential while keeping their finances organized and stress-free.

The concept is straightforward: instead of one person handling all the credit card applications and bonuses, couples coordinate their efforts to maximize welcome bonuses, referral rewards, and ongoing earning rates. With proper planning, two players can earn significantly more transferable points than either could achieve alone—often 150,000 to 300,000+ bonus points within the first six months.

This approach has become increasingly valuable in 2026 as credit card issuers have tightened application rules and reduced some bonus categories. The regulatory environment continues to evolve, with the Credit Card Competition Act gaining bipartisan support and the CFPB issuing warnings about devaluations of rewards programs. These changes make strategic coordination between partners more important than ever.

Key Takeaways

• Role Definition: Assign Player 1 (P1) as the primary strategist handling applications and tracking, while Player 2 (P2) focuses on referrals and spending optimization • Ecosystem Focus: Choose 1-2 core transferable points programs (Chase, Amex, Capital One, or Citi) rather than spreading across all issuers • Timing Strategy: Plan 90-180 day application sequences with proper spacing to avoid velocity issues and maximize referral bonuses • Risk Management: Monitor credit scores, track application velocity, and maintain organized records to prevent shutdowns or relationship stress • Redemption Coordination: Pool points strategically using transfer bonuses and sweet spots to maximize value for shared travel goals

Understanding Two-Player Mode Credit Card Strategy for Couples

The foundation of any successful two-player mode credit card strategy for couples starts with clear role definitions and shared goals. Unlike individual credit card strategies, the two-player approach requires coordination, communication, and a systematic framework to avoid confusion or missed opportunities.

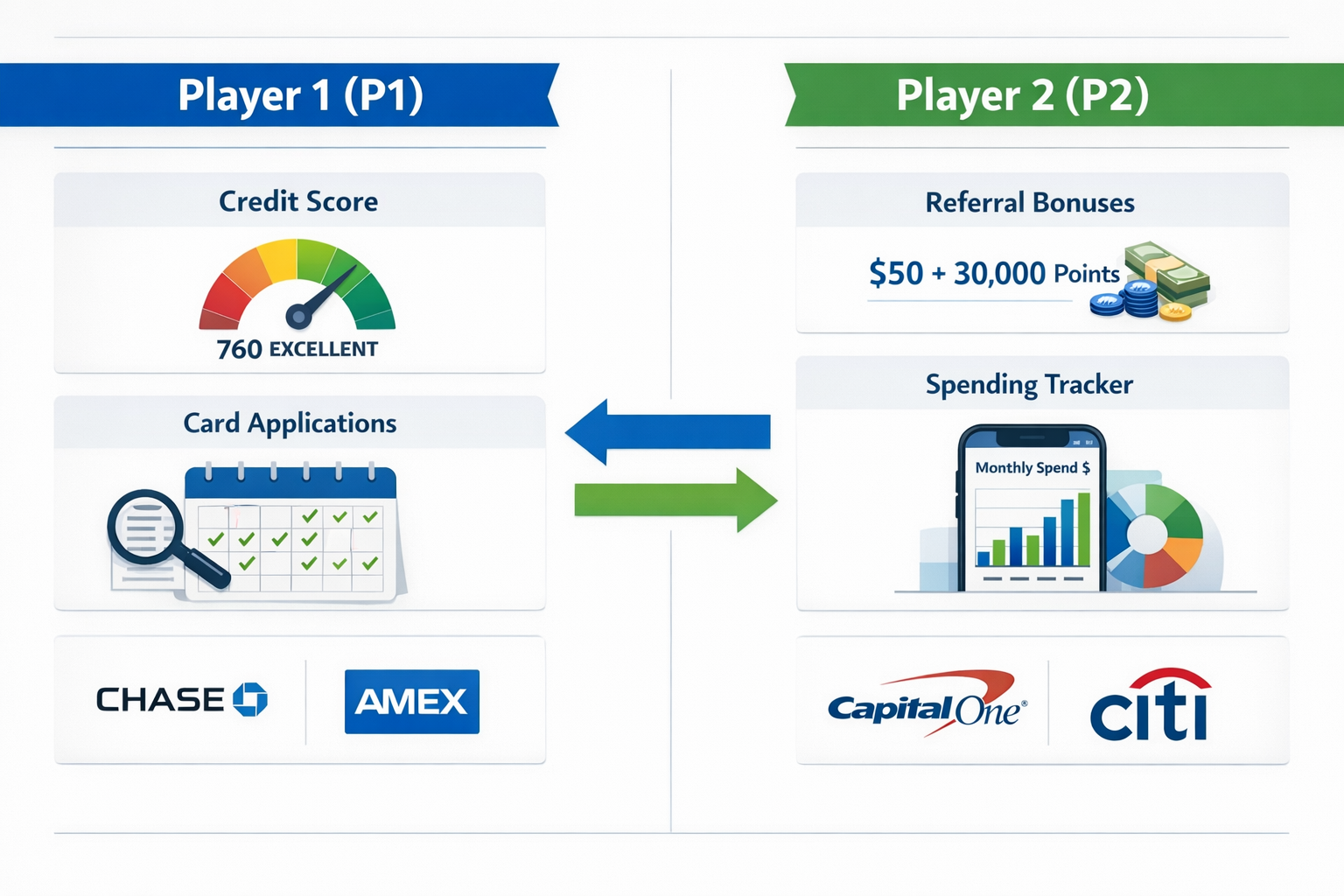

Player 1 (P1) typically serves as the primary strategist. This person handles research, tracks application timelines, monitors credit scores, and manages the overall points portfolio. P1 usually has the higher credit score or more experience with credit cards, making them better positioned to handle premium cards with strict approval requirements.

Player 2 (P2) focuses on execution and optimization. They handle referral applications, manage day-to-day spending across multiple cards, and often serve as the authorized user on P1’s accounts when beneficial. P2 doesn’t need to be the credit card expert—they just need to follow the plan consistently.

The key advantage lies in the multiplication of referral bonuses. When P1 opens a card and refers P2 to the same product, both players earn substantial bonuses. For example, the Chase Sapphire Preferred currently offers 60,000 points for the welcome bonus, plus 15,000 points for successful referrals. A couple executing this strategy earns 135,000 Chase points—more than double what one person could earn.

Recent Bankrate survey data shows that 62% of American couples maintain at least some separate financial accounts, making the two-player approach particularly relevant. Couples can coordinate their credit card strategy while maintaining individual credit profiles and financial independence.

Choose Your Core Ecosystems: Focus Beats Spreading

The most critical decision in implementing a two-player mode credit card strategy for couples involves selecting your core transferable points ecosystems. While it might seem logical to pursue all available bonuses across Chase, Amex, Capital One, Citi, and Bilt, successful couples typically focus on 1-2 primary ecosystems to maximize their earning potential and simplify redemptions.

One-Core Strategy: Deep Ecosystem Focus

The one-core approach involves both players concentrating on a single transferable points program for 6-12 months before considering other ecosystems. This strategy works best for couples with moderate spending ($3,000-6,000 monthly) who want to accumulate a large balance quickly for a specific redemption goal.

Chase Ultimate Rewards Example:

- P1: Chase Sapphire Preferred (60,000 points) → Chase Freedom Unlimited (20,000 points) → Chase Ink Business Cash (75,000 points)

- P2: Chase Sapphire Preferred via referral (60,000 points + 15,000 referral bonus to P1) → Chase Freedom Flex (20,000 points)

- Total after 6 months: 250,000 Chase points

This approach leverages Chase’s comprehensive transfer partner network while staying under the 5/24 rule that restricts access to Chase cards after opening five cards from any issuer within 24 months.

Two-Core Strategy: Balanced Diversification

Couples with higher spending capacity ($6,000+ monthly) often benefit from pursuing two complementary ecosystems simultaneously. The most effective combinations pair Chase with either Amex or Capital One, as these programs offer different sweet spots and transfer partners.

Chase + Amex Example:

- P1: Chase Sapphire Preferred (60,000 points) → Amex Gold Card (60,000 points)

- P2: Amex Gold Card via referral (60,000 points + 30,000 referral bonus to P1) → Chase Sapphire Preferred via referral (60,000 points + 15,000 referral bonus to P1)

- Total after 4 months: 285,000 points split between ecosystems

This diversification provides access to different airline and hotel partners while reducing devaluation risk. Chase excels with United, Southwest, and Hyatt transfers, while Amex offers unique access to Delta, British Airways, and Hilton with frequent transfer bonuses.

Ecosystem Selection Framework

When choosing your core ecosystem(s), consider these decision factors:

Chase Ultimate Rewards works best for:

- Couples prioritizing domestic U.S. travel

- Those wanting hotel flexibility with Hyatt

- Partners are comfortable with the 5/24 restriction

Amex Membership Rewards suits couples who:

- Travel internationally frequently

- Value premium airline partnerships (Delta, British Airways)

- Can maximize category bonuses (dining, groceries, travel)

Capital One Miles appeals to those seeking:

- Transfer flexibility without blackout dates

- Simple earning structure across all purchases

- Access to unique partners like Turkish Airlines

For detailed comparisons of transfer partner networks and current bonus categories, review our comprehensive transfer partners guide.

Application Sequencing and Bonus Timing Plan

Successful execution of a two-player mode credit card strategy for couples requires precise timing and sequencing. The goal is to maximize welcome bonuses and referral rewards while avoiding velocity issues that could lead to denials or account shutdowns.

90-Day Quick Start Sequence

For couples wanting immediate results, the 90-day plan focuses on high-value cards with manageable minimum spending requirements:

| Timeline | Player | Card | Welcome Bonus | Min Spend | Referral Bonus |

|---|---|---|---|---|---|

| Month 1 | P1 | Chase Sapphire Preferred | 60,000 points | $4,000/3mo | N/A |

| Month 1 | P2 | Chase Freedom Unlimited | 20,000 points | $500/3mo | N/A |

| Month 2 | P1 | Amex Gold Card | 60,000 points | $4,000/6mo | N/A |

| Month 3 | P2 | Chase Sapphire Preferred (via P1 referral) | 60,000 points | $4,000/3mo | 15,000 to P1 |

| Month 3 | P2 | Amex Gold Card (via P1 referral) | 60,000 points | $4,000/6mo | 30,000 to P1 |

Total Expected Points: 305,000 across Chase and Amex ecosystems

This sequence assumes both players have credit scores above 700 and can comfortably meet the combined minimum spending of approximately $2,800 per month. The staggered timing prevents velocity issues while maximizing referral bonuses.

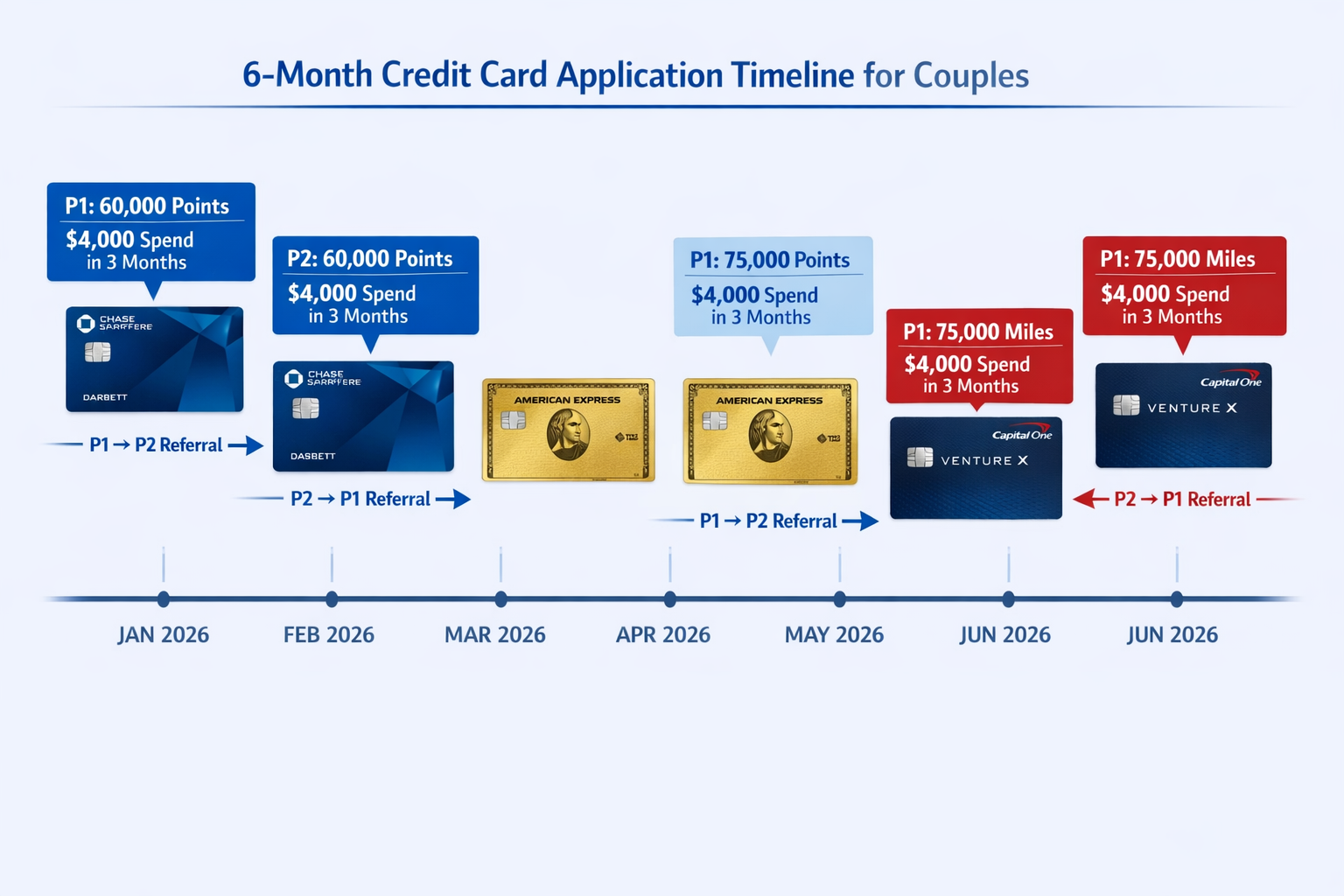

180-Day Comprehensive Plan

Couples with higher risk tolerance and spending capacity can extend their timeline for maximum point accumulation:

Months 1-2: Chase Foundation

- P1 opens Chase Sapphire Preferred and Chase Ink Business Preferred

- P2 opens Chase Freedom Unlimited and Chase Freedom Flex

- Combined minimum spend: $7,000 over 3 months

Months 3-4: Referral Execution

- P2 applies for Chase Sapphire Preferred via P1 referral

- P1 applies for a premium Amex card (Platinum or Gold)

- Focus on meeting the previous cards’ minimum spending

Months 5-6: Ecosystem Expansion

- P2 applies for the Amex card via P1 referral

- Both players consider business cards if applicable

- Begin optimization for ongoing category bonuses

Velocity and Spacing Considerations

Credit card issuers monitor application velocity—the frequency of new account openings. Exceeding recommended limits can trigger denials or account reviews. Follow these spacing guidelines:

Chase: Maximum 2 personal cards per player every 6 months, with 2-3 month spacing between applications Amex: More lenient on velocity but monitor for popup restrictions on bonuses Capital One: Conservative approach recommended—1 card every 6 months per player Citi: 1 personal card every 8 days, maximum 2 every 65 days per player

Business cards often have separate velocity considerations and can provide additional earning opportunities without impacting personal card limits. Our business credit card guide covers qualification requirements and optimal timing strategies.

Referral Strategy: Timing and Optimization

Referral bonuses represent the highest-value component of any two-player mode credit card strategy for couples. When executed correctly, referrals can add 50,000 to 100,000+ bonus points annually while requiring no additional spending or effort beyond the standard application process.

When Referrals Make Sense

High-Value Referral Cards:

- Amex Platinum: 30,000-55,000 point referral bonuses

- Chase Sapphire Preferred: 15,000-20,000 point referral bonuses

- Capital One Venture X: 20,000 mile referral bonuses

- Amex Gold: 30,000 point referral bonuses

Timing Optimization Rules:

- P1 applies first for any card both players want

- Wait for approval before generating the referral link

- P2 applies via referral within 30-90 days, depending onthe issuer

- Track referral posting (typically 8-12 weeks after P2’s approval)

When to Skip Referrals

Not every situation benefits from referral coordination. Skip the referral approach when:

Limited-Time Elevated Bonuses: If P2’s welcome bonus would be significantly higher through a public offer than the standard referral bonus, apply directly Velocity Concerns: When spacing applications properly would cause P2 to miss a valuable limited-time offer Different Card Preferences: If players want different products within the same ecosystem (e.g., P1 wants Amex Platinum, P2 prefers Amex Gold)

Referral Bonus Tracking

Maintain a simple tracking system to monitor referral bonus posting:

Essential Data Points:

- P1 application date and approval

- P2 referral application date and approval

- Expected referral bonus amount

- Actual posting date and amount

- Any discrepancies requiring follow-up

Most referral bonuses post automatically, but occasional issues require contacting customer service. Keep screenshots of referral links and application confirmations as documentation.

For couples concerned about welcome bonus clawbacks, referral bonuses typically have lower risk since they depend on another person’s legitimate application rather than meeting spending requirements.

The Couples Points Tracker: Organization System

Effective organization separates successful couples from those who abandon their two-player mode credit card strategy for couples due to confusion or missed requirements. A well-designed tracking system prevents costly mistakes while ensuring both players stay aligned on goals and progress.

Essential Spreadsheet Fields

Create a shared tracking document (Google Sheets works well) with these core components:

Card Tracking Tab:

- Player (P1/P2)

- Card Name

- Application Date

- Approval Date

- Welcome Bonus Amount

- Minimum Spend Requirement

- Spend Deadline

- Current Spend Progress

- Bonus Posted Date

- Annual Fee Date

- Status (Active/Cancelled/Downgraded)

Points Balance Tab:

- Program (Chase UR, Amex MR, Capital One, etc.)

- P1 Balance

- P2 Balance

- Combined Balance

- Last Updated Date

- Transfer Bonus Opportunities

- Planned Redemptions

Monthly Spending Tab:

- Card Used

- Spending Category

- Amount

- Bonus Rate

- Points Earned

- Progress Toward Minimum Spend

Weekly Review Routine

Establish a consistent 15-minute weekly review to maintain system accuracy:

Week 1 of Month: Update all point balances and check for new transfer bonuses Week 2 of Month: Review minimum spend progress and adjust spending allocation Week 3 of Month: Plan next month’s applications or strategy adjustments Week 4 of Month: Reconcile all spending and prepare monthly summary

This routine prevents the common mistake of losing track of minimum spending requirements or missing valuable transfer bonus opportunities. Use our points value calculators during weekly reviews to identify optimal redemption timing.

Communication Guidelines

Establish clear communication protocols to avoid relationship stress:

Daily: Brief check-in on any large purchases or card usage changes Weekly: Structured review meeting using the tracking spreadsheet Monthly: Strategic planning session for upcoming applications or redemptions Quarterly: Comprehensive strategy review and goal adjustment

The key is making credit card coordination feel collaborative rather than controlling. Both players should understand the strategy and feel comfortable with their roles and responsibilities.

Risk Management and Relationship Harmony

While a two-player mode credit card strategy for couples can generate substantial rewards, it also introduces risks that require careful management. The most successful couples proactively address potential issues before they impact their credit scores, approval odds, or relationship dynamics.

Credit Score and Velocity Monitoring

Individual Credit Monitoring: Each player should monitor their credit score monthly using free services like Credit Karma or directly through their credit card issuers. Hard inquiries from applications typically reduce scores by 2-5 points temporarily, but multiple inquiries in a short period can compound the impact.

Velocity Tracking: Maintain a simple log of application dates across all issuers:

- Chase: Stay under 5 total cards (any issuer) in 24 months

- Amex: Monitor for “popup” warnings indicating bonus restrictions

- Capital One: Conservative approach—limit to 1-2 cards annually per player

- Citi: Follow 8/65 rule (maximum 2 cards every 65 days)

Warning Signs to Monitor:

- Credit score drops exceeding 10 points

- Application denials citing “too many recent accounts”

- Popup warnings about bonus eligibility

- Requests for additional income verification

Shutdown Prevention Strategies

Account shutdowns represent the most serious risk in aggressive credit card strategies. While rare when following conservative guidelines, certain behaviors increase shutdown probability:

High-Risk Activities to Avoid:

- Manufactured spending or cash advance abuse

- Rapid account closures immediately after bonus posting

- Inconsistent income reporting across applications

- Excessive credit limit requests

Protective Measures:

- Maintain legitimate spending on all cards

- Keep accounts open for at least 12 months

- Report consistent income information

- Spread applications across multiple issuers

For couples concerned about shutdown risks, our application rules guide provides detailed issuer-specific guidelines and conservative timing recommendations.

Relationship-Friendly Guidelines

Money discussions can create tension in relationships. Establish these guidelines to maintain harmony:

Financial Boundaries:

- Set maximum monthly spending limits for each player

- Agree on major purchase approvals (typically $500+ transactions)

- Maintain individual emergency funds separate from rewards strategy

- Define “fun money” budgets that don’t require coordination

Responsibility Sharing:

- Rotate who handles monthly payment responsibilities

- Share access to all tracking documents and account logins

- Establish backup plans if one player becomes unavailable

- Create simple handoff procedures for strategy management

Stress Reduction Tactics:

- Start with conservative goals and expand gradually

- Celebrate milestone achievements together

- Maintain perspective—rewards are bonuses, not necessities

- Have exit strategies if the approach becomes burdensome

Remember that the most sophisticated two-player mode credit card strategy for couples fails if it creates relationship stress or financial strain. Prioritize communication, set realistic expectations, and adjust the approach based on what works for your specific situation and comfort level.

Redemption Strategy: Maximizing Your Combined Points

After successfully accumulating points through your two-player mode credit card strategy for couples, the redemption phase determines your actual return on investment. Strategic redemption planning can multiply your effective earning rate while poor choices can waste months of careful accumulation.

Transfer Partner Sweet Spots

The power of transferable points lies in finding high-value redemptions through airline and hotel partners. Focus on these consistently strong sweet spots:

Chase Ultimate Rewards:

- United Saver Awards to Europe: 30,000 points one-way in economy, 60,000 in business

- Southwest Companion Pass: Use points for flights while companion flies free

- Hyatt Category 1-4 hotels: Often 5,000-15,000 points for properties costing $200+ per night

Amex Membership Rewards:

- British Airways short-haul flights: 7,500-9,000 points for flights under 650 miles

- Delta business class to Europe: 62,500-75,000 points during off-peak periods

- Hilton premium properties: Transfer bonuses often provide 40-50% bonus value

- Turkish Airlines business class: Excellent availability and routing options

- Wyndham hotel transfers: Frequent 100% transfer bonuses effectively double your points

Transfer Bonus Timing

Never transfer points without checking for current transfer bonuses. These limited-time offers can increase your redemption value by 25-50%:

Typical Transfer Bonus Patterns:

- Amex: 20-40% bonuses rotating quarterly among airline partners

- Chase: Less frequent but valuable bonuses (15-25%) typically twice yearly

- Capital One: Regular 100% bonuses to hotel partners, occasional airline bonuses

- Citi: Frequent airline bonuses ranging from 25-40%

Before any transfer, check our current transfer bonus tracker to identify active promotions. A 30% transfer bonus can make the difference between a good redemption and an exceptional one.

Booking Coordination Strategy

Couples face unique challenges when booking award travel, particularly for premium cabin flights with limited availability. Use these coordination tactics:

Search Strategy:

- Identify availability first using airline websites or search tools

- Check multiple date ranges to find optimal availability windows

- Book immediately when finding suitable flights—availability disappears quickly

- Use positioning flights if necessary to reach departure cities with better award space

Split Bookings When Necessary: Don’t assume you must book identical flights. Consider these alternatives:

- Different departure times on the same day

- Positioning flights to meet at a hub airport

- One-way awards mixed with paid flights for optimal value

- Different cabin classes if business availability is limited

For complex international itineraries, our business class booking guide provides step-by-step instructions for finding and booking premium cabin awards.

Redemption Value Tracking

Monitor your redemption success using cents-per-point (CPP) calculations:

Strong Redemption Values:

- Chase points: 1.5-2.5 CPP for travel, 2.0+ CPP for premium hotels

- Amex points: 1.5-2.0 CPP for flights, 2.5+ CPP for business class

- Capital One miles: 1.3-1.8 CPP for most transfers

Warning Signs of Poor Value:

- Redeeming transferable points for cash back (typically 1.0 CPP)

- Booking economy flights during peak periods (often under 1.2 CPP)

- Using points for domestic hotels without elite benefits

Use our points valuation guide to calculate redemption value before completing bookings. A few minutes of math can prevent costly mistakes and ensure your two-player mode credit card strategy for couples delivers maximum value.

Sample Implementation: Low-Spend vs High-Spend Couples

Real-world examples demonstrate how different couples can adapt the two-player mode credit card strategy for couples to their specific spending levels and travel goals. These scenarios show realistic timelines, point totals, and redemption outcomes.

Low-Spend Couple Example: $4,000 Monthly Spending

Background: Jessica and David, both teachers, have a combined monthly spending of $4,000 primarily on groceries, dining, and utilities. Their goal is to earn a free honeymoon to Europe within 12 months.

6-Month Strategy:

- Month 1: Jessica (P1) applies for Chase Sapphire Preferred

- Month 2: David (P2) applies for Chase Freedom Unlimited

- Month 3: David applies for Chase Sapphire Preferred via Jessica’s referral

- Month 4: Jessica applies for Amex Gold Card

- Month 5: David applies for Amex Gold Card via Jessica’s referral

- Month 6: Both focus on category optimization and bonus earning

Point Accumulation:

- Chase Sapphire Preferred bonuses: 135,000 points (60k + 60k + 15k referral)

- Chase Freedom Unlimited bonus: 20,000 points

- Amex Gold bonuses: 150,000 points (60k + 60k + 30k referral)

- Category spending bonuses: ~25,000 points

- Total: 330,000 points across Chase and Amex

Redemption Outcome: Using United partners for flights (60,000 Chase points each for business class) and Hyatt for hotels (40,000 Chase points for 4 nights), Jessica and David booked a luxury European honeymoon worth over $8,000 while spending only $400 in taxes and fees.

High-Spend Couple Example: $8,000+ Monthly Spending

Background: Mark and Sarah, both consultants, have high business expenses they can put on personal cards for reimbursement. Their goal is to accumulate points for annual international travel plus domestic weekend trips.

6-Month Aggressive Strategy:

- Month 1: Mark applies for Chase Sapphire Preferred and Amex Platinum

- Month 2: Sarah applies for Chase Ink Business Preferred and Capital One Venture X

- Month 3: Sarah applies for Chase Sapphire Preferred and Amex Platinum via referrals

- Month 4: Mark applies for Amex Gold and Chase Ink Business Cash

- Month 5: Sarah applies for Amex Gold via referral, Mark gets Capital One Venture X

- Month 6: Both optimize category spending and plan next wave

Point Accumulation:

- Chase ecosystem: ~280,000 points

- Amex ecosystem: ~350,000 points

- Capital One ecosystem: ~140,000 miles

- Category and business spending bonuses: ~75,000 points

- Total: 845,000+ points/miles across three ecosystems

Redemption Flexibility: This diversified approach provides multiple redemption options: Chase points for United and Hyatt, Amex points for Delta and international partners, Capital One miles for Turkish Airlines, and hotel transfers. Mark and Sarah can book 2-3 international trips annually while maintaining flexibility for domestic travel.

Key Success Factors

Both examples demonstrate essential principles:

Realistic Minimum Spending: Neither couple stretched beyond comfortable spending levels or resorted to manufactured spending Strategic Patience: Both waited for optimal referral timing rather than rushing applications Ecosystem Focus: Even the high-spend couple concentrated on 2-3 primary programs rather than spreading across all issuers Redemption Planning: Both couples identified specific travel goals before beginning their strategy

The most important lesson: a successful two-player mode credit card strategy for couples requires matching your approach to your actual spending capacity and travel preferences. Aggressive strategies work for high-spend couples, while conservative approaches suit those with limited spending or risk tolerance.

For couples just starting their journey, consider beginning with our beginner’s guide to travel rewards to establish foundational knowledge before implementing advanced two-player strategies.

Conclusion

A well-executed two-player mode credit card strategy for couples can transform your travel experiences while strengthening your financial partnership. The key lies in starting with clear communication, realistic goals, and a systematic approach that matches your spending capacity and risk tolerance.

The most successful couples focus on 1-2 core transferable points ecosystems, maintain organized tracking systems, and prioritize relationship harmony over maximum point accumulation. Whether you’re a low-spend couple targeting one major trip or high-spend partners building long-term travel flexibility, the fundamental principles remain consistent: strategic timing, careful velocity management, and patient execution.

Remember that credit card regulations continue evolving in 2026, making coordination between partners more valuable than ever. Start conservatively with your first few applications, establish effective communication routines, and gradually expand your strategy as you gain experience and confidence.

Next Steps:

- Choose your core ecosystem using our transfer partners comparison guide

- Set up your tracking system with the spreadsheet framework outlined above

- Plan your first 90-day sequence focusing on high-value welcome bonuses and referrals

- Monitor transfer bonuses using our current bonus tracker before making any point transfers

The rewards of coordinated credit card strategy extend beyond free flights and hotel nights—they include shared financial goals, improved money communication, and unforgettable travel experiences that strengthen your relationship for years to come.