Standing at the rental car counter after a long flight, you’re exhausted and ready to get on the road. Then the agent asks the question that adds $200+ to your week-long rental: “Would you like our collision damage waiver for $35 per day?”

Most travelers either panic-accept the upsell or blindly decline it—without understanding what they actually need. The truth is more nuanced: rental car insurance through your credit card can save hundreds of dollars per trip, but only if you understand the coverage gaps, exclusions, and when counter coverage actually makes sense.

In 2026, credit card rental benefits have become more complex. Chase reduced coverage caps on most cards to $60,000 in October 2024, while New York residents lost access to primary coverage entirely. Meanwhile, rental counter prices continue climbing, and the stakes for making the wrong choice have never been higher.

This guide provides a clear decision framework for when to decline counter coverage, when credit card CDW is sufficient, and when you should actually buy the rental company’s insurance—complete with real-world cost scenarios and coverage gap analysis.

Key Takeaways

- Credit card CDW typically covers collision and theft damage, but excludes liability, medical expenses, and coverage for damage you cause to other vehicles or property

- Primary coverage (Chase Sapphire Reserve®, Sapphire Preferred®) pays first without involving your personal auto insurance; secondary coverage only pays after your personal policy

- You must decline the rental counter’s CDW/LDW and pay the full rental with your eligible card to activate credit card coverage

- Chase reduced most card coverage caps to $60,000 effective October 2024, though Sapphire Reserve® and Ritz-Carlton® cards maintain $75,000 limits

- International travel, luxury vehicles, and peer-to-peer rentals often require purchasing additional coverage due to credit card exclusions

Understanding Rental Car Insurance: What You’re Actually Buying

The rental car insurance conversation at the counter moves fast, but the products being sold fall into distinct categories with different purposes.

Collision Damage Waiver (CDW) and Loss Damage Waiver (LDW)

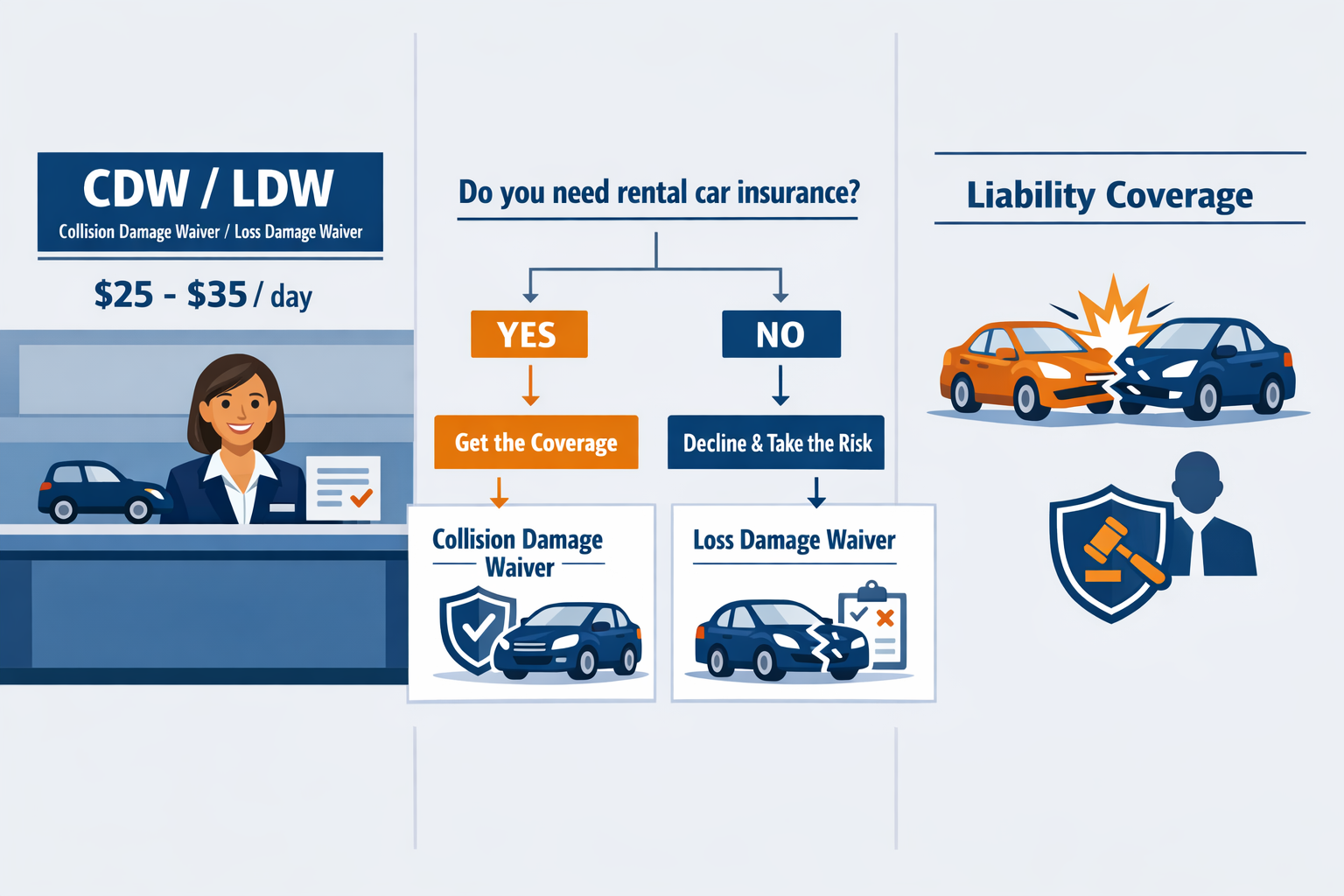

CDW and LDW are not technically insurance—they’re waivers that release you from financial responsibility if the rental car is damaged or stolen. When you purchase CDW/LDW from the rental company, they agree not to hold you liable for covered damage to their vehicle.

These waivers typically cost $25-$35 per day, depending on location and vehicle class. For a week-long rental, that’s $175-$245 added to your bill.

What CDW/LDW covers:

- Collision damage to the rental vehicle

- Theft of the rental vehicle

- Vandalism and weather damage

- Loss of use fees (what the rental company loses while the car is being repaired)

What CDW/LDW does not cover:

- Damage to other vehicles or property

- Injuries to you or passengers

- Personal belongings stolen from the vehicle

Liability Insurance

Liability coverage protects you when you damage someone else’s property or cause injuries. This is separate from CDW/LDW and addresses the most financially devastating scenarios—when you’re at fault in an accident that injures others or totals their vehicle.

Rental companies offer Supplemental Liability Insurance (SLI) or Extended Protection (EP) for approximately $10-$15 per day. This typically provides $1 million in third-party liability coverage.

Critical distinction: Your personal auto insurance policy usually extends liability coverage to rental cars in the U.S., but credit card rental benefits do not include liability protection. This is the most common and dangerous coverage gap.

Personal Accident Insurance (PAI) and Personal Effects Coverage (PEC)

PAI covers medical expenses for you and your passengers if injured in the rental vehicle. PEC covers theft of personal belongings from the rental car.

Most travelers don’t need these add-ons because:

- Health insurance typically covers accident injuries regardless of where they occur

- Homeowners or renters insurance usually covers personal property theft, including from rental cars

- Travel insurance purchased separately often provides better coverage at lower cost

For comprehensive guidance on travel insurance benefits, see our complete guide to credit card travel insurance.

How Credit Card Rental Car Insurance Works

Credit cards with rental car benefits provide collision damage waiver coverage when you follow specific rules. Understanding the difference between primary and secondary coverage determines whether you can truly skip the rental counter upsell.

Primary vs Secondary Coverage: The Critical Distinction

Primary coverage means the credit card’s insurance pays first when damage occurs. You file a claim directly with the card issuer without involving your personal auto insurance. Your personal policy never knows about the incident, so your rates won’t increase.

Secondary coverage means the credit card only pays after your personal auto insurance has paid its portion. You must file a claim with your personal insurer first, potentially facing deductibles and rate increases, and the credit card covers remaining costs.

Cards offering primary rental car insurance:

- Chase Sapphire Reserve® ($75,000 limit)

- Chase Sapphire Preferred® ($60,000 limit as of October 2024)

- Chase Ritz-Carlton Rewards® ($75,000 limit)

- Select premium travel cards from other issuers

Most standard credit cards offer secondary coverage, including:

- Chase Freedom Unlimited®, Freedom Flex®, and Freedom Rise℠

- Many airline and hotel co-branded cards

- Entry-level rewards cards

The distinction matters significantly. With secondary coverage, a $3,500 fender-bender means filing a claim with your auto insurer (facing your $500-$1,000 deductible and potential rate increases), then seeking reimbursement from the credit card for the deductible amount.

With primary coverage, you file one claim with the card issuer and never involve your personal insurance.

Coverage Caps and Recent Changes

In October 2024, Chase reduced rental car coverage limits on most cards from higher thresholds to $60,000 per vehicle. This change affects:

- Chase Sapphire Preferred®

- Chase Freedom cards

- Most Chase co-branded cards

Chase Sapphire Reserve® and Ritz-Carlton® cards maintained their $75,000 limits, remaining among the strongest credit card rental protections available.

What this means for travelers: If you’re renting a luxury vehicle valued at $60,000 or more (high-end SUVs, premium sedans, exotic cars), even premium credit card coverage may not fully protect you. The rental company will hold you liable for the portion exceeding your card’s coverage cap.

New York Resident Restrictions

If your credit card billing address is in New York, primary rental car coverage is completely unavailable on most Chase cards. New York insurance regulations prohibit primary coverage, forcing NY residents to rely on secondary coverage only—meaning their personal auto insurance must be involved in any claim.

This restriction applies even when renting outside New York. The determining factor is your billing address, not the rental location.

For a detailed comparison of cards with the best travel insurance benefits, including rental car coverage, check our best credit cards for travel insurance guide.

Activation Requirements: What You Must Do

Credit card rental car insurance only activates when you follow these rules :

✅ Decline the rental company’s CDW/LDW — If you accept the rental counter’s damage waiver, credit card coverage is voided. You cannot “stack” both coverages.

✅ Pay the entire rental with the eligible credit card — Partial payment or splitting the bill across multiple cards may invalidate coverage. The full rental cost, including taxes and fees, must be charged to the card providing coverage.

✅ Rent from a commercial rental agency — Coverage applies to traditional rental companies (Enterprise, Hertz, Avis, Budget, National, etc.) but excludes peer-to-peer services like Turo.

✅ Keep the rental under 31 consecutive days — Most credit cards limit coverage to rentals of 31 days or less. Longer rentals, leases, and mini-leases are excluded.

✅ Rent in your own name — The credit cardholder must be listed as the primary driver on the rental agreement.

Common Exclusions and Coverage Gaps

Even with primary coverage on a premium card, significant exclusions remain:

❌ Liability coverage — Credit cards do not cover damage you cause to other vehicles, property, or injuries to other people. This is the most critical gap.

❌ Medical expenses — Injuries to you or your passengers are not covered by credit card rental insurance.

❌ Certain vehicle types — Commonly excluded vehicles include:

- Trucks and cargo vans

- Exotic and antique cars

- Motorcycles and recreational vehicles

- Vehicles with open beds

❌ International restrictions — Some countries are excluded entirely (Ireland, Israel, Jamaica, and others vary by card issuer). Always verify international coverage before traveling.

❌ Off-road use — Damage occurring while driving on unpaved roads or during prohibited uses may not be covered.

❌ Loss of use and administrative fees — While some cards cover these rental company charges, others exclude them. Read your specific card’s benefit terms.

For insights on what changed in credit card travel insurance recently, including rental car coverage updates, see what’s new in credit card travel insurance for 2025.

When to Decline Rental Counter Insurance

The decision to decline counter coverage depends on your specific situation. Use this framework to determine when credit card coverage is sufficient.

Decision Tree: Should You Decline Counter CDW?

START HERE: Are you renting a car?

↓ YES

Question 1: Do you have a credit card with rental car coverage?

- NO → Evaluate personal auto insurance extension or purchase counter coverage

- YES → Continue to Question 2

Question 2: Does your card offer primary or secondary coverage?

- Primary → Continue to Question 3

- Secondary → Continue to Question 4

Question 3 (Primary Coverage Path): Are you renting in the United States?

- YES → Continue to Question 5

- NO → Check if your destination country is excluded; if not excluded, continue to Question 5

Question 4 (Secondary Coverage Path): Do you have personal auto insurance that extends to rentals?

- NO → PURCHASE counter CDW (you have no collision coverage otherwise)

- YES → Continue to Question 5

Question 5: Is the rental vehicle valued under your card’s coverage cap ($60,000 or $75,000)?

- NO → PURCHASE counter CDW (card won’t cover the full vehicle value)

- YES → Continue to Question 6

Question 6: Is this a standard passenger vehicle (sedan, SUV, minivan)?

- NO (exotic, luxury, truck, van) → PURCHASE counter CDW (likely excluded from card coverage)

- YES → Continue to Question 7

Question 7: Is the rental 31 days or less?

- NO → PURCHASE counter CDW (exceeds card coverage duration)

- YES → DECLINE counter CDW ✅ (use credit card coverage)

Ideal Scenarios for Declining Counter Coverage

Scenario A: Domestic rental with primary coverage card

You’re traveling within the U.S., renting a standard sedan valued at $35,000, and paying with Chase Sapphire Reserve®. You decline CDW at the counter, saving $245 on a week-long rental. If damage occurs, you file directly with Chase without involving personal insurance.

Scenario B: Domestic rental with secondary coverage and personal auto insurance

You’re renting an economy car in California, paying with Chase Freedom Unlimited®, and you have personal auto insurance with comprehensive and collision coverage. You decline counter CDW, knowing your personal policy extends to rentals and the credit card will cover your deductible if needed.

Scenario C: International rental in covered country with primary card

You’re renting in France (not an excluded country), using Chase Sapphire Preferred®, and renting a compact car valued under $60,000. You decline counter CDW and rely on the card’s primary international coverage.

Cost-Benefit Analysis: Counter CDW vs Credit Card Coverage

Example: 7-day rental

| Coverage Option | Upfront Cost | Annual Card Fee | Annual Rentals | Total Annual Cost |

|---|---|---|---|---|

| Counter CDW ($30/day) | $210 per rental | $0 | 3 rentals | $630 |

| Chase Sapphire Preferred® (primary) | $0 per rental | $95 | 3 rentals | $95 |

| Annual Savings | $535 |

Breakeven analysis: If you rent a car just twice per year and decline counter CDW using credit card coverage, you save enough to justify a premium travel card’s annual fee—even before considering other benefits.

For a deeper analysis of whether premium cards pay for themselves, see our credit card annual fee ROI calculator guide.

When You Should Buy Rental Car Insurance

Even with credit card coverage, certain situations require purchasing additional insurance at the counter or through a third-party provider.

International Travel Considerations

Country-specific exclusions are common on credit card rental benefits. Countries frequently excluded include:

- Ireland

- Israel

- Jamaica

- Northern Ireland

- Italy (on some cards)

Why these exclusions exist: High claim rates, local insurance requirements, or regulatory restrictions make coverage unprofitable for card issuers in certain countries.

What to do: Before international travel, call your card issuer to confirm coverage in your destination country. If excluded, purchase the rental company’s CDW or buy standalone rental car insurance from a third-party provider like Bonzah or InsureMyRentalCar.

Liability coverage abroad: Even with collision coverage from your credit card, you typically need liability insurance when renting internationally. Many countries require proof of liability coverage before you can rent. Options include:

- Purchasing SLI from the rental counter

- Buying a comprehensive travel insurance policy that includes rental car liability

- Checking if your personal auto policy offers international liability extension (rare)

Luxury and Specialty Vehicles

Vehicle value exceeding coverage caps: If you’re renting a vehicle valued at more than $60,000 (or $75,000 for top-tier cards), credit card coverage won’t cover the full value. The rental company will hold you liable for the difference.

Commonly excluded vehicle types:

- Exotic cars (Ferrari, Lamborghini, McLaren, etc.)

- Antique and collector vehicles

- Trucks with open beds

- Cargo vans and moving trucks

- Vehicles with more than 9 passengers

- Motorcycles, mopeds, and scooters

- Recreational vehicles (RVs, campers)

Recommendation: For specialty vehicles, purchase the rental company’s CDW. The daily cost increase ($50-$100+) is justified by the potential six-figure liability if something goes wrong.

Peer-to-Peer Rental Services (Turo, Getaround)

Credit card rental car insurance does not cover peer-to-peer rentals. These services are not considered commercial rental agencies, so standard credit card benefits are void.

Turo’s insurance options: Turo offers its own protection plans ranging from minimal coverage (where you’re liable for damage) to premium plans that function like CDW. If using Turo:

- Purchase Turo’s Premier or Standard plan for meaningful protection

- Verify whether your personal auto insurance extends to peer-to-peer rentals (most don’t)

- Consider standalone rental car insurance from third-party providers

No Personal Auto Insurance

If you don’t own a car and have no personal auto insurance, secondary credit card coverage provides no benefit—there’s no primary policy for it to be “secondary” to.

Your options:

- Get a credit card with primary coverage (Chase Sapphire Reserve®, Sapphire Preferred®, or similar)

- Purchase the counter CDW when renting

- Buy standalone rental car insurance from third-party providers for better rates than counter purchases

Important: Even with primary credit card coverage, you still need liability insurance. Most personal auto policies include liability that extends to rentals, but without personal insurance, you’re exposed. Consider:

- Purchasing SLI at the rental counter

- Buying a comprehensive travel insurance policy

- Getting a non-owner auto insurance policy if you rent frequently

Real-World Scenarios: Cost and Coverage Outcomes

Understanding how coverage works in practice clarifies the financial stakes of your decision.

Scenario 1: Minor Fender-Bender (Primary Coverage)

Situation: You’re driving a rental sedan in Colorado (paid with Chase Sapphire Reserve®) and back into a pole in a parking lot, causing $3,500 in damage to the rear bumper.

With counter CDW ($30/day × 7 days = $210):

- You report the damage to the rental company

- No further action required

- No out-of-pocket cost beyond the CDW you already paid

- Total cost: $210 (CDW purchase)

With credit card primary coverage (declined counter CDW):

- You report the damage to the rental company and get a damage report

- File a claim with Chase within 20 days

- Chase investigates and approves the claim

- Chase pays the rental company directly or reimburses you

- No involvement of personal auto insurance

- No rate increase on personal policy

- Total cost: $0 (no deductible, no CDW purchase)

Savings with credit card coverage: $210

Scenario 2: Vehicle Theft (Secondary Coverage)

Situation: You’re renting a midsize SUV in Miami (paid with Chase Freedom Unlimited®, which offers secondary coverage). The vehicle was stolen from your hotel parking lot. Rental company values the loss at $28,000.

With counter CDW ($35/day × 7 days = $245):

- You file a police report and notify the rental company

- Rental company absorbs the loss under the CDW you purchased

- Total cost: $245 (CDW purchase)

With credit card secondary coverage and personal auto insurance (declined counter CDW):

- You file a police report and notify the rental company

- Rental company initially holds you liable for $28,000

- You file a claim with your personal auto insurance

- Your personal policy pays $28,000 minus your comprehensive deductible ($500)

- Your credit card reimburses your $500 deductible

- Your personal auto insurance rates may increase at renewal (typically $200-$400 annually for 3-5 years)

- Immediate cost: $0 (deductible reimbursed)

- Long-term cost: $600-$2,000 (potential rate increases over 3-5 years)

With credit card secondary coverage but NO personal auto insurance:

- You are personally liable for the full $28,000

- Credit card provides no benefit (nothing to be “secondary” to)

- Rental company pursues collection, potentially damaging credit and finances

- Total cost: $28,000 ⚠️

Savings with counter CDW in this scenario: $355-$1,755 (when factoring in long-term insurance rate increases)

Key insight: Secondary coverage is less valuable than primary coverage because it involves your personal insurance, potentially triggering rate increases that exceed the cost of purchasing counter CDW.

Scenario 3: International Rental Without Liability Coverage

Situation: You’re renting in Spain, paying with Chase Sapphire Preferred® (primary collision coverage). You cause an accident that damages another vehicle ($8,000) and injures the other driver (medical costs: $15,000). You declined all rental counter insurance.

Coverage analysis:

- Chase Sapphire Preferred® covers damage to your rental car (collision): ✅ Covered

- Damage to the other vehicle: ❌ Not covered (no liability insurance)

- Injury to the other driver: ❌ Not covered (no liability insurance)

Financial outcome:

- You’re personally liable for $23,000 in third-party damages

- Potential legal consequences in Spain

- Total cost: $23,000+ ⚠️

With SLI purchased at the counter ($12/day × 7 days = $84):

- Rental company’s liability coverage pays the $23,000

- Total cost: $84

Lesson: Collision coverage (credit card CDW) and liability coverage are separate. Never skip liability coverage, especially internationally.

Cost Comparison Table: Annual Savings Analysis

| Scenario | Counter Insurance Cost | Credit Card Strategy Cost | Annual Savings (3 rentals/year) |

|---|---|---|---|

| Domestic, primary card, no claims | $630 (CDW only) | $95 (Sapphire Preferred® fee) | $535 |

| Domestic, secondary card, no claims | $630 (CDW only) | $0 (no-fee card) | $630 |

| International, primary card + SLI | $882 (CDW + SLI) | $347 (card fee + SLI only) | $535 |

| One minor claim with primary card | $630 (CDW) | $95 (card fee, no deductible) | $535 |

| One minor claim with secondary card | $630 (CDW) | $500 (deductible) + rate increase | -$70 to -$370 (loss) |

Takeaway: Primary coverage provides consistent savings even with occasional claims. Secondary coverage savings evaporate if you file a claim due to deductibles and rate increases.

Step-by-Step: How to Use Credit Card Rental Car Insurance

When you’ve determined credit card coverage is sufficient, follow this process to ensure proper activation and claim handling.

Before You Rent

1. Verify your card’s coverage details

- Call the number on the back of your card or review the benefits guide online

- Confirm whether coverage is primary or secondary

- Check the coverage cap ($60,000 vs $75,000)

- Verify your rental destination is not excluded

- Ask about vehicle type restrictions

2. Understand your personal auto insurance

- If using secondary coverage, confirm your personal policy includes comprehensive and collision

- Verify your policy extends to rental cars

- Note your deductible amounts

- Check if liability coverage extends to rentals

3. Review rental agreement terms

- Some rental companies have specific requirements or restrictions

- Understand what the rental company will charge if damage occurs

- Note the rental company’s claims process

At the Rental Counter

1. Decline CDW/LDW clearly

- When asked about insurance, state: “I’m declining the collision damage waiver”

- Rental agents may pressure you or suggest you’re making a mistake—remain firm

- Ensure “CDW DECLINED” or similar language appears on your rental agreement

2. Consider liability coverage carefully

- If you have personal auto insurance, verify it includes liability that extends to rentals

- If no personal insurance or are renting internationally, strongly consider purchasing SLI

- Remember: credit cards do not provide liability coverage

3. Pay with the correct card

- Charge the entire rental to the card providing coverage

- Do not split payment across multiple cards

- Keep the receipt

4. Document the vehicle thoroughly

- Take photos/videos of the entire vehicle before leaving the lot

- Note any existing damage on the rental agreement

- Photograph the odometer, fuel level, and VIN

- Document the interior condition

If Damage Occurs

1. Immediate steps at the scene

- Ensure everyone’s safety and call emergency services if needed

- Take photos of all damage from multiple angles

- Get contact information from other parties involved

- File a police report if required by local law or rental agreement

- Do not admit fault or sign anything acknowledging liability

2. Notify the rental company

- Report damage immediately upon returning the vehicle or as soon as discovered

- Request a damage report or an incident report

- Get a copy of all documentation

- Note the name of the rental company representative you spoke with

3. Contact your credit card issuer

- Call the benefits administrator (number in your benefits guide) within 20 days

- Provide all documentation: rental agreement, damage report, photos, police report

- Complete any required claim forms

- Keep copies of everything submitted

4. If using secondary coverage

- File a claim with your personal auto insurance first

- Obtain documentation of what your personal policy paid

- Submit remaining costs to your credit card issuer

- Provide an explanation of the benefits from your personal insurer

5. Follow up

- Claims can take 30-90 days to process

- Respond promptly to any requests for additional information

- Keep detailed records of all communication

- Escalate if claims are delayed beyond reasonable timeframes

For additional context on how credit card travel protections work in practice, see this real-world example of credit card rental car coverage.

Common Mistakes to Avoid

Even experienced travelers make costly errors with rental car insurance. Avoid these pitfalls:

❌ Assuming All Credit Cards Offer the Same Coverage

The mistake: Believing any credit card provides adequate rental car insurance without checking specific terms.

The reality: Coverage varies dramatically by card. Some offer primary coverage, others secondary. Coverage caps range from $50,000 to $75,000 (or higher on some premium cards). Exclusions differ by issuer.

What to do: Review your specific card’s benefits guide before every rental. Don’t assume—verify.

❌ Accepting Counter CDW “Just to Be Safe”

The mistake: Purchasing counter CDW despite having credit card coverage, paying $200+ unnecessarily because the rental agent created doubt.

The reality: If you’ve verified your credit card coverage applies to your rental, accepting counter CDW wastes money and voids your credit card benefit.

What to do: Prepare mentally before reaching the counter. Know your coverage details and decline firmly.

❌ Forgetting About Liability Coverage

The mistake: Declining all rental counter insurance, including liability, while having only credit card collision coverage.

The reality: Credit cards do not provide liability coverage. If you cause damage to other vehicles or injure someone, you’re personally liable without liability insurance.

What to do:

- Verify your personal auto insurance includes liability that extends to rentals

- If no personal insurance, purchase SLI at the counter

- Always purchase liability coverage when renting internationally

❌ Using the Wrong Card to Pay

The mistake: Booking the rental with one card but paying with another, or splitting payment across multiple cards.

The reality: Coverage only applies when you pay the entire rental with the card providing the benefit.

What to do: Pay the full rental amount, including all fees and taxes, with your coverage-providing card. Use the same card for any additional charges during the rental.

❌ Renting Excluded Vehicle Types

The mistake: Renting a truck, luxury SUV, or specialty vehicle without verifying it’s covered by your credit card.

The reality: Many vehicle types are excluded from credit card coverage, leaving you fully liable for damage.

What to do: Check your card’s vehicle exclusions before booking. If renting an excluded type, purchase counter CDW.

❌ Failing to Document Pre-Existing Damage

The mistake: Rushing away from the rental counter without thoroughly inspecting and photographing the vehicle.

The reality: Rental companies may attempt to charge you for pre-existing damage you didn’t cause.

What to do: Spend 5-10 minutes photographing the entire vehicle from all angles, including wheels, undercarriage (if visible), interior, and any existing scratches or dents. Time-stamped photos are your protection.

❌ Not Reading the Fine Print on International Rentals

The mistake: Assuming credit card coverage works the same internationally as domestically.

The reality: Country exclusions, different liability requirements, and local regulations significantly change coverage.

What to do: Call your card issuer before international travel to confirm coverage in your destination country and understand local insurance requirements.

Choosing the Right Credit Card for Rental Car Coverage

If rental car insurance is a priority—whether you rent frequently or want peace of mind—selecting a card with strong coverage makes sense.

Best Cards for Primary Rental Car Coverage

Chase Sapphire Reserve®

- Coverage type: Primary

- Coverage cap: $75,000

- Geographic scope: Domestic and international (with country exclusions)

- Annual fee: $795

- Best for: Frequent travelers who rent cars regularly and want the highest coverage cap plus comprehensive travel benefits

- Note: NY residents do not receive primary coverage

Chase Sapphire Preferred®

- Coverage type: Primary

- Coverage cap: $60,000 (reduced from higher limit in October 2024)

- Geographic scope: Domestic and international (with country exclusions)

- Annual fee: $95

- Best for: Travelers seeking primary coverage at a lower annual fee, renting standard vehicles under $60,000

- Note: NY residents do not receive primary coverage

American Express Premium Car Rental Protection

- Coverage type: Primary (requires enrollment and $24.95 per rental fee)

- Coverage cap: Varies by card

- Geographic scope: Domestic and international

- Best for: Amex cardholders who want primary coverage without holding a Sapphire card

- Note: Pay-per-rental model rather than an included benefit

For a comprehensive comparison of travel credit cards, including rental car coverage, see our top travel credit cards guide.

Cards with Strong Secondary Coverage

If you have personal auto insurance and want to avoid annual fees, secondary coverage cards can still provide value by covering your deductible:

- Chase Freedom Unlimited®, Freedom Flex®, Freedom Rise℠

- Most airline and hotel co-branded cards

- Many no-annual-fee rewards cards

When secondary coverage works well:

- You have comprehensive personal auto insurance

- You’re comfortable with potential rate increases if you file a claim

- You rent infrequently (1-2 times per year)

- You want to avoid annual fees

Decision Framework: Which Card Makes Sense?

Choose a card with primary coverage if:

- You rent cars 3+ times per year

- You don’t have personal auto insurance

- You want to avoid involving personal insurance in claims

- You travel internationally frequently

- You rent vehicles valued $40,000-$75,000

Secondary coverage is sufficient if:

- You have comprehensive personal auto insurance with low deductibles

- You rent cars 1-2 times per year domestically

- You’re comfortable with potential insurance rate impacts

- You prioritize no-annual-fee cards

Calculate your breakeven: If you rent cars three times per year at $30/day CDW for 7-day rentals, you’re paying $630 annually. A Chase Sapphire Preferred® at $95 annual fee saves you $535 per year—and that’s before considering the card’s other benefits like transferable points and travel protections.

For more on maximizing credit card rewards including travel protections, see our guide to maximizing credit card rewards.

Advanced Strategies and Considerations

Once you understand the basics, these advanced tactics can optimize your rental car insurance approach.

Combining Personal Insurance with Credit Card Coverage

Optimal setup for maximum protection:

- Maintain personal auto insurance with liability coverage (extends to rentals)

- Hold a credit card with primary collision coverage

- Decline counter CDW and SLI (if personal liability extends to rentals)

Result: Comprehensive protection without paying rental counter fees. Your credit card provides primary collision coverage (no deductible, no rate impact), while your personal policy provides liability coverage without additional cost.

Cost comparison for 3 annual rentals:

- Counter insurance: $630-$900

- Credit card + personal insurance: $95 (Sapphire Preferred® fee) + $0 (existing personal insurance)

- Annual savings: $535-$805

Maximizing Value from Premium Travel Cards

Premium cards with high annual fees ($795+ like Chase Sapphire Reserve®) justify their cost through multiple benefits, including rental car coverage:

Chase Sapphire Reserve® annual value calculation:

- $300 annual travel credit: $300

- Primary rental car coverage (3 rentals): $630 saved

- Priority Pass lounge access: $429 value

- 3x points on travel and dining: ~$200-$500 value (varies by spend)

- Total value: $1,559-$1,859

- Annual fee: $795

- Net value: $1,009-$1,309

Rental car coverage alone doesn’t justify a premium card, but as part of a comprehensive benefits package, it contributes significantly to the card’s value proposition.

For a detailed breakdown of maximizing the value of the premium card, see our American Express Platinum Card value guide.

International Rental Strategy

Three-tier approach for international rentals:

Tier 1: Covered countries with primary card

- Verify the country is not excluded

- Decline CDW at the counter

- Purchase SLI for liability coverage ($10-15/day)

- Use the credit card’s primary collision coverage

Tier 2: Excluded countries or uncertain coverage

- Purchase full counter coverage (CDW + SLI)

- Consider third-party rental car insurance for better rates

- Factor insurance costs into trip budget

Tier 3: High-risk destinations or luxury vehicles

- Purchase maximum coverage at the counter

- Consider travel insurance with rental car coverage

- Photograph documentation extensively

Cost optimization tip: Third-party rental car insurance from providers like Bonzah, RentalCover, or InsureMyRentalCar often costs $8-12 per day for comprehensive coverage including liability—significantly less than counter rates of $40-50/day for full coverage.

Using Points and Miles for Rental Cars

While this guide focuses on insurance, Award Travel Hub readers often ask about using points for car rentals.

Generally not recommended: Rental car redemptions typically deliver poor value (0.5-0.8 cents per point) compared to premium cabin flights (1.5-3+ cents per point).

Better strategy:

- Pay for rentals with a credit card, earning bonus points on travel (3x-5x)

- Use accumulated points for high-value award flights

- Save cash by declining counter insurance using credit card coverage

Exception: If you have expiring points in a hotel program (Marriott, Hilton, IHG) that partners with rental companies, using points for rentals can be worthwhile rather than losing them.

For more on maximizing transferable points value, see our guide to credit card transfer partners.

Conclusion: Your Rental Car Insurance Action Plan

Rental car insurance doesn’t need to be confusing or expensive. By understanding the distinction between collision coverage (CDW) and liability insurance, knowing whether your credit card offers primary or secondary coverage, and recognizing when exceptions require purchasing counter insurance, you can save hundreds of dollars annually while maintaining adequate protection.

Your action steps:

Verify your credit card coverage today — Don’t wait until you’re at the rental counter. Call your card issuer or review the benefits guide online to understand your specific coverage type, cap, and exclusions.

Review your personal auto insurance — Confirm whether you have comprehensive and collision coverage that extends to rentals, and verify liability coverage extends to rental vehicles.

Create a rental car insurance checklist — Document your coverage details, card payment requirements, and documentation procedures. Save this in your phone for reference at the rental counter.

Consider upgrading to a primary coverage card — If you rent cars three or more times per year, calculate whether a card with primary coverage (like Chase Sapphire Preferred® at a $95 annual fee) saves money compared to purchasing counter CDW.

Never skip liability coverage — Whether through personal auto insurance, rental counter SLI, or travel insurance, always ensure you have liability protection. Credit cards do not provide this critical coverage.

Plan ahead for international rentals — Before traveling abroad, verify your destination country isn’t excluded from credit card coverage and understand local insurance requirements.

Remember the key principle: Credit card rental car insurance is a valuable benefit that can save $200-300 per rental, but only when you understand its limitations and use it correctly. The coverage gaps—particularly liability and certain vehicle types—require thoughtful planning rather than blindly declining all counter insurance.

For comprehensive guidance on credit card travel protections beyond rental cars, explore our complete credit card travel insurance guide and best credit cards for travel insurance.

Safe travels, and may your rental car experiences be claim-free.