Have you ever been excited to book a “free” flight with your hard-earned miles, only to find a surprise charge of hundreds of dollars at checkout? This frustrating surprise is an everyday reality for many travelers. We understand that feeling completely.

These extra costs, often referred to as carrier-imposed fees, can quietly erode the value of your redemption. Sometimes, the final price can even match the price of a paid economy seat. It turns a dream trip into a stressful financial decision.

But you don’t have to accept this as the norm. We are here to cut through the confusion. This guide will give you the clear, data-driven insights you need to take back control.

We will identify which loyalty programs assess these fees and which do not. You will learn proven strategies to minimize or avoid these charges altogether. Our goal is to help you maximize every point and mile for the premium travel experiences you deserve.

Key Takeaways

- “Free” flights can come with surprisingly high out-of-pocket costs.

- Specific loyalty programs are known for adding hefty fees to redemptions.

- You can often book the same flight for fewer fees by using a different program.

- Understanding these charges is the first step to avoiding them.

- Strategic booking decisions can save you hundreds of dollars per trip.

- This guide provides a clear comparison of fees across different programs.

- Empower yourself to unlock luxury travel without the hidden costs.

Understanding Award Fees and Fuel Surcharges

The excitement of booking with accumulated loyalty points can quickly fade when unexpected mandatory charges arise. We want to clarify the key differences among the various types of fees you’ll encounter.

Defining Carrier-Imposed Fees vs. Government Taxes

When you redeem miles, you’ll always pay some cash costs beyond the points required. However, not all these payments serve the same purpose. Government taxes fund essential services such as airport security, and are mandatory for all travelers.

Carrier-imposed fees, often called YQ or YR surcharges, are discretionary charges the carrier retains as revenue. These have little connection to actual operating costs despite their common name.

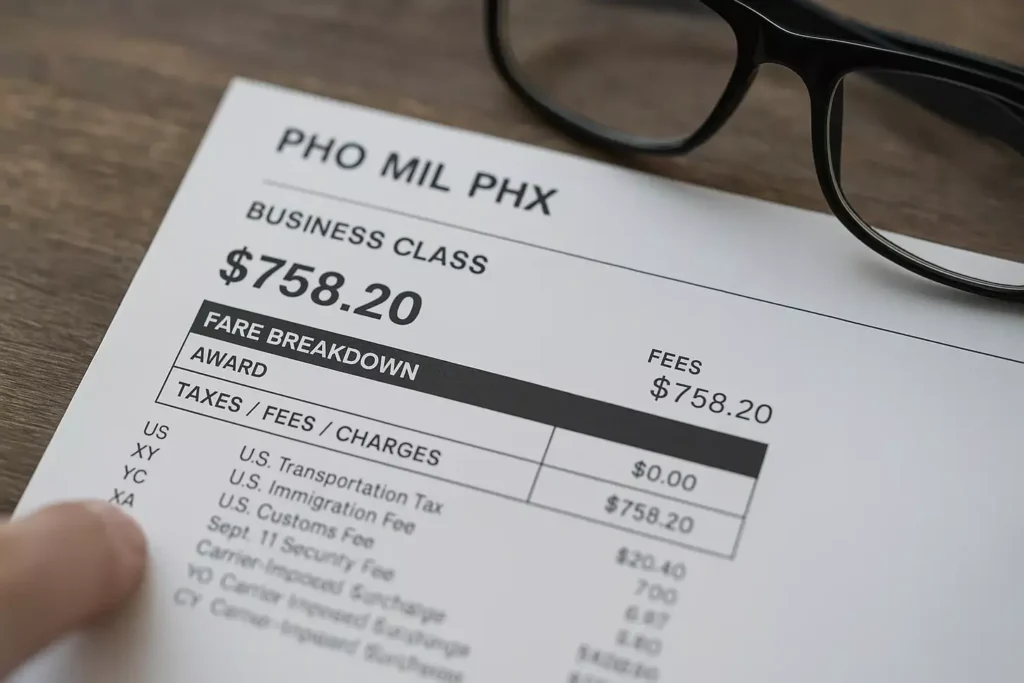

Examining the Fare Breakdown and YQ/YR Codes

Your booking confirmation contains a detailed fare breakdown that reveals exactly where your money goes. Look for codes such as YQ or YR—these indicate carrier-imposed surcharges rather than legitimate government taxes.

Consider this real scenario: a Business Class reward from Phoenix to Milan costs $758.20 per person, with $700 being carrier fees. That’s money going directly to the company rather than essential services.

By learning to read these breakdowns, you gain transparency into your expenses. This knowledge helps you identify costs you can avoid by making smarter booking decisions.

We believe understanding this distinction empowers you to make strategic decisions. You can minimize unnecessary payments while still accessing the premium travel experiences you deserve.

Why They Matter for Your Travel Budget

What appears as a points-only redemption can suddenly reveal substantial cash requirements. These additional payments directly affect how much value you receive from your loyalty program investments.

We want to emphasize why understanding these expenses is crucial for thoughtful travel planning. The difference between various programs can mean saving or spending hundreds of dollars.

The Impact on Out-of-Pocket Costs

The cash component of your redemption can range dramatically. Some programs charge minimal government taxes, while others add significant carrier-imposed fees.

Premium cabin redemptions often carry the heaviest burden. A Business Class seat might require $700+ in fees alone, on top of your hard-earned miles.

| Cabin Class | Low-Fee Program | High-Fee Program | Potential Savings |

|---|---|---|---|

| Economy | $50-100 | $200-400 | $150-300 |

| Premium Economy | $75-150 | $300-600 | $225-450 |

| Business Class | $100-200 | $600-1,000+ | $500-800+ |

| First Class | $150-300 | $800-1,500+ | $650-1,200+ |

Family trips or multiple annual journeys compound this financial impact. Strategic program selection becomes essential for maximizing your travel budget.

Knowing which loyalty programs minimize these expenses helps you plan smarter. Your miles should open doors to premium experiences, not create financial stress.

Airline Loyalty Programs Without Extra Surcharges

Fortunately, several forward-thinking loyalty programs have eliminated the frustrating practice of adding hefty carrier fees to point redemptions. These programs deliver exceptional value by keeping your out-of-pocket costs minimal.

Booking with Air Canada Aeroplan and Avianca LifeMiles

Air Canada Aeroplan made a customer-friendly move in 2020 by removing all carrier-imposed surcharges. You can now book flights on 50 partner carriers without paying extra fees.

The program charges just CA$39 per person for partner bookings. This makes Star Alliance awards particularly valuable for international travel.

Avianca LifeMiles offers incredible sweet spots with zero carrier fees. It only adds a $25 per ticket charge for partner redemptions.

This program excels at booking premium cabins on carriers such as Lufthansa. You get luxury experiences without the steep costs.

Leveraging Frontier, JetBlue, and Southwest Options

For domestic travelers, Frontier Miles, JetBlue TrueBlue, and Southwest Rapid Rewards maintain no-surcharge policies. While their networks may be more limited, they deliver straightforward value.

JetBlue’s partnership with Qatar Airways opens premium international options without extra fees. Their points are easy to accumulate through credit card transfers.

Southwest offers a simple, transparent program focused solely on its own flights. United MileagePlus provides extensive global access without wallet-damaging surcharges.

We recommend building balances in these programs through strategic credit card transfers. This ensures you always have surcharge-free options for your next journey.

Airline Loyalty Programs That Impose Surcharges

Navigating loyalty programs requires understanding which ones add significant cash costs to your point redemptions. We believe transparency helps you make informed decisions about where to invest your miles.

Some programs maintain policies that include carrier fees on specific partners or routes. Knowing these details prevents unexpected expenses at checkout.

Considerations for Alaska Airlines, ANA, and American Airlines

Alaska Airlines Atmos Rewards charges a $12.50 partner fee per direction. British Airways flights through this program carry particularly high surcharges.

ANA Mileage Club imposes fees on its own flights and on certain partner flights. However, you can avoid these by booking with United, Air New Zealand, or Singapore Airlines.

American AAdvantage adds substantial fees to British Airways bookings. The good news: most other partners remain surcharge-free, including American’s own flights.

Challenges with British Airways, Delta, Flying Blue, and Virgin Atlantic

British Airways Executive Club is notorious for high fees on their flights. Their Reward Flight Saver option lets you pay more points to reduce cash costs.

Delta SkyMiles has a complex fee structure affecting many SkyTeam carriers. Bookings on Korean Air and Vietnam Airlines typically avoid these extra charges.

Flying Blue imposes surcharges on nearly all awards except Delta and Aeromexico. This significantly limits its value despite some attractive route options.

Virgin Atlantic Flying Club charges fees on its flights and most European partners. Focus on their Delta and Hawaiian Airlines partnerships for surcharge-free redemptions.

We recommend using these programs strategically by targeting their fee-free partners. This approach preserves your budget while still accessing premium travel experiences.

Avoiding Airline Fuel Surcharges Award Tickets

Strategic booking decisions can transform an expensive redemption into a genuinely valuable travel experience. We believe avoiding extra costs isn’t about finding loopholes—it’s about understanding how different variables interact within the booking system.

The amount you’ll pay depends on multiple factors. Your choice of loyalty program, the operating carrier, and your specific routing all play crucial roles in determining final costs.

One powerful strategy is to recognize that the same physical journey can incur dramatically different fees. This occurs based on which program’s points you use for booking.

Direction of travel also matters significantly, particularly for routes that pass near European airports. Departures from Europe often carry higher additional costs than the same route flown in reverse.

| Booking Scenario | Program A Fees | Program B Fees | Potential Savings |

|---|---|---|---|

| European Departure | $450-600 | $75-150 | $375-450 |

| Transatlantic Business | $700-900 | $100-200 | $600-700 |

| Asian Premium Cabin | $300-500 | $50-100 | $250-400 |

| Domestic First Class | $150-250 | $25-50 | $125-200 |

Understanding these dynamics often allows you to fly your preferred route in your preferred cabin. Strategic program selection and minor routing adjustments can make a substantial difference in your out-of-pocket expenses.

We’re committed to helping you navigate this complexity with confidence. Your loyalty redemptions should deliver genuine value rather than becoming expensive disappointments at checkout.

Strategies to Maximize Rewards and Save on Fees

The true art of maximizing travel rewards lies in strategic flexibility across multiple point currencies. We believe smart planning transforms potential expenses into exceptional value.

Building a diversified portfolio gives you powerful options. This approach lets you compare costs across different loyalty programs before committing your hard-earned points.

Mixing Rewards and Transferable Points to Increase Flexibility

Combine airline-specific frequent flyer miles with transferable currencies like Chase Ultimate Rewards or American Express Membership Rewards. This mix creates unparalleled booking flexibility.

You can evaluate identical flights through different programs. The total cost—points plus cash—often varies dramatically between options.

Comparing Award Routes for Optimal Value

Always price-compare the same journey across multiple programs. Sometimes paying more points saves significant cash expenses.

Consider alternative routing and cabin classes. A slight adjustment can unlock better value while maintaining premium comfort.

| Strategy | Points Required | Cash Fees | Total Value |

|---|---|---|---|

| Program A – Direct | 60,000 | $700 | Poor |

| Program B – Flexible | 70,000 | $50 | Excellent |

| Alternative Routing | 65,000 | $75 | Good |

| Mixed Points Approach | 68,000 | $40 | Very Good |

Calculate total out-of-pocket costs to determine true redemption value. The flexibility from multiple programs empowers smarter travel decisions.

Using Credit Card Perks and Flexible Points

Your wallet holds more power than you might realize when facing mandatory travel costs. We believe strategic financial tools can transform frustrating expenses into manageable redemptions.

Flexible points programs create incredible booking flexibility. Major options include Chase Ultimate Rewards, American Express Membership Rewards, and Capital One.

Leveraging Credit Card Offers and Travel Credits

Specific cards provide direct relief from extra costs. The Chase Sapphire Reserve offers a $300 annual travel credit that automatically applies to these expenses.

For British Airways bookings, their Visa Signature Card delivers exceptional value. You can save up to $600 annually on economy and premium cabin fees.

Transferring Points Effectively to Airline Programs

Transferable currencies let you compare costs across multiple loyalty programs. This shopping approach helps you find the optimal mix of points and cash.

Capital One cards offer unique flexibility. Their Venture cards let you redeem miles to cover travel expenses charged to your card.

| Credit Card | Key Benefit | Annual Value | Best For |

|---|---|---|---|

| Chase Sapphire Reserve | $300 Travel Credit | $300 | General Travel Expenses |

| British Airways Visa | Fee Statement Credits | Up to $600 | BA Premium Cabins |

| Capital One Venture X | Points Cover Charges | Variable | Flexible Redemption |

| American Express Platinum | Transfer Partners | Multiple Options | Airline Program Access |

Building relationships with multiple card programs maximizes your flexibility. This approach ensures you always have strategies to reduce out-of-pocket costs.

Conclusion

Your journey toward smarter travel redemptions begins with understanding that some extra costs may be unavoidable when pursuing premium experiences. We recognize that specific routing constraints or limited availability may make paying certain fees necessary for your travel plans.

However, the strategies we’ve shared empower you to make informed choices that protect your budget. By comparing programs and reviewing fare breakdowns, you can often identify routes with minimal additional costs.

Bookmark this guide for your next booking adventure. With this knowledge, you’re equipped to maximize every point and mile for the luxury journeys you deserve.

FAQ

Q: What exactly are carrier-imposed surcharges on a miles redemption?

A: These are fees added by the carrier itself, separate from government taxes. They often cover costs like fuel (coded as YQ or YR) and can significantly increase the total price of your reward travel, even when you’re using points.

Q: Which loyalty programs are known for having low or no extra fees on their awards?

A: We often recommend programs like Air Canada Aeroplan and Avianca LifeMiles for their transparent pricing. Domestic carriers like Southwest and JetBlue are also excellent choices, as they typically include all taxes and fees in the points price you see.

Q: Which programs tend to add high surcharges, especially for international business class?

A: Be cautious with programs like British Airways Executive Club, Virgin Atlantic Flying Club, and Air France-KLM Flying Blue. They are known for imposing hefty carrier-imposed fees, particularly on partner airline tickets, which can cost hundreds of dollars per ticket.

Q: How can I avoid paying these expensive fees when booking with miles?

A: The most effective strategy is to book your flight through a partner program that doesn’t pass on these surcharges. For example, you can use Avianca LifeMiles to book a Lufthansa flight and avoid the high fees that Lufthansa’s own program would charge.

Q: How do flexible credit card points help me save on these costs?

A: Cards like the Chase Sapphire Preferred® or American Express® Gold Card let you transfer points to various airline partners. This gives you the power to choose a program with the best fee structure for your specific flight, maximizing your savings on out-of-pocket expenses.

Q: Can I use a travel credit from my credit card to pay for fuel surcharges?

A: Yes, absolutely. Many premium cards, such as The Platinum Card® from American Express, offer annual travel credits. You can typically use these credits to cover the taxes and fees portion of your award booking, effectively making your luxury flight even more affordable.