Chase Ultimate Rewards cardholders face a familiar dilemma in February 2026: a 50% transfer bonus to Marriott Bonvoy that sounds compelling but requires careful analysis. With the Chase Marriott Transfer Bonus February 2026 promotion running through February 28, the question isn’t whether you can transfer—it’s whether you should.

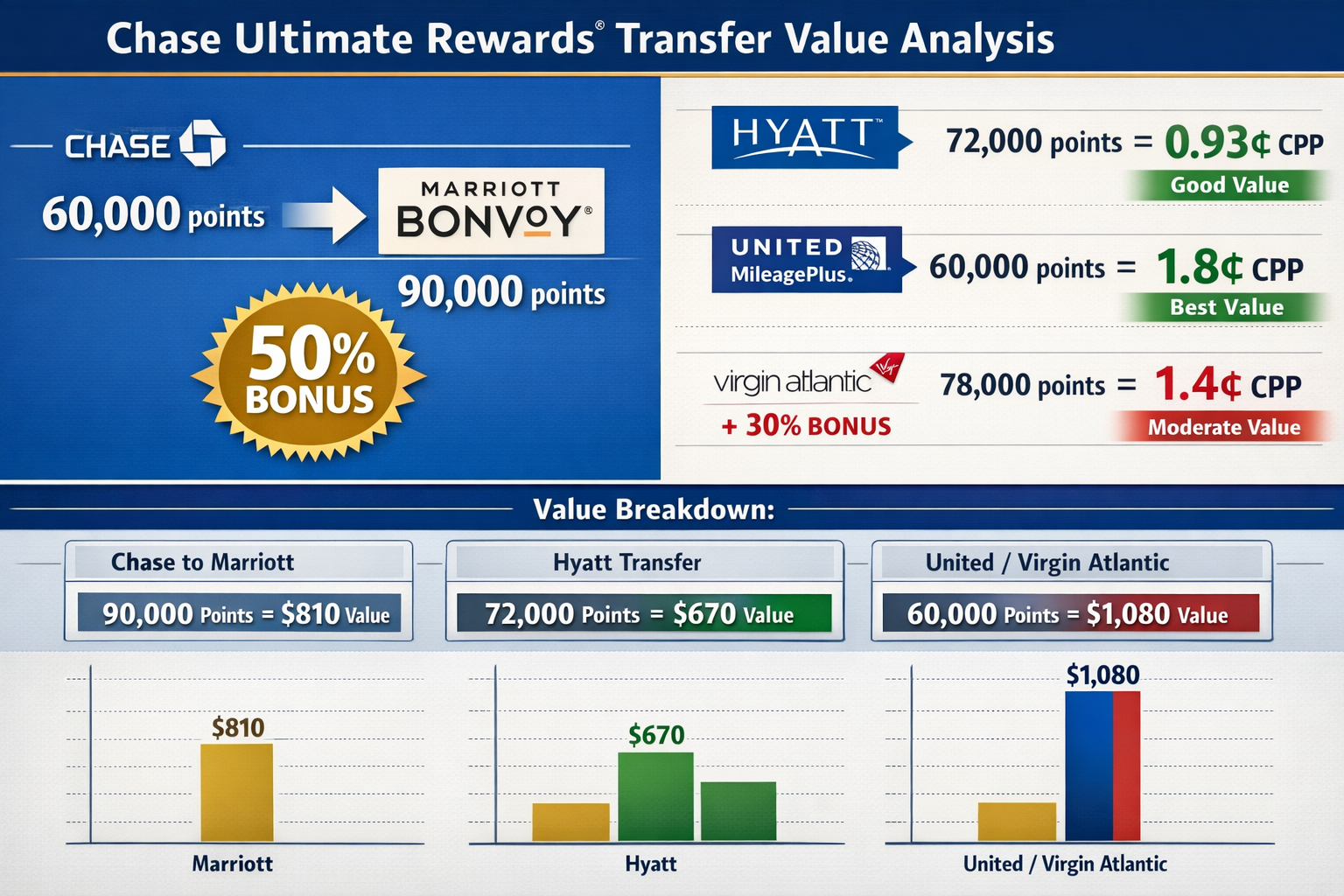

This month-long promotion converts Chase points to Marriott Bonvoy at a 1:1.5 ratio instead of the standard 1:1, meaning 60,000 Chase points become 90,000 Marriott points. That sounds attractive on the surface, but the math tells a more nuanced story. Marriott Bonvoy points typically deliver around 0.93 cents per point in redemption value, translating to approximately 1.4 cents per Chase point after the bonus—still below what you’d achieve transferring to premium partners like Hyatt or certain airline programs.

The reality: this bonus works for specific situations, not as a default strategy. If you’re sitting on Chase points without a clear redemption plan, this promotion probably isn’t your best move. But if you have a targeted Marriott booking in mind—particularly at Category 7-8 properties where you can leverage the fifth-night-free benefit—the 50% bonus can deliver genuine value that rivals or exceeds other Chase transfer options.

Key Takeaways

- The Chase Marriott transfer bonus February 2026 runs through February 28, converting points at 1:1.5 (60,000 Chase → 90,000 Marriott)

- Base value analysis shows Marriott delivers ~0.93¢ per point, meaning the bonus yields approximately 1.4¢ per Chase point—lower than Hyatt (1.8¢) but competitive for specific redemptions

- Best use cases: topping off accounts for immediate bookings, Category 7-8 luxury properties, and fifth-night-free strategies where you can extract $800-$1,200/night equivalent value

- This is a tactical bonus, not a strategic one—transfer only with a specific redemption planned, not to stockpile Marriott points speculatively

- Alternative Chase partners currently offer better baseline value, making this bonus most valuable when Marriott has superior availability, or you’re targeting properties outside Hyatt’s footprint

Understanding the Chase Marriott Transfer Bonus February 2026 Offer

Chase Ultimate Rewards launched this 50% Marriott Bonvoy transfer bonus on February 1, 2026, with a firm deadline of February 28, 2026. The mechanics are straightforward: instead of the standard 1:1 transfer ratio, you’ll receive 1.5 Marriott Bonvoy points for every Chase Ultimate Rewards point transferred during the promotional period.

Transfer in increments of 1,000 Chase points minimum, and the bonus applies automatically—you don’t need to enter a promo code or take additional steps beyond initiating the transfer through your Chase Ultimate Rewards portal. The points typically post instantly to your Marriott Bonvoy account, though Chase notes transfers can take up to 24 hours in some cases.

Historical Context: Where This Bonus Ranks

This isn’t Marriott’s most generous transfer bonus from Chase, but it’s far from the weakest. Since early 2021, Chase has offered Marriott transfer bonuses ranging from 40% to 70%, with the 50% tier appearing more than a dozen times. The most recent comparable 50% bonus ended in August 2025, while a more generous 70% promotion expired in November 2025.

The pattern suggests Chase and Marriott deploy these bonuses regularly—roughly every 2-3 months—making this a recurring opportunity rather than a rare event. That frequency matters for your decision-making: if this bonus doesn’t align with your travel plans, another will likely appear within a few months.

For context on evaluating transfer bonuses strategically, see our guide on transfer bonus strategy and timing.

Who Can Take Advantage

This promotion is available to holders of Chase Ultimate Rewards-earning cards, including:

- Chase Sapphire Preferred® Card

- Chase Sapphire Reserve®

- Chase Freedom Unlimited® (points must be combined with a Sapphire or Ink card)

- Chase Freedom Flex℠ (points must be combined with Sapphire or Ink card)

- Ink Business Preferred® Credit Card

- Ink Business Unlimited® Credit Card (points must be combined with Ink Preferred)

- Ink Business Cash® Credit Card (points must be combined with Ink Preferred)

If you hold a Freedom or Ink Cash/Unlimited card without a premium card, you’ll need to combine your points with a Sapphire or Ink Preferred account to access transfer partners. The bonus applies regardless of which Chase card originally earned the points—what matters is having transfer capability through a premium card.

Value Analysis: Is 50% Enough to Make Marriott Competitive?

The fundamental question: does a 50% bonus transform Marriott Bonvoy from a mediocre Chase transfer partner into a competitive option? The answer depends entirely on your specific redemption.

The Base Math

According to AwardWallet’s analysis, Marriott Bonvoy points average 0.93 cents per point in redemption value. With the 50% transfer bonus, here’s how the math breaks down:

- Without bonus: 1,000 Chase points → 1,000 Marriott points → ~$9.30 value (0.93¢ per Chase point)

- With 50% bonus: 1,000 Chase points → 1,500 Marriott points → ~$14.00 value (1.4¢ per Chase point)

That 1.4 cents per Chase point represents the average value you’d extract. For comparison, The Points Guy values Chase Ultimate Rewards points at 2.05 cents each—meaning that if you could consistently achieve that valuation through other redemptions, transferring to Marriott, even with the bonus, would represent a significant value loss.

Comparing Against Other Chase Partners

The real test comes when you compare Marriott (with bonus) against Chase’s other transfer options:

| Transfer Partner | Transfer Ratio | Typical CPP Value | Effective Value per Chase Point | Best Use Cases |

|---|---|---|---|---|

| Marriott Bonvoy (with 50% bonus) | 1:1.5 | 0.93¢ | ~1.4¢ | Category 7-8 properties, fifth-night-free bookings |

| World of Hyatt | 1:1 | 1.8¢ | 1.8¢ | Luxury hotels globally, consistent value |

| United MileagePlus | 1:1 | 1.4¢ | 1.4¢ | Domestic flights, Star Alliance partners |

| Virgin Atlantic Flying Club | 1:1 | 1.5¢ | 1.5¢ | Partner awards (Delta, ANA) |

| Air France/KLM Flying Blue | 1:1 | 1.3¢ | 1.3¢ | Transatlantic business class |

Even with the 50% bonus, Marriott delivers lower value than Hyatt and matches United’s typical redemption value. This explains why multiple expert sources recommend this bonus primarily for tactical top-offs rather than strategic transfers.

For a comprehensive breakdown of all Chase transfer partners and their relative values, check our Chase Transfer Partners Guide 2026.

When Marriott Actually Wins

Despite the lower average value, specific scenarios make the Chase Marriott transfer bonus in February 2026 worthwhile:

1. Availability trumps theoretical value. If Hyatt has no award availability for your dates but Marriott does, the points you can actually use are worth more than the points you can’t redeem.

2. Geographic coverage gaps. Marriott operates 8,500+ properties globally, compared with Hyatt’s 1,300+. If you’re traveling to destinations without a Hyatt presence, Marriott is your default hotel transfer option.

3. High-category properties with fifth-night-free. When booking five nights at Category 7-8 properties (70,000-100,000 points per night standard rate), the fifth night free benefit effectively reduces your per-night cost by 20%, pushing your effective value above the baseline calculation.

4. Topping off for immediate bookings. If you have 250,000 Marriott points and need 300,000 for a specific redemption, transferring 34,000 Chase points (yielding 51,000 Marriott points) solves your immediate problem without requiring you to maximize theoretical value.

Decision Framework: When to Use the Chase Marriott Transfer Bonus February 2026

Rather than asking “Is this bonus good?” ask “Is this bonus right for my situation?” Here’s a practical decision framework:

✅ Transfer to Marriott with the 50% Bonus If:

You have a specific Marriott redemption planned within the next 12 months. Don’t transfer speculatively. Marriott points are subject to devaluation risk, and you’re better off keeping Chase points flexible until you’re ready to book.

The property you want isn’t available through Hyatt or other hotel partners. Geographic coverage matters more than theoretical value when you have fixed travel dates.

You’re booking Category 7-8 properties and can use the fifth-night-free benefit. This combination can push your effective value to 1.6-1.8 cents per Chase point, rivaling Hyatt transfers.

You need to top off your Marriott account by less than 100,000 points. Small transfers to complete a booking make sense even if the overall value isn’t optimal.

Marriott has significantly better award availability than alternatives. During peak periods, available awards beat unavailable awards regardless of point cost.

❌ Skip This Bonus If:

You don’t have a specific Marriott booking in mind. Speculative transfers lock in value at ~1.4 cents per point, whereas you might achieve 1.8-2+ cents with other partners.

You’re targeting Category 1-4 properties. Lower-category Marriott properties (requiring 7,500-35,000 points per night) typically deliver poor value compared to paying cash or using Hyatt points at similar properties.

You have other Chase transfer bonuses available. If Chase is simultaneously offering bonuses to airline partners or if you can wait for a Hyatt transfer bonus, those typically deliver better value.

You’re more than six months from your travel dates. Award availability often opens 11-12 months out. Transferring now means you’re holding Marriott points that could devalue before you use them.

You value flexibility over immediate booking. Chase points transfer to 14 partners; Marriott points can only be redeemed within Marriott’s ecosystem.

For a broader context on evaluating transfer bonuses across all programs, see our article on how to use transfer bonuses to maximize travel rewards.

The “Maybe” Zone: Situations Requiring Calculation

Some scenarios require you to run the actual numbers:

Category 5-6 properties (50,000-70,000 points per night). These fall into a gray zone where value depends heavily on cash rates. If the hotel costs $400+ per night, the redemption might work; at $200/night, you’re better off paying cash and saving points.

Points + Cash rates. Marriott’s points + cash option sometimes delivers better value than straight award nights, but requires property-by-property analysis.

Peak season bookings at resort properties. When cash rates spike to $800-$1,200+ per night, even Category 6-7 award redemptions (60,000-85,000 points) can deliver 1.5+ cents per point value.

The key: calculate the cents-per-point value for your specific redemption before transferring. Divide the cash rate by the points required (after applying fifth-night-free if relevant) to determine if you’re beating the 1.4¢ baseline.

Best Marriott Redemptions to Maximize the 50% Bonus

If you’ve determined this bonus aligns with your plans, focus on redemptions that extract maximum value from Marriott Bonvoy points. Here are five scenarios where the Chase Marriott transfer bonus in February 2026 delivers competitive or superior value compared to other Chase transfer options.

1. St. Regis Maldives Vommuli Resort (Category 8)

Standard award rate: 100,000 points per night

With fifth-night-free: 400,000 points for 5 nights (80,000 per night effective)

Cash rate: Typically $1,000-$1,500+ per night

Chase points required (with 50% bonus): 267,000 Chase points → 400,500 Marriott points

Value calculation: At $1,200/night average, you’re getting $6,000 in hotel value for 267,000 Chase points = 2.25 cents per Chase point—significantly better than the baseline and competitive with premium airline transfers.

This overwater villa property represents Marriott’s top-tier luxury category. The fifth-night-free benefit is crucial here; without it, you’d need 500,000 points for five nights, dropping your value to 1.8 cents per Chase point.

2. Ritz-Carlton Tokyo (Category 7)

Standard award rate: 85,000 points per night

With fifth-night-free: 340,000 points for 5 nights (68,000 per night effective)

Cash rate: Typically $700-$900 per night

Chase points required (with 50% bonus): 227,000 Chase points → 340,500 Marriott points

Value calculation: At $800/night average, you’re getting $4,000 in value for 227,000 Chase points = 1.76 cents per Chase point.

Tokyo’s Park Hyatt (the Lost in Translation hotel) often has better availability through Hyatt transfers, but the Ritz-Carlton Tokyo offers comparable luxury with Marriott’s broader award calendar. This redemption makes sense when Hyatt availability is constrained.

3. W Maldives (Category 7)

Standard award rate: 85,000 points per night

Peak season cash rate: $900-$1,200 per night

Off-peak award rate: Sometimes drops to 70,000 points

Chase points required for 5 nights (with 50% bonus): 227,000 Chase points → 340,500 Marriott points

Value calculation: At $1,000/night cash rate, five nights = $5,000 value for 227,000 Chase points = 2.2 cents per Chase point.

The W Maldives demonstrates how resort properties during peak season deliver outsized value. The same property might only cost $400/night during monsoon season, dropping your redemption value below 1 cent per point—making a cash payment the better choice during low season.

4. JW Marriott Venice Resort & Spa (Category 6)

Standard award rate: 60,000 points per night

With fifth-night-free: 240,000 points for 5 nights (48,000 per night effective)

Cash rate: Typically $500-$700 per night

Chase points required (with 50% bonus): 160,000 Chase points → 240,000 Marriott points

Value calculation: At $600/night average, you’re getting $3,000 in value for 160,000 Chase points = 1.88 cents per Chase point.

This private island property near Venice offers a sweet spot: Category 6 pricing with luxury resort amenities. The redemption value approaches Hyatt-level returns while accessing a property outside Hyatt’s European footprint.

5. The Ritz-Carlton, Kapalua (Maui) – Category 7

Standard award rate: 85,000 points per night

With fifth-night-free: 340,000 points for 5 nights

Peak season cash rate: $800-$1,100 per night

Chase points required (with 50% bonus): 227,000 Chase points → 340,500 Marriott points

Value calculation: At $900/night, five nights = $4,500 value for 227,000 Chase points = 1.98 cents per Chase point.

Hawaii properties consistently deliver strong award value due to high cash rates year-round. This Ritz-Carlton competes directly with Hyatt’s Maui properties (Andaz and Grand Hyatt), but Marriott often has better award availability during peak holiday periods.

The Fifth Night Free Multiplier Effect

Every example above leverages Marriott’s Fifth Night Free benefit on award stays, which applies automatically when you book five consecutive nights. This benefit effectively reduces your per-night cost by 20%, transforming marginal redemptions into competitive ones.

Without fifth-night-free: 5 nights at 85,000 points/night = 425,000 points

With fifth-night-free: 4 × 85,000 = 340,000 points (saving 85,000 points)

The fifth-night-free benefit is why Marriott redemptions work best for longer stays. One or two-night bookings at Category 7-8 properties rarely deliver competitive value compared to other Chase partners, but five-night stays with the benefit can rival or exceed Hyatt’s value proposition.

For strategies to maximize hotel points across programs, see our guide to the best hotel points redemptions for high-value stays.

Fifth Night Free Strategy: Stacking Benefits for Maximum Value

Marriott’s Fifth Night Free benefit on award stays represents the single most important factor in extracting competitive value from the Chase Marriott transfer bonus in February 2026. Understanding how to structure your bookings around this benefit separates optimal redemptions from mediocre ones.

How Fifth Night Free Works

When you book five or more consecutive award nights at the same Marriott property, the fifth night is automatically free. The system charges you for nights 1-4, then adds the fifth night at zero points.

Key rules:

- Must be the same property for all five nights

- Must be consecutive nights (no gaps)

- Applies to standard award bookings, not points + cash

- Automatically applied—no code or request needed

- Works for stays of 5 nights or more (10th night free, 15th night free, etc.).

- Does not apply to peak/off-peak pricing—you pay the standard rate for nights 1-4

The Math That Makes It Work

Consider a Category 7 property at 85,000 points per night:

Three-night stay: 255,000 points = 85,000 per night effective

Five-night stay: 340,000 points = 68,000 per night effective

Seven-night stay: 510,000 points = 72,857 per night effective

The five-night stay offers the best per-night value, as you’re getting a full 20% discount. Extending to seven nights dilutes the benefit slightly (you pay for nights 6-7 at full rate), though you’d get the 10th night free if you booked that long.

Structuring Your Transfer for Fifth Night Free Bookings

If you’re planning a five-night stay at a Category 7 property (340,000 Marriott points required), here’s how to calculate your Chase transfer with the 50% bonus:

340,000 Marriott points ÷ 1.5 (bonus ratio) = 226,667 Chase points needed

Round up to 227,000 Chase points to ensure you have enough. The transfer will yield 340,500 Marriott points—enough for your booking with a small buffer.

Pro tip: Transfer slightly more than the minimum to account for potential category changes. If the property moves from Category 7 to Category 8 before you book (requiring 100,000 points per night instead of 85,000), you’d need 400,000 points instead of 340,000. Transferring an extra 40,000 Chase points (yielding 60,000 Marriott points) provides insurance against this scenario.

Combining Fifth-Night-Free with Peak/Off-Peak Pricing

Marriott uses dynamic award pricing with peak, standard, and off-peak rates. The fifth-night-free benefit applies to whichever rate tier you’re booking:

Example: Category 6 property

- Off-peak: 40,000 points per night → 160,000 for 5 nights (32,000 per night effective)

- Standard: 60,000 points per night → 240,000 for 5 nights (48,000 per night effective)

- Peak: 80,000 points per night → 320,000 for 5 nights (64,000 per night effective)

The percentage savings remain constant (20%), but your absolute point savings increase during peak periods. This creates a counterintuitive opportunity: peak season bookings sometimes deliver better value because you’re saving more absolute points (80,000 vs 40,000) while cash rates are simultaneously higher.

When Fifth-Night-Free Doesn’t Help

The benefit only matters if you were planning a five-night stay anyway. Don’t extend a three-night trip to five nights just to capture the benefit—you’re still spending more total points even if the per-night rate improves.

Three nights at Category 7: 255,000 points

Five nights at Category 7: 340,000 points (85,000 more points for two extra nights)

Those two additional nights at an effective 42,500 points each only make sense if:

- You actually want to stay five nights

- The cash rate for those extra nights would cost more than 42,500 points × your target cents-per-point value

If you’re only planning a three-night stay, don’t let the fifth-night-free benefit tempt you into an inefficient booking.

Step-by-Step: How to Transfer Chase Points to Marriott with the 50% Bonus

Once you’ve decided the Chase Marriott transfer bonus for February 2026 aligns with your redemption plans, executing the transfer takes less than five minutes. Here’s the complete process.

Before You Transfer: Pre-Transfer Checklist

✓ Confirm award availability. Log in to your Marriott Bonvoy account and verify that the property, dates, and room category you want are available for award booking. Don’t transfer points until you’ve confirmed availability—award space can disappear between when you transfer and when you book.

✓ Calculate exact points needed. Note the total points required for your booking, including all nights. Add a 5-10% buffer for potential category changes or rate fluctuations.

✓ Verify your Marriott account details. Ensure your Marriott Bonvoy account number is correct and your account is in good standing. Points transfer to the account number you specify—there’s no way to reverse a transfer to the wrong account.

✓ Check the deadline. The promotion ends February 28, 2026, at 11:59 PM ET. Don’t wait until the last day—allow time for any technical issues.

Step 1: Log Into Chase Ultimate Rewards

Navigate to the Chase Ultimate Rewards portal by:

- Logging into your Chase account at chase.com

- Clicking “Ultimate Rewards” in the main navigation

- Or going directly to ultimaterewards.com

You’ll need to log in with your Chase online banking credentials. If you have multiple Chase cards, select the card with transfer capability (Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred).

Step 2: Navigate to Transfer Partners

From your Ultimate Rewards dashboard:

- Click “Transfer to Travel Partners” in the left sidebar

- Scroll to the “Hotels” section

- Select “Marriott Bonvoy”

The transfer page will display the current transfer ratio. During the promotional period, you should see “1:1.5” or “50% Bonus” indicated prominently. If you don’t see the bonus ratio, don’t proceed—contact Chase to confirm the promotion is active on your account.

Step 3: Enter Transfer Details

Marriott Bonvoy Member Number: Enter your Marriott Bonvoy account number (found in your Marriott account profile or on your Marriott credit card if you have one).

Transfer Amount: Enter the number of Chase points you want to transfer in increments of 1,000. The minimum transfer is 1,000 Chase points.

Confirmation: The page will show you:

- Chase points to be transferred

- Marriott Bonvoy points you’ll receive (including the 50% bonus)

- Your remaining Chase points balance after transfer

Example display:

Transfer 60,000 Chase points → Receive 90,000 Marriott Bonvoy points

Step 4: Review and Confirm

Critical warnings before you click “Transfer”:

⚠️ Transfers are instant and irreversible. You cannot transfer points back from Marriott to Chase under any circumstances.

⚠️ Double-check the account number. Transferring to the wrong Marriott account cannot be undone. Verify every digit.

⚠️ Confirm the bonus is applied. Make sure the transfer ratio shows 1:1.5, not the standard 1:1. If it shows 1:1, stop and contact Chase—the promotion may not be properly linked to your account.

Click “Transfer Points” to execute the transfer.

Step 5: Verify Transfer Completion

Chase side: Your Ultimate Rewards balance will update immediately, showing the points deducted from your account.

Marriott side: Points typically appear in your Marriott Bonvoy account within seconds to minutes. In rare cases, transfers can take up to 24 hours.

Log into your Marriott Bonvoy account and verify:

- The correct number of points posted (including the 50% bonus)

- Your new total points balance

- The transaction appears in your account activity

If points don’t appear within 24 hours, contact Chase Ultimate Rewards customer service with your transfer confirmation number.

Step 6: Book Your Award Immediately

Don’t delay booking once points are in your Marriott account. Award availability can disappear quickly, especially at popular properties during peak seasons.

- Search for your hotel and dates in the Marriott app or website

- Select “Use Points” when viewing room options

- Choose your room category

- Complete the booking

Pro tip: If you’re booking five nights to use the fifth-night-free benefit, verify the system automatically applies the discount at checkout. The booking summary should show four nights charged and the fifth night at zero points.

For a broader context on transfer timing strategies across all programs, see our guide on transfer bonus strategy: when to transfer points in 2026.

Common Transfer Mistakes to Avoid

Transferring before confirming availability. Award space can disappear between the transfer and the booking. Always check availability first.

Transferring to the wrong account. There’s no recovery option if you enter an incorrect Marriott account number. Triple-check the number.

Transferring too few points. If a property moves up a category between the time you transfer and the time you book, you’ll be short on points. Transfer 5-10% extra as a buffer.

Missing the deadline. The February 28, 2026, deadline is firm. Transfers initiated after 11:59 PM ET on February 28 will receive the standard 1:1 ratio, not the 1:1.5 bonus.

Transferring speculatively. Don’t transfer points to Marriott “just in case” you might use them. Keep points in Chase until you have a specific booking planned.

Alternative Chase Partners to Consider Before Transferring

Before committing to the Chase Marriott transfer bonus in February 2026, evaluate whether other Chase transfer partners might deliver better value for your specific travel goals. Here’s how Marriott stacks up against the most compelling alternatives.

World of Hyatt: The Hotel Transfer Benchmark

Transfer ratio: 1:1 (no bonus needed)

Typical value: 1.8 cents per point

Best for: Luxury hotels globally, consistent redemption value

World of Hyatt consistently delivers the best value among Chase’s hotel transfer partners, even without a bonus. At a 1.8 cents per point baseline value, Hyatt beats Marriott’s 1.4 cents per point, even with the 50% bonus.

When to choose Hyatt over Marriott:

- The property you want exists in both portfolios

- You’re booking Category 1-4 properties (Hyatt’s lower categories deliver exceptional value)

- You value consistency—Hyatt’s award chart is more predictable than Marriott’s dynamic pricing

- You’re targeting urban luxury hotels (Park Hyatt, Andaz, Grand Hyatt)

When Marriott wins despite lower value:

- Your destination has no Hyatt properties (Marriott’s 8,500+ properties vs Hyatt’s 1,300+)

- Hyatt has no award availability for your dates

- You’re targeting specific Marriott brands (St. Regis, Ritz-Carlton, W Hotels), not in Hyatt’s portfolio

For a detailed comparison of hotel programs, see our World of Hyatt Award Chart 2026 guide.

United MileagePlus: Domestic and International Flights

Transfer ratio: 1:1

Typical value: 1.4 cents per mile

Best for: Domestic flights, Star Alliance partner awards, international business class

United MileagePlus matches Marriott’s effective value with the 50% bonus but offers completely different redemption opportunities. If you’re debating between a hotel stay and flights, United often delivers more flexibility.

Sweet spots that beat Marriott:

- Domestic one-way flights: 12,500-25,000 miles (often better value than paying cash)

- Star Alliance partner awards: Access to ANA, Lufthansa, Swiss, and 25+ other airlines

- United Polaris business class to Europe: 60,000-70,000 miles one-way

- Short-haul international: 20,000-30,000 miles to Central America/Caribbean

When to choose United:

- You need flights more than hotels

- You’re booking international premium cabins where United’s Star Alliance access excels

- You want to preserve flexibility (airline miles typically offer more routing options than hotel points)

Virgin Atlantic Flying Club: Premium Cabin Sweet Spots

Transfer ratio: 1:1

Typical value: 1.5 cents per point

Best for: Delta partner awards, ANA business/first class, transatlantic Upper Class

Virgin Atlantic Flying Club offers some of the best premium cabin redemptions available through Chase transfers, particularly for partner awards that would cost significantly more through the operating airline’s program.

Standout redemptions:

- ANA business class to Japan: 95,000 miles round-trip (vs 180,000 through United)

- Delta One business class to Europe: 50,000 miles one-way

- Virgin Atlantic Upper Class: 50,000 miles one-way to London

When Virgin Atlantic beats Marriott:

- You’re booking premium cabin international flights

- You want to access Delta award space at reasonable rates

- You’re targeting Japan via ANA (Virgin’s sweet spot)

Chase recently offered a 40% Virgin Atlantic transfer bonus that expired in January 2026. If another Virgin bonus appears before the Marriott promotion ends, it likely delivers better value for most travelers. See our analysis of Virgin Atlantic’s transfer bonus opportunities.

Air France/KLM Flying Blue: Transatlantic Business Class

Transfer ratio: 1:1

Typical value: 1.3 cents per point

Best for: Transatlantic business class, monthly Promo Rewards, SkyTeam partner awards

Flying Blue uses dynamic pricing but regularly offers excellent business class redemptions to Europe, often beating United and other Star Alliance options.

When Flying Blue makes sense:

- You’re booking transatlantic flights during off-peak periods

- You can take advantage of monthly Promo Rewards (50% discounts on specific routes)

- You want to access Delta, Air France, or KLM metal

Chase occasionally offers Flying Blue transfer bonuses (most recently 20% in late 2025). If you’re primarily interested in flights to Europe, waiting for another Flying Blue bonus might deliver better value than the current Marriott promotion.

The Transfer Partner Decision Matrix

Use this framework to choose between Marriott and alternatives:

Choose Marriott (with 50% bonus) if:

- You have a specific hotel booking planned at a Category 7-8 property

- You can use the fifth-night-free benefit

- Hyatt doesn’t operate in your destination

- Hotel award availability is better than flight award availability

Choose Hyatt instead if:

- Your destination has Hyatt properties with availability

- You’re booking shorter stays (1-3 nights) where fifth-night-free doesn’t apply

- You want the highest baseline value for hotel transfers

Choose airline partners instead if:

- You need flights more than hotels

- You’re booking premium cabins where airline miles deliver 2+ cents per point value

- You want to preserve maximum flexibility

- Another airline transfer bonus is simultaneously available

For a comprehensive comparison of all transfer partners across programs, see our guide comparing transfer partners 2026: Chase vs Amex vs Citi vs Capital One.

Current Competing Transfer Bonuses (February 2026)

As of February 2026, these transfer bonuses are simultaneously available from other programs:

Capital One → Japan Airlines Mileage Bank: 30% bonus (through February 28, 2026)

Capital One → Avianca LifeMiles: 15% bonus (through February 11, 2026)

If you hold both Chase and Capital One cards, compare the redemption opportunities. Japan Airlines’ Mileage Bank offers excellent Business Class redemptions to Asia, while Avianca LifeMiles provides strong Star Alliance partner award access—both potentially more valuable than Marriott hotel stays depending on your travel goals.

Real-World Scenarios: Should You Transfer?

Abstract value calculations only tell part of the story. Here are five realistic scenarios showing when the Chase Marriott transfer bonus in February 2026 makes sense—and when it doesn’t.

Scenario 1: Tokyo Luxury Hotel Stay ✅ Transfer Makes Sense

Situation: Planning a 5-night Tokyo stay in October 2026. Considering Ritz-Carlton Tokyo (Category 7) vs Park Hyatt Tokyo.

Marriott option:

- Ritz-Carlton Tokyo: 85,000 points per night standard rate

- With fifth-night-free: 340,000 Marriott points for 5 nights

- Chase points needed with 50% bonus: 227,000

- Cash rate: ~$800/night = $4,000 total

- Value: 1.76 cents per Chase point

Hyatt option:

- Park Hyatt Tokyo: 30,000 points per night

- 5 nights: 150,000 World of Hyatt points

- Chase points needed (1:1 transfer): 150,000

- Cash rate: ~$750/night = $3,750 total

- Value: 2.5 cents per Chase point

Decision: Transfer to Hyatt instead. Despite the Marriott bonus, Hyatt delivers better value (2.5¢ vs 1.76¢ per Chase point) and requires fewer total Chase points (150,000 vs 227,000). The Marriott bonus doesn’t overcome Hyatt’s superior baseline value for this redemption.

Exception: If Park Hyatt Tokyo has no award availability for your dates but Ritz-Carlton does, Marriott becomes the better choice—1.76¢ per point beats 0¢ per point for unavailable awards.

Scenario 2: Maldives Resort Booking ✅ Transfer Makes Sense

Situation: Honeymoon in the Maldives, 7 nights in March 2026. Targeting an overwater villa at St. Regis Maldives Vommuli Resort (Category 8).

Marriott option:

- St. Regis Maldives: 100,000 points per night

- 7 nights: 600,000 points (with 5th night free, you’d book 5 nights for 400,000, then 2 additional nights for 200,000)

- Chase points needed with 50% bonus: 400,000 Chase points → 600,000 Marriott points

- Cash rate: ~$1,200/night = $8,400 total

- Value: 2.1 cents per Chase point

Hyatt option:

- Park Hyatt Maldives Hadahaa: 30,000 points per night (Category 7)

- 7 nights: 210,000 World of Hyatt points

- Chase points needed: 210,000

- Cash rate: ~$900/night = $6,300 total

- Value: 3.0 cents per Chase point

Decision: This depends on property preference and availability. Hyatt delivers better value per point (3.0¢ vs 2.1¢), but if you specifically want St. Regis over Park Hyatt—or if Park Hyatt has no availability—the Marriott redemption at 2.1¢ per point still represents excellent value, beating most airline transfers.

Key insight: At this value level (2+ cents per Chase point), the Marriott bonus creates genuinely competitive redemptions for luxury resort properties.

Scenario 3: Weekend City Hotel ❌ Skip This Bonus

Situation: 2-night weekend stay in Chicago for a wedding. Looking at Marriott Category 5 properties.

Marriott option:

- Category 5 property: 50,000 points per night

- 2 nights: 100,000 Marriott points (no fifth-night-free benefit)

- Chase points needed with 50% bonus: 67,000

- Cash rate: ~$250/night = $500 total

- Value: 0.75 cents per Chase point

Hyatt option:

- Hyatt Regency Chicago: 15,000 points per night (Category 4)

- 2 nights: 30,000 World of Hyatt points

- Chase points needed: 30,000

- Cash rate: ~$220/night = $440 total

- Value: 1.47 cents per Chase point

Decision: Don’t transfer to Marriott. The short stay means no fifth-night-free benefit, and the lower category property delivers poor value (0.75¢ per Chase point). Either transfer to Hyatt for better value or simply pay cash—$500 is reasonable for a weekend hotel and preserves your Chase points for higher-value redemptions.

For more guidance on when to transfer versus when to wait, see our comprehensive guide on transfer bonus strategy for 2026.

Common Mistakes and How to Avoid Them

Even experienced points users make errors when evaluating transfer bonuses. Here are the most frequent mistakes with the Chase Marriott transfer bonus February 2026—and how to avoid them.

Mistake 1: Transferring Before Checking Award Availability

The error: Transferring Chase points to Marriott for a property you’d like to book without first verifying award availability for your specific dates.

Why it’s costly: Award availability fluctuates constantly. The property might show availability today but be fully booked by the time your points transfer and you’re ready to book. Once points are in your Marriott account, you can’t transfer them back to Chase or to another program.

How to avoid it:

- Log into your Marriott Bonvoy account

- Search for your specific property and dates

- Verify award nights are available (not just cash rates)

- Only after confirming availability should you transfer points

Pro tip: Screenshot the availability confirmation with date/time stamp before transferring. If availability disappears between when you check and when you book, you have documentation to reference when contacting Marriott customer service.

Mistake 2: Comparing Bonus Percentages Instead of Absolute Value

The error: Assuming a 50% transfer bonus automatically makes Marriott more valuable than partners without bonuses.

Why it’s costly: Percentage bonuses don’t tell you anything about absolute value. A 50% bonus to a low-value program can still deliver worse results than no bonus to a high-value program:

- 100,000 Chase → 150,000 Marriott (with 50% bonus) = ~$1,400 value (0.93¢ per Marriott point)

- 100,000 Chase → 100,000 Hyatt (no bonus) = ~$1,800 value (1.8¢ per Hyatt point)

How to avoid it:

- Calculate the effective cents-per-Chase-point value for your specific redemption

- Compare that number against alternative partners

- Don’t let the “50% bonus” marketing override the actual value analysis

Mistake 3: Forgetting About Alternative Transfer Bonuses

The error: Transferring to Marriott because a 50% bonus is available, without checking if better bonuses exist for other Chase partners.

Why it’s costly: Chase sometimes runs multiple transfer bonuses simultaneously. If a 30% bonus to Virgin Atlantic and a 50% bonus to Marriott are both active, you need to compare the actual redemption value, not just the bonus percentage.

How to avoid it:

- Check current transfer bonuses across all programs before transferring

- Compare the effective value for your specific travel goals

- Consider whether you need hotels or flights more urgently

Conclusion: Making Your Chase Marriott Transfer Decision

The Chase Marriott transfer bonus in February 2026 represents a tactical opportunity, not a strategic imperative. With the promotion ending February 28, you have limited time to decide—but that deadline shouldn’t override sound decision-making.

Here’s the bottom line: transfer to Marriott with this 50% bonus only if you have a specific redemption planned that meets these criteria:

✅ Category 7-8 property where cash rates exceed $700/night

✅ Five-night stay to leverage the fifth-night-free benefit

✅ Confirmed award availability for your exact dates

✅ Better availability or value than Hyatt for your specific destination

If your situation checks all four boxes, this bonus can deliver 1.8-2.2 cents per Chase point—competitive with Hyatt transfers and superior to most airline redemptions. The St. Regis Maldives, Ritz-Carlton Tokyo, and similar luxury properties represent genuine sweet spots where Marriott’s value proposition works.

But if you’re considering this bonus for:

- Short stays (1-3 nights) without 5th night free

- Lower-category properties (Category 1-5)

- Speculative transfers without confirmed bookings

- Destinations where Hyatt has better availability

Don’t transfer. Keep your Chase points flexible and wait for a redemption opportunity that delivers clear, measurable value.

Your Next Steps

If you’re transferring:

- Verify award availability one final time

- Calculate exact points needed plus 5-10% buffer

- Execute the transfer through the Chase Ultimate Rewards portal before February 28

- Book your award immediately after points post to Marriott

- Screenshot your confirmation for the records

If you’re not transferring:

- Monitor your Chase Ultimate Rewards account for future transfer bonuses

- Check our Chase transfer partners guide for alternative redemption opportunities

- Consider whether current airline transfer bonuses better match your travel goals

- Set a calendar reminder for when Marriott typically runs promotions (every 2-3 months)

If you’re unsure:

- Use the cents-per-point calculator to analyze your specific redemption

- Compare against Hyatt and airline partner values for the same trip

- Ask yourself: “Would I book this hotel if the bonus wasn’t available?” If no, that’s your answer

The best transfer bonus is the one that aligns with your actual travel plans and delivers measurable value compared to alternatives. A 50% bonus to Marriott isn’t automatically better than no bonus to Hyatt—it depends entirely on your specific redemption.

Don’t let the February 28 deadline create false urgency. Another Marriott bonus will appear in a few months. Another Hyatt opportunity will emerge. Another airline transfer promotion will launch. The points and miles game rewards patience and strategic thinking, not reactive transfers to capture every bonus.

Make the decision that’s right for your travel goals, your timeline, and your redemption opportunities. That’s how you maximize your Chase Ultimate Rewards points—not by chasing every promotion, but by using the right promotions for the right situations.

For ongoing updates on transfer bonuses and redemption strategies, bookmark our transfer partners guide and award travel trends for 2026.