What if a single decision with your flexible rewards could be the difference between a standard trip and a luxury getaway? This is the powerful question we’re tackling head-on. In the ever-evolving world of travel loyalty, knowing where to send your hard-earned points is more critical than ever.

The landscape has shifted. Program valuations change, new partnerships emerge, and redemption opportunities evolve. We believe your rewards should work as hard as you do to earn them. That’s why we’ve done the deep dive into the data for you.

This analysis cuts through the noise. We compare the real-world value of redeeming your credit card rewards for hotel programs versus airline partners. Our goal is simple: to provide you with clear, actionable insights. You’ll see exactly how to maximize every point in your account.

We’ll explore how a general travel credit card offers incredible flexibility. You can use your rewards for various redemptions or move them to a high-value travel partner. The key is understanding which path delivers the best return for your specific goals.

Key Takeaways

- Credit card rewards programs often provide more dependable value and flexibility than standalone airline or hotel programs.

- The value of points and miles can vary dramatically, from less than half a cent to over three cents each.

- Your personal travel ambitions are the most important factor in deciding between hotel and airline partners.

- Transferring to partners can unlock significantly higher redemption value for luxury experiences.

- The rewards landscape in 2025 introduces new considerations, including transfer bonuses and program updates.

- Data-driven comparisons are essential for making informed decisions that maximize your points.

Understanding Loyalty Programs and Rewards Valuations

At the heart of every smart travel strategy lies a fundamental understanding of how loyalty programs calculate reward valuations. We believe this knowledge forms the bedrock of making informed decisions about your flexible currency.

Leading experts like TPG and Bankrate have developed sophisticated methodologies to assess true point worth. They analyze hundreds of real bookings across various travel scenarios.

The Role of Credit Card Points and Miles

Your credit card rewards serve as powerful, flexible currency. Programs like Chase Ultimate Rewards and American Express Membership Rewards offer access to dozens of transfer partners.

This versatility means your points aren’t locked into a single airline or hotel chain. You maintain control over where your rewards deliver maximum value.

Data-Driven Valuation Methodologies

Modern valuation approaches rely on extensive data collection. Experts examine pricing across diverse routes, hotel locations, and booking timeframes.

The calculation is straightforward: divide the cash cost by the points required. For example, a $139 flight costing 21,500 points yields approximately 0.6 cents per point.

This data-driven approach establishes median values that reflect real-world redemption scenarios. It moves beyond subjective estimates to provide actionable insights.

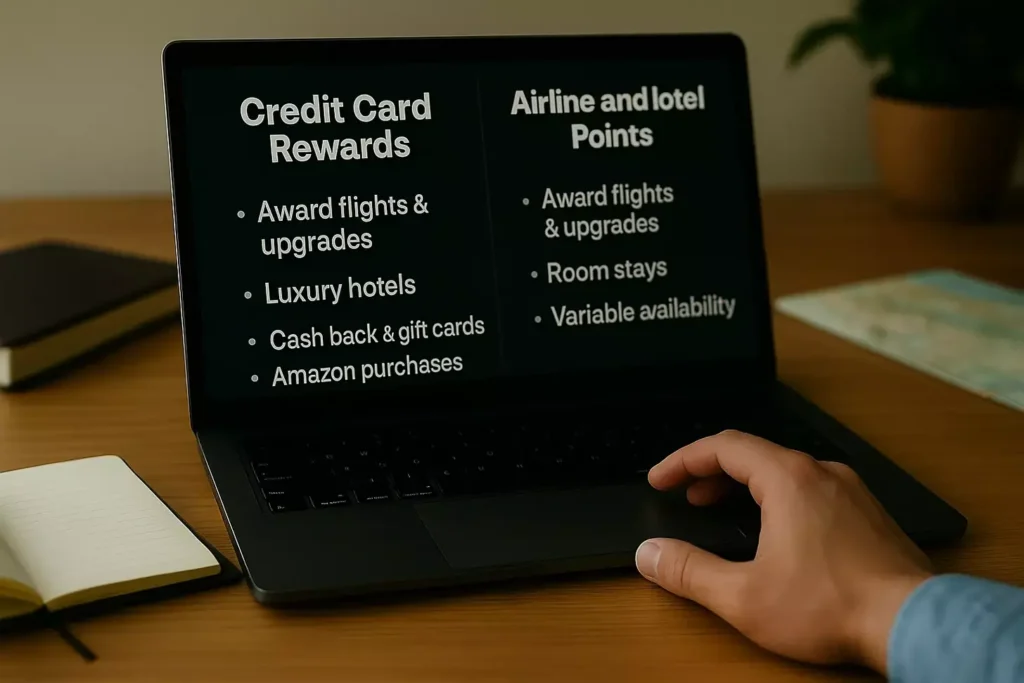

Credit Card Rewards vs. Airline and Hotel Points

Navigating the world of travel benefits requires understanding the fundamental differences among various reward-accumulation methods. Your choice fundamentally shapes your redemption power and future travel possibilities.

Flexibility and Redemption Options

We consistently favor flexible credit card rewards programs for their unmatched versatility. Programs like Chase Ultimate Rewards and American Express Membership Rewards offer dependable value across multiple redemption scenarios.

Unlike points locked into specific airline or hotel loyalty programs, transferable credit card points provide strategic advantages. You can transfer your rewards across multiple partners to capture optimal value for your specific travel needs.

The flexibility extends beyond just travel redemptions. Many issuer programs allow you to redeem for cash back, statement credits, or gift cards. This protects you from sudden program devaluations that frequently impact standalone loyalty programs.

| Feature | Credit Card Programs | Airline Programs | Hotel Programs |

|---|---|---|---|

| Transfer Partners | 10+ airline & hotel partners | Limited alliance partners | Limited partnership network |

| Redemption Options | Travel, cash, gifts, Amazon | Flights & upgrades only | The room stays primarily |

| Value Consistency | High across scenarios | Variable by route/demand | Fluctuates dramatically |

| Program Lock-in | No restrictions | Airline network only | Chain properties only |

When you earn miles directly through flying or hotel stays, those rewards confine you to one program’s award chart. Credit card rewards deliver more consistent value while offering superior shopping capability among partners.

Factors Impacting Rewards Value in 2025

The actual worth of your accumulated benefits depends on several key booking considerations. We’ve analyzed how different scenarios affect your redemption power.

Your booking specifics dramatically influence the final value you receive. Destination choices, travel dates, and cabin selections all play crucial roles.

Booking Details and Timing

When you book, it makes a significant difference in rates and availability. Planning 6-11 months typically yields better award space and more favorable redemption rates.

Route selection and property tier directly impact your points’ worth. Long-haul international flights in premium cabins often deliver premium value, while budget hotel stays may offer lower cents-per-point returns.

Seasonal demand and special events can create opportunities for exceptional value. Cash prices often spike during peak periods while point costs remain stable.

Always account for additional fees when calculating the actual value of rewards. Dynamic pricing models mean point costs can vary significantly based on demand at the time of booking.

Transfer to Hotel or Airline? The 2025 Value Comparison

Choosing between accommodation chains and carrier alliances requires careful analysis of current program valuations. We’ve examined the data to provide clear guidance on this crucial decision.

Our research reveals distinct valuation patterns. Aviation rewards typically range from 0.8 to 1.55 cents per mile across major U.S. carriers. Accommodation programs show wider variation, with values spanning from approximately 0.4 to over 2 cents per point.

Flexible credit card programs offer baseline values around 1 cent per point. However, strategic partner selections can boost this significantly. Programs like American Express Membership Rewards and Chase Ultimate Rewards typically average about 2.0 cents per point when transferred optimally.

Luxury property bookings often deliver exceptional value through accommodation transfers. Premium programs like World of Hyatt consistently achieve 2.3+ cents per point. This makes them ideal for aspirational stays that would be costly with cash.

Aviation transfers shine for premium cabin international flights. Miles can stretch to 1.5-2+ cents in value with partners like Alaska Airlines Atmos Rewards. Your travel patterns ultimately determine the best path forward.

We recommend calculating a specific cents-per-point value for your intended booking before committing. Individual redemptions can vary significantly from average valuations. Temporary transfer bonuses can also tip the scales during promotional periods.

Maximizing Credit Card Redemption Options

Your premium credit card’s true potential lies beyond simple redemptions, in the strategic use of transfer bonuses and built-in perks. We help you navigate both avenues to extract maximum worth from your spending.

Transfer Partners and Bonus Opportunities

Major issuers provide access to extensive partner networks. American Express Membership Rewards currently offers 20% extra points when moving rewards to Aeromexico. Chase Ultimate Rewards has an exceptional 80% bonus for IHG One Rewards through April.

These promotions significantly boost your points value. A 30% bonus from Citi to Virgin Atlantic can transform marginal redemptions into outstanding deals. Always check current offers before committing your rewards.

Optimizing Statement Credits and Perks

Premium cards now include substantial credit benefits that offset annual fees. The American Express Platinum card provides up to $75 in quarterly Lululemon purchases and $300 in biannual hotel stays.

Chase Sapphire Reserve cardholders can access up to $500 in hotel credits through The Edit. We recommend enrolling immediately in all credit programs and setting calendar reminders to maximize these benefits.

Strategic cardholders combine transfer bonuses with statement credits for exceptional overall value. This approach often delivers returns far exceeding standard redemption calculations.

Key Airline Loyalty Programs and Their Valuations

The landscape of airline loyalty programs in 2025 presents both opportunities and challenges for savvy travelers. We’ve analyzed the leading programs to provide current valuations that help determine which partners offer the best returns.

Insights from Leading U.S. Airline Programs

American Airlines AAdvantage leads our valuations at 1.55 cents per mile. This makes it an excellent target for transfers from multiple credit card programs.

Alaska Airlines Atmos Rewards maintains a strong 1.5 cents-per-mile valuation despite recent partnership changes. JetBlue TrueBlue delivers 1.45 cents per mile with flexible booking options.

“Dynamic pricing models are becoming the industry standard, requiring travelers to calculate specific redemption values rather than relying on averages.”

Southwest Rapid Rewards increased to 1.4 cents per point despite March changes that introduced variable pricing. Air Canada Aeroplan also offers 1.4 cents per mile with similar pricing adjustments.

| Airline Program | Valuation (cents/mile) | Key Feature |

|---|---|---|

| American AAdvantage | 1.55 | Highest U.S. valuation |

| Alaska Atmos Rewards | 1.50 | Strong partner network |

| JetBlue TrueBlue | 1.45 | No blackout dates |

| Southwest Rapid Rewards | 1.40 | Popular domestic option |

| Air Canada Aeroplan | 1.40 | Transatlantic value |

Delta SkyMiles improved slightly to 1.2 cents per mile, while United MileagePlus provides solid 1.3 cents per mile value. These programs demonstrate the importance of calculating specific redemption worth.

Hotel Rewards: Value and Redemption Strategies

Accommodation programs offer varying returns, with luxury options often delivering superior value. We analyzed stays across different cities and booking windows to provide clear insights.

Our research reveals consistent patterns across accommodation tiers. Property selection dramatically impacts your rewards’ worth.

Comparing Budget, Mid-Tier, and Luxury Options

Budget properties typically yield 0.4-0.7 cents per point. These stays require 5,000-15,000 points per night for rooms under $150.

Mid-tier accommodations strike a balance. They often need 15,000-30,000 points per night for $150-$275 rooms. This delivers around 1-1.5 cents per point.

Luxury properties frequently provide the highest returns. Premium stays can yield 1.5-2+ cents per point when cash rates exceed $400-$600.

“Property tier selection remains the single most important factor in maximizing accommodation rewards value.”

| Property Category | Typical Points per Night | Average Value (cents/point) | Best For |

|---|---|---|---|

| Budget | 5,000-15,000 | 0.4-0.7 | Affordable short stays |

| Mid-Tier | 15,000-30,000 | 1.0-1.5 | Balanced value |

| Luxury | 30,000-50,000 | 1.5-2.3+ | Premium experiences |

World of Hyatt consistently delivers over 2.3 cents per point across categories. Geographic location also affects value, with international destinations often offering higher redemption rates.

Booking 4-11 months in advance typically offers better room availability. Current transfer bonuses, like Chase’s 80% boost to IHG through April, create exceptional opportunities.

Comparative Analysis: Fees, Rates, and Booking Flexibility

When evaluating premium travel cards, the sticker price tells only part of the story—we need to examine what lies beneath the surface. Our analysis digs into the actual costs and benefits that impact your rewards strategy.

We start by comparing the complete picture of costs versus benefits. This approach reveals whether higher annual fees deliver corresponding value.

Understanding Hidden Charges and Annual Fees

Premium card annual fees have increased significantly. The Amex Platinum now costs $895, up from $695. Chase Sapphire Reserve sits at $795. These rates require careful evaluation.

Hidden charges can dramatically affect your true redemption value. Airline awards often include substantial surcharges, sometimes adding hundreds to “free” flights. Hotel programs typically involve fewer surprise fees.

Booking flexibility differs greatly between programs. Many hotel chains offer free cancellation up to 24-48 hours before arrival. Airline policies vary widely and may involve redeposit fees.

| Card Program | Annual Fee | Key Credits | Booking Flexibility |

|---|---|---|---|

| Amex Platinum | $895 | Multiple travel/dining | Varies by partner |

| Chase Sapphire Reserve | $795 | $500 hotel credit | Good cancellation terms |

| Capital One Venture X | $395 | $300 travel credit | Flexible partner options |

| Amex Gold Card | $325 | Dining credits | Standard terms apply |

When calculating true point value, subtract mandatory taxes and fees from the cash price before dividing by point cost. This reveals your actual redemption rate.

Cards with higher annual fees often provide access to better transfer partners. They can justify their costs when you maximize credits and target high-value redemptions.

Tips to Optimize Your Travel Rewards in 2025

The most successful travelers we’ve studied share a common philosophy: maximize earning opportunities while minimizing redemption delays. This approach protects your hard-earned benefits from program devaluations.

We’re sharing expert-backed strategies to elevate your rewards game. These insights come from industry leaders who’ve mastered the art of points optimization.

Strategies for Earn and Burn

Ryan Flanigan from Bankrate champions the “earn and burn” mindset. Having witnessed numerous devaluations, he plans trips far in advance to target specific rewards.

His strategy involves using flexible points that can be transferred to multiple partners. He typically moves Chase points to Southwest or Hyatt, while reserving Amex points for international Business Class flights.

“Setting a personal benchmark of 2 cents per point ensures you’re always getting superior value from your travel card purchases.”

Maximizing category bonuses accelerates your points accumulation. Cards like the Amex Gold offer 4X points on dining, while premium cards provide enhanced earnings on travel purchases.

| Spending Category | Optimal Card | Points Multiplier |

|---|---|---|

| Dining & Groceries | Amex Gold Card | 4X points |

| Travel Purchases | Chase Sapphire Reserve | 5X-10X points |

| General Spending | Capital One Venture X | 2X miles |

| Quarterly Bonuses | Various Premium Cards | 3X-5X points |

Strategic calendar management helps capture time-sensitive opportunities. Monitor transfer bonuses monthly and maintain a diverse portfolio across multiple membership programs.

Always calculate your specific redemption value before committing points. Divide the cash price by the point cost to ensure you’re meeting your personal benchmark.

Conclusion

Mastering the art of points optimization means recognizing that context determines the ideal redemption path. We’ve provided a comprehensive analysis to empower your rewards decisions.

The key insight is clear: neither accommodation nor aviation partners are universally superior. Your specific travel goals and current valuations should guide each redemption choice.

Premium programs like World of Hyatt consistently deliver exceptional value for luxury stays. Aviation miles shine for international premium cabin flights through top-valued carriers.

Your flexible credit card rewards offer the strategic advantage of comparing multiple partners. Adopt an “earn and burn” mindset and calculate a specific cents-per-point value for every major booking.

Success requires ongoing education and vigilance about program changes. By applying these data-driven strategies, you’ll unlock maximum value from your everyday purchases.

FAQ

Q: Should I transfer my credit card points to an airline or a hotel program?

A: The best choice depends on your specific travel goals. Generally, airline miles offer great value for premium cabin flights, while hotel points can be ideal for luxury stays. We recommend comparing the cents-per-point value for your desired redemption before transferring any Chase Ultimate Rewards or American Express Membership Rewards points.

Q: How do I calculate the value of my points and miles?

A: To find the value, divide the cash price of a flight or hotel room by the number of points required. For example, a 0 hotel room costing 30,000 points gives you a value of 1 cent per point. We use this data-driven methodology to provide our valuations, helping you understand if a transfer offers good value.

Q: What are the main advantages of flexible credit card points?

A: Cards like the Chase Sapphire Preferred® and The Platinum Card® from American Express offer incredible flexibility. Their points, like Chase Ultimate Rewards points, can be transferred to numerous airline and hotel partners or redeemed directly for travel through their portals, often at a fixed cents-per-point rate. This gives you more options than being locked into a single loyalty program.

Q: Are there fees associated with transferring points to travel partners?

A: Most transfers from major banks like Chase and American Express do not have fees. However, some international airline partners might charge a small transfer fee. It’s always wise to check the terms before confirming a transfer. The value gained from a great redemption typically far outweighs any minimal fees.

Q: How can I get the most value from my hotel loyalty points?

A: Maximizing hotel points often involves targeting high-end properties where the cash rates are steep. Programs like World of Hyatt and Marriott Bonvoy can offer outsized value for luxury suite redemptions. Also, look for periodic bonus promotions that let you earn more points on stays or get discounted award nights.

Q: What is a good cents-per-point value for airline miles?

A: While it varies by program, we generally consider a redemption value of 1.5 cents or more per mile to be excellent. This is often achievable by using miles for international business or first-class tickets through programs like Air Canada Aeroplan or Virgin Atlantic Flying Club, which are transfer partners of major credit card programs.

Q: How does booking timing affect the value of my rewards?

A: Timing is critical. Airline award space can open up 11-12 months in advance or at the last minute. For hotels, prices and availability fluctuate with demand. Being flexible with your travel dates and booking early (or snagging a last-minute deal) can significantly impact the redemption value you get from your points and miles.