Every few weeks, your inbox fills with promotional emails screaming “125% BONUS MILES!” or “50% OFF—LIMITED TIME!” The offers look compelling. But here’s the reality: most people who buy airline miles during these bonus sales end up wasting money. A smaller group—those who understand the math and have specific redemptions in mind—can unlock exceptional value that beats even the best transfer bonuses.

The difference comes down to a simple framework: knowing when the numbers work and when they don’t. This guide walks through the exact calculations, real 2026 bonus sale examples, and a decision checklist to help determine whether buying airline miles makes sense for your situation.

Key Takeaways

- Value depends on redemption, not purchase cost: Buying miles at 2¢ each only makes sense if you’ll redeem them for 3-5+ cents per point in premium cabin awards

- Current 2026 bonuses range from 45% to 125%: JetBlue offers 125% through February 23, while Alaska and Aeroplan provide 100% bonuses with different cost structures

- Transfer bonuses often beat purchase promotions: A 30-40% transfer bonus from Chase or Amex to partners typically delivers better value than buying miles directly

- Award availability must be confirmed first: Never buy miles speculatively—search and confirm the exact award space before purchasing

- Expiration and devaluation create real risk: Most purchased miles expire in 18-36 months, and programs can devalue awards at any time

Understanding Airline Miles Purchase Value Calculation

The fundamental question when evaluating whether to buy airline miles isn’t about the bonus percentage—it’s about redemption value. A 125% bonus sounds impressive until you realize you’re paying 1.43¢ per mile for awards that deliver only 1.2¢ per mile in value.

The Core Formula:

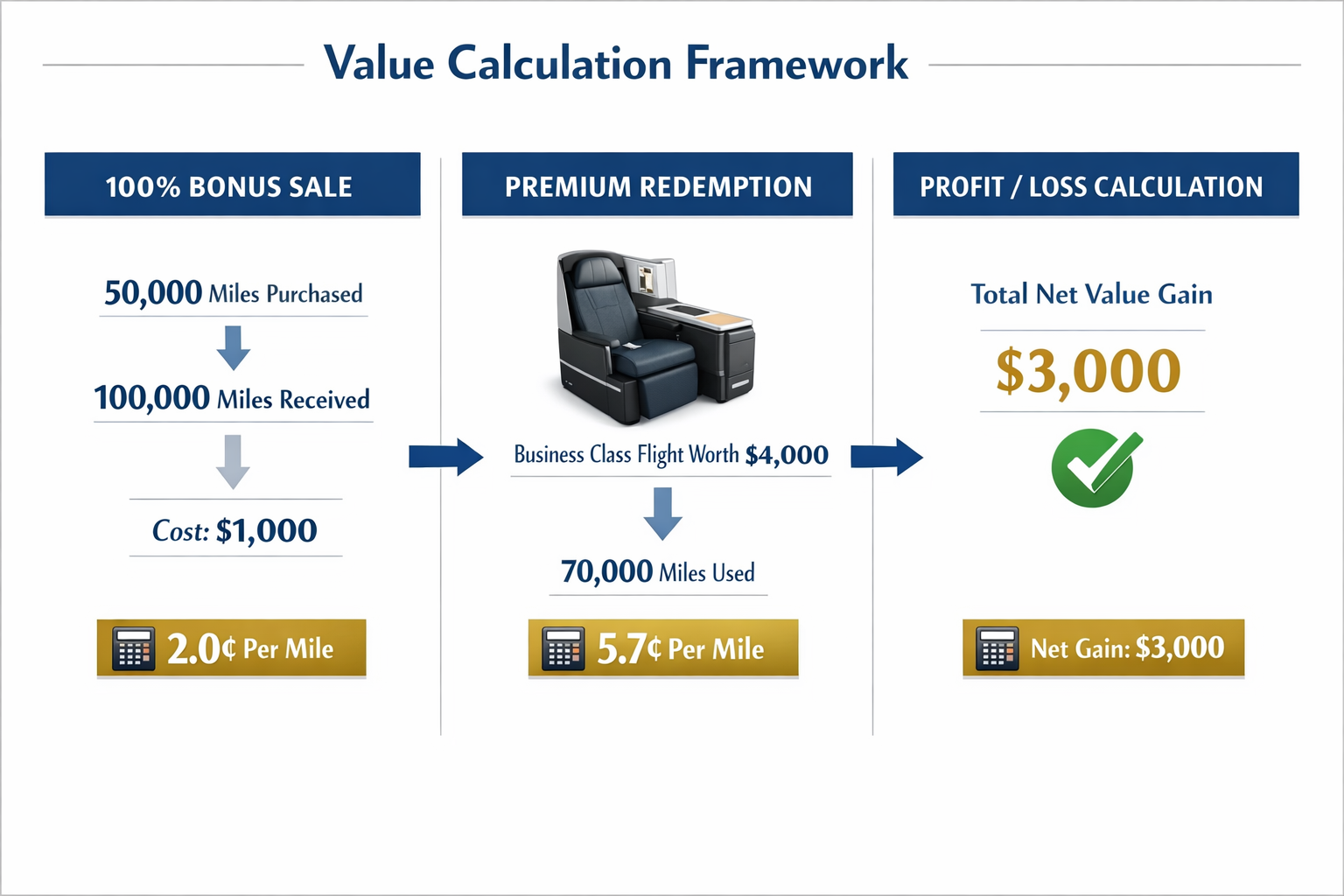

Cents Per Point (CPP) = Cash Price of Flight ÷ Miles Required

If a business class ticket costs $4,000 and requires 70,000 miles, your redemption value is 5.7 CPP ($4,000 ÷ 70,000 = $0.057 per mile). If you purchased those miles at 2.0¢ each during a 100% bonus sale, your total cost would be $1,400 (70,000 miles × $0.02). You’d save $2,600 compared to paying cash.

But if that same 70,000-mile award only replaces a $700 economy ticket, your redemption value drops to 1.0 CPP—meaning you paid double what the ticket was worth.

Real-World Value Benchmarks

Award Travel Hub uses these CPP targets for evaluating redemptions:

- Economy awards: 1.5-2.0 CPP minimum

- Premium economy: 2.0-3.0 CPP minimum

- Business class: 3.0-6.0 CPP target

- First class: 5.0-10.0+ CPP target

When you buy airline miles, you need redemptions that significantly exceed your purchase cost. For detailed guidance on calculating redemption value, see our 2026 Guide to Cents-Per-Point.

Purchase Cost Threshold:

Most bonus sales deliver miles at 1.3-2.5¢ each after bonuses. To justify the purchase:

- Minimum redemption value: 2.5-3.0 CPP (25-50% profit margin)

- Target redemption value: 4.0+ CPP (100%+ profit margin)

- Premium cabin sweet spot: 5.0-8.0 CPP (200-300% profit margin)

The Hidden Costs

Published bonus rates don’t tell the complete story. Additional factors affect true cost:

Taxes and Fees on Purchase:

- Most programs charge 7.5% U.S. excise tax on mileage purchases

- Some add processing fees ($30-50 flat rate)

- Credit card foreign transaction fees (if applicable)

Redemption Surcharges:

- British Airways: $400-800 fuel surcharges on long-haul awards

- Lufthansa: $300-600 on business class awards

- Air France/KLM: $200-400 on transatlantic awards

Opportunity Cost:

- Could you earn these miles through credit card spend instead?

- Are transfer bonuses available from Chase, Amex, Capital One, Citi, or Bilt?

- What’s your effective earning rate on transferable points?

For most intermediate travelers, earning transferable points through credit cards and waiting for transfer bonuses delivers better value than buying miles directly.

Current Buy Airline Miles Bonus Sale Examples (February 2026)

February 2026 offers one of the most competitive mileage sale environments in recent years, with bonuses ranging from 45% discounts to 125% bonus miles. Here’s the complete breakdown of current promotions:

Airline Programs with Active Bonuses

| Program | Bonus/Discount | Cost Per Mile | Valid Through | Value Rating |

|---|---|---|---|---|

| JetBlue TrueBlue | 125% bonus | 1.43¢ | Feb 23, 2026 | ⭐⭐⭐ Good |

| Alaska Atmos Rewards | 100% bonus | 1.88¢ | Feb 18, 2026 | ⭐⭐⭐⭐ Very Good |

| Air Canada Aeroplan | 100% bonus | 1.37¢ | Feb 16, 2026 | ⭐⭐⭐⭐ Very Good |

| Southwest Rapid Rewards | 50% discount | 1.50¢ | Feb 23, 2026 | ⭐⭐⭐ Good |

| Copa ConnectMiles | 45% discount | 1.65¢ | Feb 13, 2026 | ⭐⭐⭐ Good |

| American AAdvantage | Varies by account | 2.08¢+ | Targeted | ⭐⭐ Fair |

Deep Dive: Best Current Opportunities

Air Canada Aeroplan (100% Bonus, 1.37¢/mile):

This represents the lowest cost-per-mile among major programs with 100% bonuses. Aeroplan’s strength lies in Star Alliance access and favorable award pricing on partner airlines.

Sweet spot example: North America to Europe in business class on Lufthansa or Swiss requires 70,000 miles one-way (off-peak). Retail price: $3,000- $5,000. If you purchase 35,000 miles and receive 70,000 total, your cost is $479.50 (35,000 × $0.0137). Redemption value: 6.3-10.4 CPP.

Alaska Atmos Rewards (100% Bonus, 1.88¢/mile):

Higher cost per mile, but Alaska offers unique sweet spots unavailable elsewhere. The program excels at Emirates First Class and Japan Airlines Business Class redemptions.

Sweet spot example: West Coast to Dubai in Emirates first class requires 110,000 miles one-way. Retail price: $18,000- $ 25,000. Purchase 55,000 miles and receive 110,000 total for $1,034 (55,000 × $0.0188). Add minimal fuel surcharges (~$100). Total cost: ~$1,134. Redemption value: 15.9-22.0 CPP.

For more on maximizing Star Alliance awards, see our complete guide to booking Star Alliance business class.

JetBlue TrueBlue (125% Bonus, 1.43¢/mile):

The highest bonus percentage, but limited to JetBlue-operated flights and select partners. Best for domestic and Caribbean routes where JetBlue has strong coverage.

Sweet spot example: New York to Aruba in Mint (business class) requires 38,000-48,000 miles one-way, depending on dates. Retail price: $800- $1,200. Purchase 21,333 miles and receive 48,000 total for $305 (21,333 × $0.0143). Redemption value: 2.6-3.9 CPP.

Hotel Programs Worth Considering

While this guide focuses on airlines, February 2026 also features strong hotel promotions:

- Hilton Honors: 100% bonus at 0.5¢ per point (through March 14, 2026)

- Wyndham Rewards: 80% bonus at 0.72¢ per point (through February 18, 2026)

- Marriott Bonvoy: 40% bonus at 0.89¢ per point (through March 26, 2026)

Hilton’s 100% bonus at half a cent per point can work for aspirational properties where standard room rates are $600-800 per night or higher.

Buy Airline Miles vs Earn Miles: The Strategic Comparison

The decision to buy airline miles exists within a larger ecosystem of earning strategies. For most travelers, buying miles should be the last option—not the first.

The Transferable Points Advantage

Transferable points from Chase, Amex, Capital One, Citi, and Bilt offer several advantages over purchased airline miles:

Flexibility:

- Transfer to 15-20+ airline and hotel partners

- Hold points in one currency until needed

- Pivot to different programs if the award space disappears

Transfer Bonuses:

- Regular 15-40% bonuses to specific partners

- Often deliver better effective rates than purchase bonuses

- No expiration pressure while points remain in the bank currency

Earning Rates:

- 2-5x points per dollar on category spend

- Welcome bonuses worth 60,000-150,000 points

- No purchase limits or fees

Current Transfer Bonus Comparison (February 2026):

According to recent data, several transfer bonuses compete directly with purchase promotions:

- Japan Airlines: 30% transfer bonus through February 28, 2026

- Avianca LifeMiles: 15% transfer bonus (recently ended February 11, 2026)

A 30% transfer bonus to Japan Airlines means 50,000 Chase points become 65,000 JAL miles—effectively 0.77¢ per mile if you value Chase points at 1¢ each (their minimum cash redemption value). That’s significantly cheaper than any current purchase promotion.

For strategies on maximizing transfer bonuses, read our guide on when to transfer points and when to wait.

When Buying Makes More Sense Than Transferring

Despite the advantages of transferable points, specific scenarios favor purchasing miles:

1. You Don’t Have Transferable Points: If you haven’t built a transferable points balance and need miles immediately for a confirmed award, buying during a bonus sale can be the fastest path.

2. The Program Isn’t a Transfer Partner: Airlines like Southwest, JetBlue, and Copa don’t partner with major transferable currencies. Buying during promotions may be your only option besides earning through flying.

3. Topping Off for a Specific Award: You’re 15,000 miles short of a premium cabin award, no transfer bonus is available, and the award space might disappear. Buying the shortfall at 1.5-2.0¢ per mile to secure a 5+ CPP redemption makes sense.

4. The Math Strongly Favors Purchase: Occasionally, purchase bonuses combined with specific sweet spots create arbitrage opportunities. The Alaska Emirates First Class example (22 CPP value for 1.88¢ purchase cost) represents this rare scenario.

Credit Card Earning Alternative

Before buying miles, calculate what you could earn through strategic credit card spend:

Example Scenario:

- Need: 70,000 airline miles

- Option A: Buy during 100% bonus (35,000 miles purchased) = $685 cost

- Option B: Earn through a credit card

Chase Sapphire Reserve earning rates:

- 3x points on travel and dining

- $22,833 spend required to earn 68,499 points

- Transfer to an airline partner

Opportunity cost: If you had earned 1x points anyway on that spend, the marginal cost is 2x points per dollar, or $11,417 in additional spend needed.

Better Option B: Welcome Bonus

- Chase Sapphire Preferred: 60,000 points after $4,000 spend

- Amex Gold: 60,000 points after $6,000 spend

- Capital One Venture X: 75,000 miles after $4,000 spend

A single welcome bonus often exceeds what you’d buy during a promotion—without paying 1.5-2.0¢ per point.

For comparing transfer partner ecosystems, see our 2026 comparison of Chase vs Amex vs Citi vs Capital One.

Buy Airline Miles: Risk Factors You Must Consider

Purchasing airline miles introduces risks that don’t exist with transferable points or cash bookings. Understanding these risks is essential before committing funds.

Devaluation Risk

Airlines can change award pricing at any time, often with minimal notice. Miles you purchase today at 1.5¢ each might require 30-50% more miles for the same award next year.

Recent Examples:

- Singapore Airlines KrisFlyer: Implemented significant devaluation effective November 1, 2025, increasing premium cabin award costs by 20-40% on many routes

- Marriott Bonvoy: Shifted to dynamic pricing in 2026, eliminating predictable award charts

- Delta SkyMiles: Moved to fully dynamic pricing years ago; award costs fluctuate based on demand

When you buy airline miles, you’re betting the program won’t devalue before you redeem. Transferable points held in Chase, Amex, Capital One, Citi, or Bilt accounts let you wait until the moment of transfer—preserving flexibility if a program devalues.

Award Availability Constraints

Purchased miles have zero value if you can’t find award space for your desired routes and dates. This risk intensifies for:

Premium cabin awards:

- Limited seats released to partners

- Popular routes book 330+ days in advance

- Holiday and peak season availability scarce

Specific airline sweet spots:

- Emirates first class on Alaska: 2-4 seats per flight maximum

- ANA first class: Often zero partner availability

- Lufthansa first class: Rarely released to partners

Common mistake: Buying miles because you saw award availability mentioned in a blog post, without confirming current space on your specific dates and route.

Best practice: Search award availability first. Confirm that the exact flights you want are bookable. Then—and only then—consider purchasing miles if the math works.

For tools to search award space efficiently, see our guide to best award travel tools and alerts for 2026.

Expiration Policies

Most airline programs have activity-based expiration policies. Purchased miles reset the expiration clock, but you must use them or maintain account activity within the specified timeframe:

Common Expiration Rules:

- American AAdvantage: 24 months of inactivity

- Delta SkyMiles: No expiration (rare exception)

- United MileagePlus: 18 months of inactivity

- Alaska Atmos Rewards: 24 months of inactivity

- Air Canada Aeroplan: 18 months of inactivity

Expiration risk increases when:

- You buy speculatively without specific redemption plans

- You can’t find award availability within the expiration window

- Program devaluation makes your miles insufficient for intended awards

Non-Refundable Purchase Risk

Unlike credit card points that you earn through spending, purchased airline miles typically cannot be refunded. Once you complete the transaction:

- No refunds: Even if the program devalues immediately after purchase

- No chargebacks: Credit card protections don’t apply to buyer’s remorse on miles

- Account restrictions: Some programs limit purchases to specific accounts or require account age minimums

Exception: Some programs allow mile transfers between accounts for a fee, creating a gray market for selling unwanted miles—but this violates most program terms and can result in account closure.

Program Changes and Restrictions

Airlines regularly modify program rules in ways that can impact purchased miles:

Recent Changes:

- American Airlines: Eliminated mileage earning on basic economy fares in 2026

- Southwest: Announced assigned seating starting January 2026, potentially affecting award availability patterns

- United: Modified partner award pricing, increasing costs on some Star Alliance routes

When you buy airline miles, you’re locked into that specific program’s rules and future changes. Transferable points preserve the option to pivot to different programs if rules become unfavorable.

For tracking program changes, check our award travel trends for 2026.

Buy Airline Miles Decision Framework: Your Complete Checklist

Use this step-by-step framework before purchasing airline miles during any bonus sale:

Step 1: Identify Your Specific Redemption

❏ Award space confirmed: You’ve searched and found available award seats on your exact dates and route

❏ Redemption value calculated: You’ve calculated the CPP value and it exceeds 3.0 CPP minimum (preferably 4.0+ CPP)

❏ Cash price verified: You’ve confirmed the retail ticket price using the same dates, cabin, and routing

❏ Fees and surcharges known: You’ve identified all taxes, fuel surcharges, and booking fees that apply

Example:

- Route: San Francisco to Tokyo in ANA business class

- Award cost: 75,000 Virgin Atlantic miles

- Retail price: $5,500

- Taxes/fees: $180

- CPP value: 7.3 CPP ($5,500 ÷ 75,000)

- ✅ Passes value threshold

Step 2: Calculate Total Purchase Cost

❏ Base miles needed: Determine exact miles required (account for current balance)

❏ Bonus structure: Understand the bonus (e.g., 100% bonus means buy 37,500, receive 75,000 total)

❏ Cost per mile: Calculate final cost per mile after bonus

❏ Taxes and fees: Add 7.5% excise tax and any processing fees

❏ Total cost: Calculate the complete out-of-pocket expense

Example:

- Need: 75,000 Virgin Atlantic miles

- Current balance: 0 miles

- Promotion: 100% bonus

- Must purchase: 37,500 miles

- Cost: $0.0188 per mile (Alaska rate)

- Base cost: $705 (37,500 × $0.0188)

- Excise tax (7.5%): $52.88

- Total cost: $757.88

Step 3: Compare Alternative Earning Methods

❏ Transfer bonus available: Check current transfer bonuses from Chase, Amex, Capital One, Citi, or Bilt

❏ Transfer partner option: Confirm the airline is a transfer partner of your points currency

❏ Effective cost comparison: Calculate the effective cost per mile via transfer vs. purchase

❏ Credit card welcome bonus: Consider whether a new card welcome bonus could cover the need

Example:

- Virgin Atlantic is an Amex, Chase, Capital One, and Citi transfer partner

- Current Chase to Virgin Atlantic bonus: None

- Current Capital One to Virgin Atlantic bonus: None (but was 30% in late 2025)

- Transfer cost: 75,000 points (1:1 ratio)

- If you value Chase points at 1.5¢ each: Effective cost = $1,125

- Purchase cost: $757.88

- ✅ Purchasing wins in this scenario

For more on transfer partner strategies, see our complete guide to credit card transfer partners.

Step 4: Assess Risk Factors

❏ Expiration timeline: Can you use the miles before they expire (typically 18-24 months)?

❏ Devaluation history: Has this program recently devalued or announced upcoming changes?

❏ Award availability stability: Is this a route with consistent availability, or is it a rare find?

❏ Backup redemption options: Do you have alternative uses for these miles if your primary plan fails?

❏ Account standing: Is your account in good standing with no restrictions?

Red flags that should stop the purchase:

- ⛔ Award space not confirmed on exact dates

- ⛔ Program announced devaluation effective within 6 months

- ⛔ You’re buying speculatively without specific plans

- ⛔ Redemption value below 2.5 CPP

- ⛔ Better transfer bonus likely coming soon (historical pattern)

Step 5: Execute Purchase Strategically

❏ Maximum bonus: Confirm you’re getting the maximum advertised bonus (some programs have tier bonuses)

❏ Account verification: Verify miles will post to the correct frequent flyer account

❏ Purchase limits: Understand annual purchase limits (typically 100,000-150,000 miles per year)

❏ Payment method: Use a credit card that earns rewards on the purchase (some cards code as travel)

❏ Confirmation saved: Save purchase confirmation and monitor for miles posting (typically 24-72 hours)

Pro tip: Some credit cards code mileage purchases as airfare, earning bonus category points. Cards like Chase Sapphire Reserve (3x on travel) or Amex Gold (3x on flights) can offset purchase costs by 3-4.5%.

Step 6: Book Award Immediately

❏ Book within 24-48 hours: Don’t wait—award space can disappear

❏ Screenshot availability: Document the award space before purchasing

❏ Backup dates ready: Have alternative dates searched in case the primary option disappears

❏ Partner booking verified: If booking a partner airline, confirm the program can actually ticket the award

Common mistake: Buying miles on Monday, waiting until the weekend to book, and discovering the award space is gone. Book immediately after the miles post.

When NOT to Buy Airline Miles

This framework helps identify good opportunities, but it’s equally important to recognize when buying miles is a bad decision:

Don’t buy if:

- ❌ You’re buying “just in case” without specific redemption plans

- ❌ The redemption value is below 2.5 CPP

- ❌ A transfer bonus to the same program is currently active or historically appears quarterly

- ❌ You haven’t confirmed award availability on your exact dates

- ❌ The program recently devalued or announced upcoming changes

- ❌ You could earn the miles through a credit card welcome bonus instead

- ❌ You’re trying to reach elite status (purchased miles typically don’t count)

- ❌ The award has high fuel surcharges that push total cost above reasonable levels

For more on avoiding common mistakes, see our guide on common pitfalls to avoid in award bookings.

Real-World Buy Airline Miles Scenarios: When It Works and When It Doesn’t

Theory matters less than practice. Here are realistic scenarios showing when buying airline miles delivers value and when it wastes money:

✅ Scenario 1: Alaska Miles for Emirates First Class (WORKS)

Situation: You want to fly Emirates first class from Los Angeles to Dubai for your honeymoon in November 2026.

Award Requirements:

- Route: LAX to DXB in Emirates F

- Miles needed: 110,000 Alaska miles one-way

- Taxes/fees: ~$100

- Retail price: $22,000

Purchase Analysis:

- Current balance: 15,000 Alaska miles

- Need to purchase: 47,500 miles (to receive 95,000 with 100% bonus)

- Cost: 47,500 × $0.0188 = $893

- Excise tax: $67

- Total cost: $960

- Plus existing miles and fees: ~$1,060 total

Value Calculation:

- CPP: $22,000 ÷ 110,000 = 20 CPP

- Net savings: $20,940

- ROI: 1,973%

Why it works:

- ✅ Exceptional redemption value (20 CPP)

- ✅ Award availability confirmed before purchase

- ✅ Specific use case with imminent travel

- ✅ No transfer partner alternative (Alaska unique sweet spot)

- ✅ Low fuel surcharges on Emirates awards

✅ Scenario 2: Topping Off for Business Class Award (WORKS)

Situation: You have 55,000 Aeroplan miles and need 70,000 for a business class award to Europe next month.

Award Requirements:

- Route: New York to Frankfurt in Lufthansa business class

- Miles needed: 70,000 Aeroplan miles

- Current balance: 55,000 miles

- Shortfall: 15,000 miles

- Retail price: $4,200

Purchase Analysis:

- Need to purchase: 7,500 miles (to receive 15,000 with 100% bonus)

- Cost: 7,500 × $0.0137 = $103

- Excise tax: $8

- Total cost: $111

Value Calculation:

- Award value: $4,200

- Total cost: $111 (purchase) + ~$300 (taxes/surcharges) = $411

- Net savings: $3,789

- Effective CPP: 6.0 CPP

Why it works:

- ✅ Small purchase to complete specific award

- ✅ Immediate use (next month)

- ✅ Strong redemption value (6.0 CPP)

- ✅ Award space already confirmed

- ✅ No transfer bonus currently available

❌ Scenario 3: Speculative Purchase for Future Travel (DOESN’T WORK)

Situation: You see JetBlue offering 125% bonus miles and think “that’s a great deal” without specific plans.

Purchase:

- Buy: 40,000 miles

- Receive: 90,000 miles with bonus

- Cost: 40,000 × $0.0143 = $572

- Excise tax: $43

- Total cost: $615

Six months later:

- You search for awards to Caribbean destinations

- Most require 30,000-50,000 miles one-way

- Retail prices: $350-600

- CPP value: 1.2-2.0 CPP

- You paid 1.43¢ per mile for 1.2-2.0¢ value

- Marginal benefit: $0-500 (vs. buying cash ticket)

Why it doesn’t work:

- ❌ No specific redemption identified before purchase

- ❌ Actual redemption value barely exceeds purchase cost

- ❌ Could have earned miles through the JetBlue credit card instead

- ❌ Limited to JetBlue-operated flights only

- ❌ Opportunity cost of $615 that could have gone toward transferable points

❌ Scenario 4: Buying When Transfer Bonus Available (DOESN’T WORK)

Situation: You want to book ANA business class using Virgin Atlantic miles and see a purchase bonus.

Purchase Option:

- Virgin Atlantic is selling miles at 100% bonus

- Need: 95,000 miles

- Purchase: 47,500 miles

- Cost: 47,500 × $0.0188 = $893

- Total with tax: $960

Transfer Bonus Alternative (if available):

- Capital One to Virgin Atlantic: 30% transfer bonus

- Need: 95,000 Virgin miles

- Transfer: 73,077 Capital One miles (becomes 95,000 with 30% bonus)

- Opportunity cost: 73,077 miles valued at 1.5¢ = $1,096

Analysis: In this case, purchasing is actually cheaper than transferring ($960 vs. $1,096). But if you value Capital One miles at 1.3¢ each (closer to minimum redemption value), the transfer cost drops to $950—essentially equal.

Why it’s borderline:

- ⚠️ Transfer bonus makes purchase less attractive

- ⚠️ Transferable points preserve flexibility

- ⚠️ Small cost difference doesn’t justify losing optionality

- ✅ If you don’t have transferable points, purchase works

Better approach: Build transferable points balances through credit cards and wait for transfer bonuses rather than buying miles directly.

For more on maximizing transfer bonuses, see our guide on how to maximize the Amex to Avianca LifeMiles 15% bonus.

✅ Scenario 5: Southwest Companion Pass Strategy (WORKS)

Situation: You’re 8,000 points short of earning Southwest Companion Pass through the points requirement (you’ve already met the flight requirement).

Context:

- Companion Pass requires 135,000 qualifying points in the calendar year

- Current balance: 127,000 qualifying points

- Need: 8,000 more points

- Southwest is offering 50% discount (1.5¢ per point)

Purchase Analysis:

- Purchase: 8,000 points

- Cost: 8,000 × $0.015 = $120

- Benefit: Companion Pass for the remainder of 2026 (assuming earned in early 2026)

- Value: Companion flies free on all Southwest flights

Value Calculation: If you take 3 round-trips with a companion at an average of $400 per ticket:

- Companion ticket value: $1,200

- Cost: $120

- ROI: 900%

Why it works:

- ✅ Specific strategic goal (Companion Pass)

- ✅ Small purchase with outsized benefit

- ✅ Immediate value realization

- ✅ Can’t achieve goal through transfer (Southwest is not a transfer partner)

Conclusion: Make the Buy Airline Miles Decision With Confidence

Buying airline miles during bonus sales can unlock exceptional value—or waste hundreds of dollars. The difference comes down to disciplined evaluation using the framework outlined above.

The core principles:

- Always confirm award availability first before purchasing miles

- Calculate redemption value and ensure it exceeds 3.0 CPP minimum (target 4.0+ CPP)

- Compare alternatives including transfer bonuses and credit card welcome bonuses

- Assess risks including devaluation, expiration, and availability constraints

- Book immediately after miles post to your account

Best candidates for buying miles:

- Travelers with specific premium cabin awards confirmed and available

- Those topping off existing balances for imminent redemptions

- Strategic purchases for programs without transfer partners (Southwest, JetBlue, Copa)

- Sweet spot redemptions delivering 5.0+ CPP value

Better alternatives for most travelers:

- Build transferable points through Chase, Amex, Capital One, Citi, or Bilt credit cards

- Wait for 15-40% transfer bonuses to specific airline partners

- Earn welcome bonuses worth 60,000-150,000 points

- Maintain flexibility until the moment of booking

The February 2026 bonus sales offer legitimate opportunities—particularly Air Canada Aeroplan at 1.37¢ per mile and Alaska Atmos at 1.88¢ per mile for specific sweet spots. But these opportunities only deliver value when paired with confirmed award space and premium cabin redemptions.

Next steps:

- Search award availability for your desired routes using airline websites or search tools

- Calculate redemption value using the CPP formula and compare to the purchase cost

- Check current transfer bonuses to see if transferable points offer better value

- Review the decision checklist in this guide before committing to any purchase

- Monitor bonus sales but only act when all criteria align

For ongoing tracking of transfer bonuses and mileage sales, bookmark our transfer bonus strategy guide and check regularly for updates.

Remember: the best use of airline miles isn’t buying them—it’s earning transferable points strategically and transferring only when you’ve confirmed the exact award you want to book. Purchased miles should be a tactical tool for specific situations, not a primary earning strategy.