Do you ever pay your card’s yearly cost out of habit? Many of us do. We assume the benefits remain worthwhile. But the value of a premium product can change over time.

As we approach a new year, it’s the perfect moment for a financial check-up. The holiday season often brings higher spending. This creates an excellent opportunity to evaluate your entire wallet.

We built a clear framework to simplify this process. It helps you decide if a product deserves a place in your strategy. You can complete the evaluation for each one in about 15 minutes.

Our method uses real math. We look at the credits you actually use. We calculate the value of lounge access and hotel status. We even consider the opportunity cost of your annual payment.

This guide provides a straightforward rubric. It also explains smart downgrade paths. Our goal is to give you the control and confidence you need for the year ahead.

Key Takeaways

- Conducting a yearly review of your financial products is a crucial habit.

- Avoid paying costs out of routine without verifying the current value.

- A simple, 15-minute evaluation per product can save you money.

- Focus on tangible benefits you use, not just the advertised perks.

- Understand your options, including product changes, before closing an account.

- Major updates to premium offerings make the upcoming year a key time to reassess.

Overview of Credit Card Annual Fees in 2026

An annual fee on a financial product is more than just a line item on your statement; it’s an investment in a suite of potential advantages. This cost provides access to a robust rewards program and exclusive privileges that standard options don’t offer.

Understanding Annual Fees and Their Role

Think of this recurring payment as the fuel for the premium experience. It directly funds the lucrative welcome bonuses, high points multipliers, and statement credits you enjoy. It also supports elevated customer service and robust travel protections.

This system is designed for strategic users. The value you extract should consistently outweigh the initial cost. It’s a direct exchange: you pay for potential, and you activate that potential through your spending and lifestyle.

Current Trends and Market Changes

The market is evolving rapidly. Premium product costs have risen, with some now near $900. However, these increases are accompanied by substantial benefits.

Issuers are increasing credit limits for everyday spending, such as dining and streaming services. This shift helps active users offset the higher fee more easily. New entrants are also emerging, focusing on unique categories.

The key takeaway is that the value of an annual fee is deeply personal. It hinges entirely on how well the attached perks align with your life. A thorough review is essential to ensure your investment is paying off.

Best credit card annual fee review for 2026 Keep Downgrade or Cancel

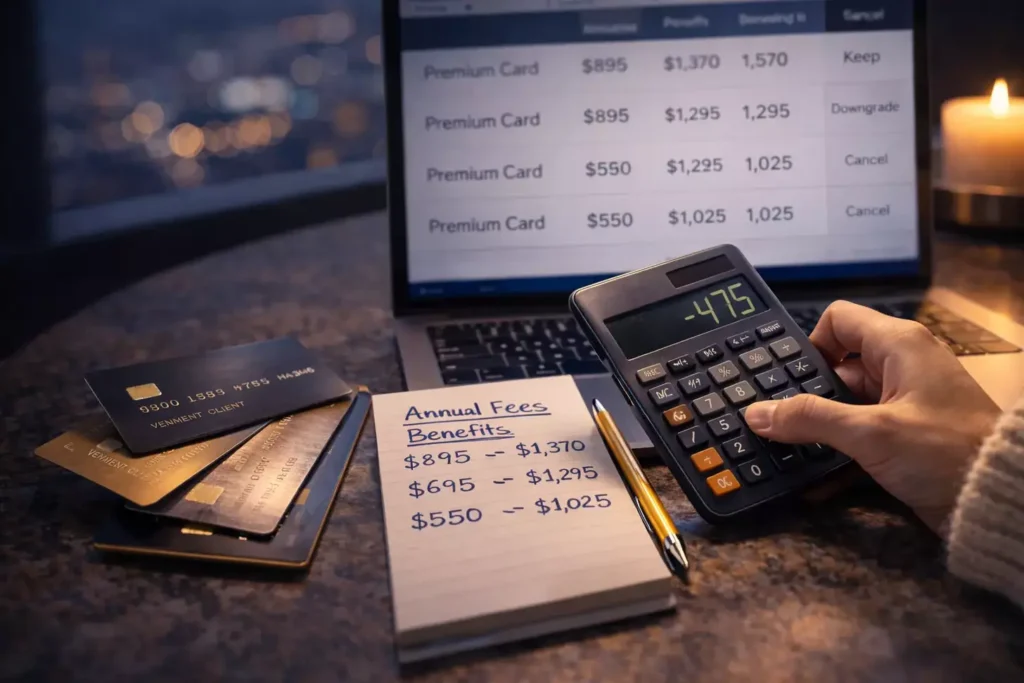

That familiar charge appearing on your billing cycle signals it’s time for a strategic assessment. We guide you through a proven method to determine if each product deserves renewal.

Our approach uses real-time usage data. Calculate your annual spending in each bonus category. Multiply this by the points earned per dollar.

Next, assign a realistic redemption value to your accumulated rewards. Add the monetary worth of all credits and perks you actually used. Subtract the yearly cost to find your net value.

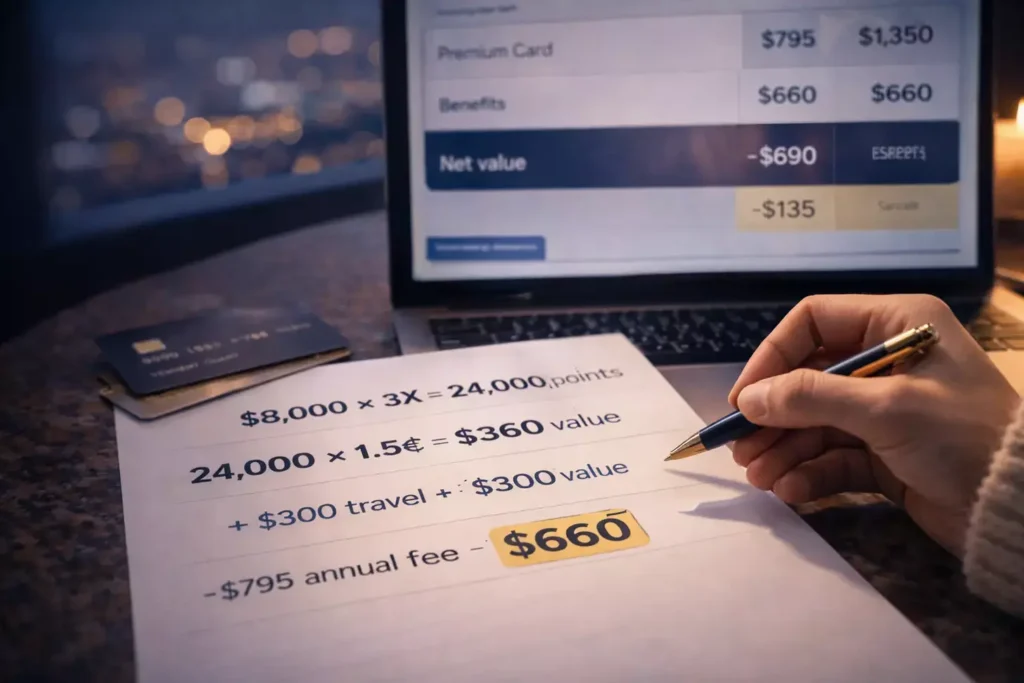

Consider this example with a premium travel product. If you spent $8,000 at 3X points, you’d earn 24,000 points. Redeeming them at 1.5 cents each gives $360 in value.

The $300 travel credit brings total benefits to $660. This helps significantly offset the investment. The decision becomes clear when you see the numbers.

| Calculation Step | Your Data | Example | Result |

|---|---|---|---|

| Annual Spending × Points Rate | Your category spending | $8,000 × 3X | 24,000 points |

| Points × Redemption Value | Your redemption rate | 24,000 × 1.5¢ | $360 value |

| Add Used Credits/Perks | Benefits you actually used | + $300 travel credit | $660 total value |

| Subtract Annual Cost | Your product’s fee | $660 – $795 | Net value assessment |

This framework enables objective decisions tailored to your unique situation. We recommend starting this process 4-6 weeks before your fee posts.

This gives adequate time to explore alternatives if needed. Your financial strategy should evolve with your lifestyle changes.

Evaluating the Value of Credit Card Rewards and Perks

Maximizing your investment means looking beyond surface-level perks to calculate actual value. We help you assess whether your current strategy delivers meaningful returns.

Not all loyalty programs are created equal. The flexibility of your redemption options significantly affects the value of your points.

Assessing Bonus Points and Travel Benefits

Premium products offer impressive earning rates on specific categories. Some provide 5-8X points on flights and hotel stays.

Track your actual spending patterns to determine real value. A product with 3X on dining delivers little benefit if you rarely eat out.

Travel advantages extend beyond simple points accumulation. Consider lounge access, hotel status, and travel protections that enhance your experiences.

“The true worth of any loyalty program lies in how well it aligns with your lifestyle and redemption preferences.”

Comparing Reward Redemption Options

Different redemption methods yield varying value. Transferring to airline partners often provides the highest return.

Portal redemptions typically offer fixed value, while cash back delivers the lowest yield. Your choice depends on travel goals and flexibility needs.

| Redemption Method | Typical Value | Best For |

|---|---|---|

| Airline Transfer Partners | 1.5-2.5 cents per point | International travel, premium cabins |

| Travel Portal | 1.0-1.5 cents per point | Simple bookings, last-minute trips |

| Cash Back | 1.0 cent per point | Flexibility, statement credits |

Match your redemption strategy to your actual travel patterns. Frequent flyers benefit most from transfer options.

In-Depth Look at Top Credit Card Offers for Future Travelers

Today’s travel rewards landscape offers diverse options to suit different spending habits. We examine both premium products and cost-effective alternatives to help you find the perfect fit.

Highlighting Premium Travel Cards

The American Express Platinum stands out with its generous welcome bonus and extensive travel credits. This product provides comprehensive access to airport lounges across multiple networks.

Chase Sapphire Reserve provides excellent flexibility with its automatic travel credit. Members enjoy Priority Pass membership and exclusive Sapphire Lounge locations.

Capital One Venture X delivers remarkable value with its lower cost structure. It includes an annual travel credit and anniversary bonus miles.

Review of No-Annual-Fee Alternatives

For those seeking simplicity, the Robinhood Gold Card offers flat-rate cash back on all purchases. It requires a separate membership but delivers consistent value.

Bank of America’s Customized Cash Rewards provides category-specific bonuses that adapt to your spending. Preferred Rewards members can significantly boost their earnings.

The Blue Cash Everyday card from American Express covers essential spending categories with no annual fee. It includes valuable streaming credits as an added perk.

Each option serves different traveler profiles. Premium products offer comprehensive benefits, while no-fee alternatives provide accessible entry points to rewards programs.

Analyzing Recent Updates and Their Impact on 2026

The past twelve months have witnessed a remarkable transformation across the premium financial products landscape. Major issuers have fundamentally reshaped their offerings throughout 2025.

These changes create a compelling reason to reassess your current strategy. The enhanced benefits could significantly alter your value calculations for the coming year.

Key Enhancements from 2025

American Express revamped its Platinum product with substantial new lifestyle credits. These include Resy dining, Uber One membership, and Lululemon purchases.

Chase responded by adding hotel credits and exclusive dining access to its Sapphire Reserve. They also introduced valuable streaming service subscriptions.

Citi disrupted the market with its Strata Elite launch in July. This became the only major flexible points program offering transfers to American Airlines.

What Changes Mean for Cardholders

These updates mean your previous evaluations may no longer reflect current value. Products that didn’t justify their costs last year might now offer compelling advantages.

Issuers are competing aggressively by adding everyday lifestyle benefits. This makes premium tools more valuable during periods when you’re not actively traveling.

| Issuer | Key 2025 Updates | Impact on Value |

|---|---|---|

| American Express | New lifestyle credits, enhanced hotel status | Higher everyday utility |

| Chase | Hotel/dining credits, streaming subscriptions | Broader benefit categories |

| Citi | American Airlines transfers, new premium product | Enhanced travel flexibility |

“Strategic portfolio evaluation requires regular reassessment as the competitive landscape evolves.”

We recommend reviewing each product against these new enhancements. The coming months present an ideal opportunity to optimize your financial tools.

Strategies for Optimizing Your Card Benefits

Optimizing your portfolio requires more than just calculating rewards—it demands proactive planning and negotiation. We guide you through proven methods to maximize value from every financial tool in your collection.

Getting the Most from Welcome Bonuses

Timing your applications during high-spending periods, such as holidays, helps you meet requirements naturally. Plan major purchases for the coming months before applying for new products.

Map out your spending patterns to comfortably reach thresholds. For example, the American Express Platinum’s 175,000-point offer requires $8,000 in six months. Strategic planning ensures you earn valuable rewards without stress.

Leveraging Retention Offers and Product Changes

Retention offers can be as valuable as welcome bonuses. Call your issuer 4-6 weeks before your fee posts to express concerns about value. Consistent spending increases your chances of receiving compelling deals.

Product changes let you adjust your portfolio without closing accounts. You can typically move between products within the same family. This preserves your credit history while aligning with current needs.

| Optimization Strategy | Optimal Timing | Potential Value |

|---|---|---|

| Welcome Bonus Application | High-spending seasons | 50,000-175,000 points |

| Retention Offer Negotiation | 4-6 weeks before the fee | 20,000-50,000 points or a fee waiver |

| Product Change | After the annual evaluation | Preserved credit history + better fit |

Set calendar reminders 60 days before each fee posts. This gives you time to evaluate usage, negotiate offers, and research alternatives. Proactive management ensures your tools always match your lifestyle.

Methods to Compare Costs Versus Benefits on Annual Fees

We’ve developed a straightforward framework to help you measure the true return on investment from your premium financial products. This systematic approach moves beyond simple math to provide clear insights.

Calculating Spend vs. Rewards

Our methodology involves three essential steps. First, multiply your yearly spending in each bonus category by the product’s earning rate. This gives you the total points accumulated.

Second, assign a realistic redemption value based on how you actually use your rewards. Third, add the monetary worth of all statement credits and perks you utilized throughout the year.

Consider this example: $8,000 in purchases averaging 3X points earns 24,000 points. At 1.5 cents per point, that’s $360 in value. Against a $795 cost, this seems insufficient.

However, adding a $300 travel credit brings the total benefits to $660. This significantly offsets the investment. We recommend using conservative redemption values for accurate planning.

Honestly assess your perk utilization rather than theoretical maximums. Track each product’s cost, points earned, and benefits used in a simple spreadsheet for objective decisions.

Tips for Managing Your Wallet and Maintaining Credit Scores

Your credit profile deserves as much attention as your rewards strategy when adjusting your financial tools. We guide you through protecting your financial reputation while optimizing your portfolio.

Making changes to your financial products requires careful planning. Your borrowing power depends on maintaining strong financial health through strategic decisions.

Preserving Credit History When Adjusting Cards

Product changes within the same family do not affect your account age or payment history. This approach maintains your established relationship with the issuer while adapting to current needs.

Downgrading to no-cost options preserves your credit limit and account longevity. This strategy eliminates recurring costs without damaging your financial profile.

| Strategy | Impact on Credit History | Recommended When |

|---|---|---|

| Product Change | Preserves account age and limit | Reducing costs, maintaining benefits |

| Credit Limit Increase | Improves the utilization ratio | Before closing other accounts |

| Balance Paydown | Reduces utilization percentage | Preparing for major applications |

Minimizing the Impact of Cancelled Accounts

Avoid closing accounts within six months of major credit applications. Lenders prefer seeing stability in your financial behavior during this sensitive period.

Pay down balances before considering any account closures. This prevents sudden increases in your credit utilization percentage that could lower your score.

Future Trends in Credit Card Perks and Rewards

Emerging trends in the financial industry are reshaping our expectations for our tools. The landscape is shifting toward more personalized benefits that align with actual spending patterns.

Emerging Card Features to Watch

We’re tracking exciting developments in housing-related rewards. Bilt launches three new products on February 7, 2026, offering points on both rent and mortgage payments.

The Mesa Homeowners Card demonstrates this trend with home-centric statement credits. This represents a fundamental shift from travel-focused benefits to lifestyle-aligned advantages.

Transfer partner networks continue expanding quietly but significantly. Capital One recently added Japan Airlines, opening premium redemption opportunities to Asia.

Predictions for 2026 and Beyond

We anticipate continued innovation in granular bonus categories. Expect more time-specific rewards like weekend dining bonuses and subscription service credits.

AI-driven personalization will likely transform how offers are tailored. Programs may analyze spending patterns to deliver hyper-relevant benefits.

The distinction between travel tools and lifestyle products will continue blurring. Premium offerings will incorporate more everyday perks to maintain value during non-travel periods.

Considerations for U.S. Consumers in 2026

U.S. consumers face both exceptional opportunities and strategic challenges when building their financial portfolios. Our market offers more premium options and generous rewards structures than virtually any other country.

This abundance of choice requires careful management to avoid cost overload. We help you navigate this competitive landscape with location-specific strategies.

Adapting Spending Habits and Loyalty Programs

Maximizing value means understanding which purchases qualify for bonus categories. Some tools, like Capital One Venture, offer simple flat-rate rewards on all eligible spending.

Others require more active management of specific categories. Your loyalty program choice depends heavily on your travel patterns and geographic location.

Airline-specific products make sense if you live near a carrier hub. Flexible points programs offer greater flexibility when your travel routes change frequently.

Always read the full terms before any application. Many advertised benefits require enrollment or have specific redemption channels.

Regional spending patterns should heavily influence your selections. Products with lounge access deliver more value if you regularly use participating airports.

Consider issuer-specific rules like application timing restrictions. Strategic planning ensures you qualify for the most valuable welcome offers.

Our key advice: align your financial tools with your actual lifestyle rather than theoretical maximums. Practical value always outweighs advertised perks you cannot use.

Conclusion

Your financial toolkit deserves regular tune-ups to maintain peak performance. We’ve provided a comprehensive framework to evaluate each product in your collection.

The landscape offers unprecedented variety for the coming year. From premium travel tools to innovative housing payment options, there are compelling choices across every price point.

Honest assessment of actual benefit usage remains the cornerstone of smart management. While costs have increased, so have valuable perks such as airport lounge access and bonus point opportunities.

Remember that no single product suits every family or budget. Your optimal strategy should evolve with your lifestyle changes throughout the year.

We encourage you to apply our data-driven methodology before any application. Always verify current offers as terms apply to specific bonuses. Your proactive approach will maximize value while minimizing unnecessary costs.

FAQ

Q: How do I know if my card’s annual fee is worth paying?

A: We recommend calculating the value of your rewards and perks against the cost. If the benefits—like points, miles, or airport lounge access—you receive annually exceed the fee, it’s typically worth keeping. Consider your spending habits and travel goals to make an informed decision.

Q: What is the best strategy before my annual fee posts?

A: A proactive approach is key. We suggest contacting your issuer to inquire about retention offers. If no satisfactory offer is available, you can consider downgrading to a no-annual-fee card from the same issuer to preserve your credit history while avoiding the annual fee.

Q: Will canceling a card hurt my credit score?

A: It can, primarily by affecting your credit utilization ratio and the average age of your accounts. To minimize impact, we often advise paying down balances on other cards first or considering a product change instead of a straight cancellation to keep the account open.

Q: What are some key benefits to look for in premium travel cards for 2026?

A: We’re watching for enhanced rewards on travel and dining, more flexible point redemption options, and valuable perks like airline fee credits and premium insurance protections. Airport lounge access remains a highly sought-after benefit for frequent travelers.

Q: How can I maximize a new card’s welcome bonus?

A: To meet the spending requirement for a bonus, we recommend timing your application around planned large purchases. Always ensure you understand the terms, including the minimum spend threshold and the timeframe you have to meet it, to successfully earn points or miles.